Restoring your own credit can save you thousands of dollars!

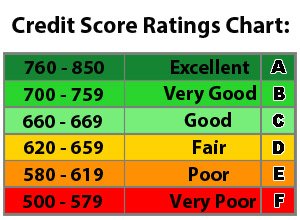

Credit scores are used by most lenders. They’re important to have if you ever decide to purchase a home, a car, or even open your own business. Potential employers or landlords, as well as cell phone and utility companies, may look at your score to determine whether to do business with you. Credit scores can range anywhere from 300 to 850. The higher your score, the more money you can typically borrow and the less you have to pay for a loan. Any score under 620 is considered “high risk.” Bankruptcy, late payments or referrals to collection agencies can all affect your score negatively and this information can remain on your credit score for seven years. To increase your score, pay your bills in a timely manner and pay your credit card balance off each month.

Loan Approval

If you want to purchase a big-ticket item, you’ll likely need a loan to do so. However, lenders won’t loan money to just anybody. Particularly since the recession hit in 2008, lenders have become especially picky when loaning money. The first thing a bank or loan office will look at when they decide whether you will be approved for any type of loan is your credit history. A bad credit score can stand between you and approval for a loan. And this means you might have to wait for that big boat, motorcycle, SUV or vacation purchase.

Interest Rate Price

Even if you qualify for a loan, your credit score greatly influences your eligibility for either high or low interest rates. For the best rates on a loan or a credit card, ideally you want a score that’s at least above 700. When you have a bad credit score, your interest rates will be much higher than someone with good credit. Interest rates can be outrageously high for those with bad credit. Some lenders can charge as much as 25 percent or higher for those with less than stellar credit. Interest rates that high can make it nearly impossible to pay off a high balance.

Home Buying

Most lenders will require a credit score of 640 or above before they will even think about giving you money to purchase a home. No one wants to do business with someone who is financially challenged -- particularly if you are asking to borrow money for 30 years ion a house. Bad credit scores can scare off real estate agents if they know you may be unable to make the payments on the house. After the housing market failed several years ago and many homes went into foreclosure, many banks are now extra cautious and stricter when it comes to approving someone for a mortgage. To be approved for the purchase of a house, lenders have to feel confident you are going to be able to handle the mortgage payments.

Insurance

In the not-too-distant future, your credit score may have a huge impact on the amount you have to pay for auto, homeowner's, health and life insurance. According to MSNBC, In a 2007 study by the Federal Trade Commission, it concluded that, “credit scores effectively predict the number of claims consumers file and the total loss that consumers pose.” Down the road, high-risk consumers may be forced to pay higher premiums while low-risk consumers will pay lower premiums.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://budgeting.thenest.com/need-credit-score-21228.html

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I just upvoted you! Have a blessed new Year

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit