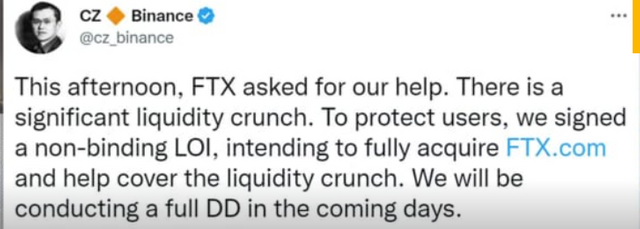

The cryptocurrency market tumbled Tuesday after Binance and FTX, the world’s two biggest crypto exchanges, agreed to merge to address what Binance called a “liquidity crunch.”

FTX’s token plunges 80% on liquidity concerns, wiping out over $2 billion in value.

The FTX's exchange token, FTT, went into freefall Tuesday even after the company got a lifeline from larger rival Binance – as fears mounted over the crypto trading firm Alameda Research's financial woes, fueling what appeared to be contagion driving down prices broadly across digital asset markets.

Both Alameda and FTX are part of the billionaire Sam Bankman-Fried's now-fast-dwindling crypto empire.

FTT fell to $4, down more than 80% over the past 24 hours. SOL, the native token of the Solana blockchain, fell to $21 from $30. At press time, FTT trades at $5.56 and SOL changes hands at $23.90.

The acquisition affects only the non-U.S. businesses for FTX. The U.S. division will remain independent of Binance. However, according to a 2021 audit, the U.S. part of FTX accounted for just 5% of total revenue. FTX is based in the Bahamas, where Bankman-Fried resides.

A rumor that sparked a ‘bank run’

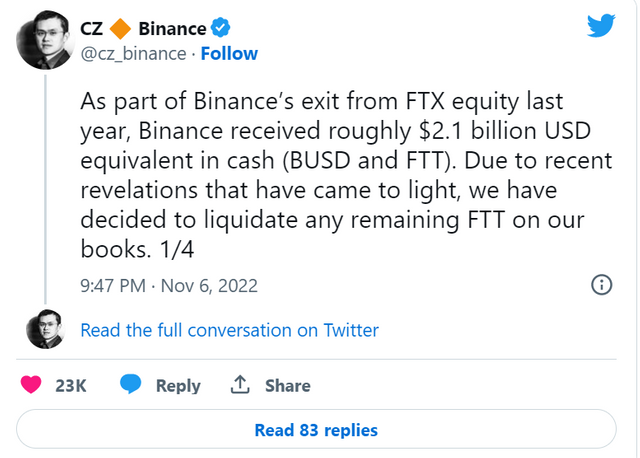

Investor confidence has been shaken after Zhao tweeted over the weekend that the company would sell its holdings of FTT. Binance is the largest crypto exchange in the world by trading volume and was an early backer of FTX. On Tuesday morning, FTX halted withdrawals from its platform, after spooked investors attempted to pull their funds en masse.

Zhao said in his tweet that Binance has about $2.1 billion combined in FTT and BUSD, the fiat-backed stablecoin issued by Binance and Paxos.

Bitcoin

tumbled 12.6% to $18,203, according to Coin Metrics. Earlier in the day, it fell to $17,300.80, its lowest level since November 2020. Ether

dived 18.2% to $1,311.50, after falling as low as $1,228.89.