Futures traders are familiar with the term limit order, which is one of the most common types of orders. A limit order features a buying or selling price set by the trader when the order is placed, and the order will only be executed when the market price reaches the Limit Price. Compared with market orders, limit orders allow traders to determine the price at which the order will be traded, and the matching system will trade the order at the best price according to the specified price and amount.

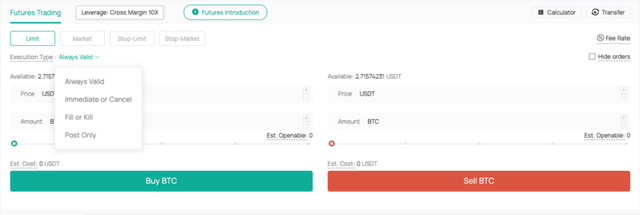

When placing a limit order, there are four choices: Always Valid, IOC, FOK, and Post Only. Since some users are confused by these terms, today, we will introduce them one by one.

Always Valid

Always Valid means that the limit order will always remain valid as long as the market price meets the order price until all orders have been fully completed, and no other conditions are required.

For instance, if you placed an Always-Valid limit order to buy 100 BTC at the limit price of 39,300 USDT, the order will be executed when there is a sell order of 50 BTC at the best market price of 39,300 USDT; the remaining buy order of 50 BTC will not be executed if the price rises to 39,310 USDT and will only be executed if the price falls below 38,300 USDT, which will complete the order of 100 BTC.IOC

IOC (Immediate or Cancel): When the order is executed, any uncompleted part will be canceled immediately.

For example, if you place an IOC limit order to buy 100 BTC at the limit price of 39,300 USDT, the order will be immediately executed when there is a sell order of 50 BTC at the best market price of 39,300 USDT; the remaining buy order of 50 BTC will be immediately canceled.FOK

FOK (Fill or Kill): When submitting an order, if the order cannot be completely executed in the market, it will be canceled immediately.

For example, if you placed a FOK limit order to buy 100 BTC at the limit price of 39,300 USDT, the order will be executed (immediately & completely) when there is a sell order of 200 BTC at the best market price of 39,300 USDT. However, when there is only a sell order of 50 BTC at the limit price, then the order will be canceled immediately since it cannot be completely executed.Post Only

Post Only: After the order is placed, the order will not be executed in the market immediately, which means that your limit order will be canceled if it would be matched with an existing order. This ensures that you will always be a Maker.

For example, if you placed a Post-Only limit order to buy 100 BTC at the limit price of 39,300 USDT, the order will not be executed when the latest price stands at 39,301 USDT, and you will become a Maker. On the other hand, when the latest price stands at 39,299 USDT, the order will be executed according to the normal matching mechanism. However, since you placed a Post-Only limit order, the order will be canceled to make sure that you will always be a Maker.

The above are the four choices you have when placing a limit order, and you can choose any of them based on your trading strategy. These types of limit orders on CoinEx fully meet a wide range of demands in futures trading.