Since 2022 kicked off, hit by the crypto slump, spot volumes have remained sluggish. According to Exchange Review (March 2022) released by CryptoCompare, derivatives volumes increased by 4.58% to $2.74 trillion, which represents 62.8% of the total crypto market. Meanwhile, spot volumes only account for 37.2% of the market. Facing a sluggish spot market, a growing number of investors started to choose crypto derivatives like futures that could help them hedge against risks and improve capital efficiency.

How futures work

The biggest difference between spot and futures is that the latter significantly improves users’ capital efficiency. In spot trading, users can only profit from price growth, while future traders can cash in on rising or falling prices as long as the direction is right.

When trading futures, users can choose from two directions: long trades or short trades.

Long trades: User A believes that the BTC price will rise. Suppose the current BTC price stands at 40,000 USDT, and he spends 4,000 USDT on 0.1 BTC at 10x leverage. When the price rises to 45,000 USDT, he could then sell the crypto for profit. In short, this approach is called “buy first & sell later”;

Short trades: User B thinks that the BTC price will drop. Suppose the current BTC price stands at 40,000 USDT, and he spends 4,000 USDT on 0.1 BTC and sells his holding at 10x leverage. When the price drops to 35,000 USDT, he could then buy the crypto for profit. In short, this approach is called “sell first & buy later”.

Basic concepts of futures

Leverage: The possibility of gaining huge profits with a small budget is why futures trading has grown more popular among crypto investors. At the moment, most mainstream exchanges offer a maximum leverage ratio of 100x. However, as it multiplies profits, leverage also increases the risks.

Margin: When trading futures, users need to pay a small amount of money according to a certain ratio as the security deposit for contract performance, which is called Margin. More specifically, the Margin required for starting your position is referred to as Initial Margin, and a proportion of the position value required to keep the position is the Maintenance Margin.

Forced Liquidation: Once a user’s Available Margin fails to cover the Maintenance Margin, his position would be forced-liquidated.

Funding Rate: In the crypto market, futures are divided into two categories: delivery contracts and futures contracts. Delivery contracts are settled every month/quarter to make sure that the futures price and the spot price stay roughly the same over the long run. Through such regular settlements, the market price of delivery contracts trends towards the spot price. Futures contracts, on the other hand, do not have a delivery date. To ensure price stability, these contracts use the Funding Rate mechanism to minimize the price difference.

How to trade futures on CoinEx?

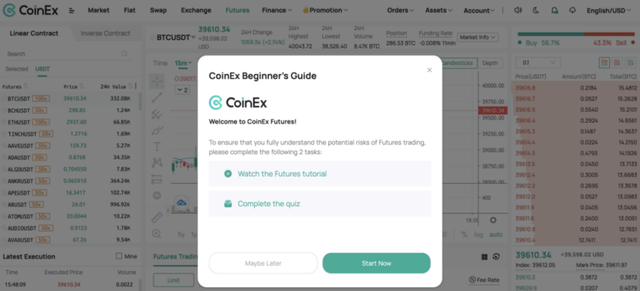

Step 1: Register a CoinEx account, and enter the futures page on CoinEx. New traders can click on Beginner’s Guide, watch the futures tutorial, and complete the quiz.

Step 2: Transfer funds from other accounts to the futures account;

Step 3: Select a cryptocurrency for your futures position (CoinEx features over 100 cryptos for linear contracts and 2 cryptos for inverse contracts);

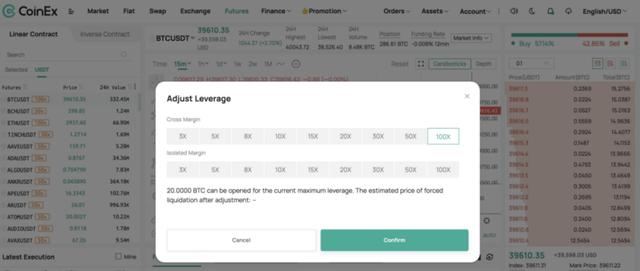

Step 4: Set up a leverage ratio for your position (CoinEx now offers leverage ranging from 3x to 100x);

Step 5: Adjust the margin ratio of the position according to your own risk tolerance, as suggested by CoinEx;

Step 6: Place an order according to the order types provided by CoinEx Futures.

CoinEx Futures: https://www.coinex.com/futures

Finally, futures contracts are a special type of investment product. The futures price, affected by multiple factors, is subject to high volatility. High leverage ratios and significant risks are the most prominent features of futures. That said, users often find it difficult to master all the characteristics of futures. For beginners, plenty of futures facts remain unknown, and prudent decision-making is required before futures investments.

*The above cannot be relied on as any financial advice.