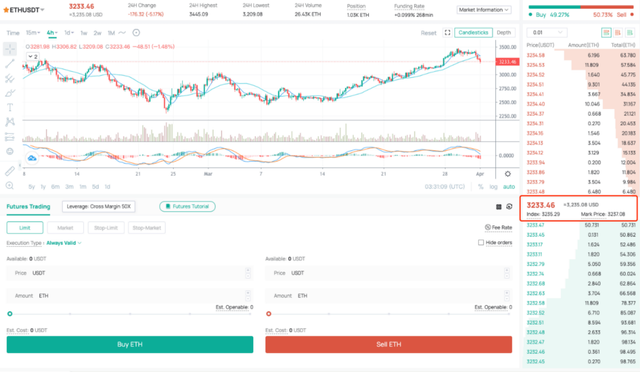

When trading futures, we can find that the page for futures trading differs from spot trading — there are three prices in the middle of the two order lists: the Latest Executed Price, Index Price, and Mark Price. In futures trading, the three prices play different roles, and the corresponding figures also differ. Today, we will dive into their connections and differences.

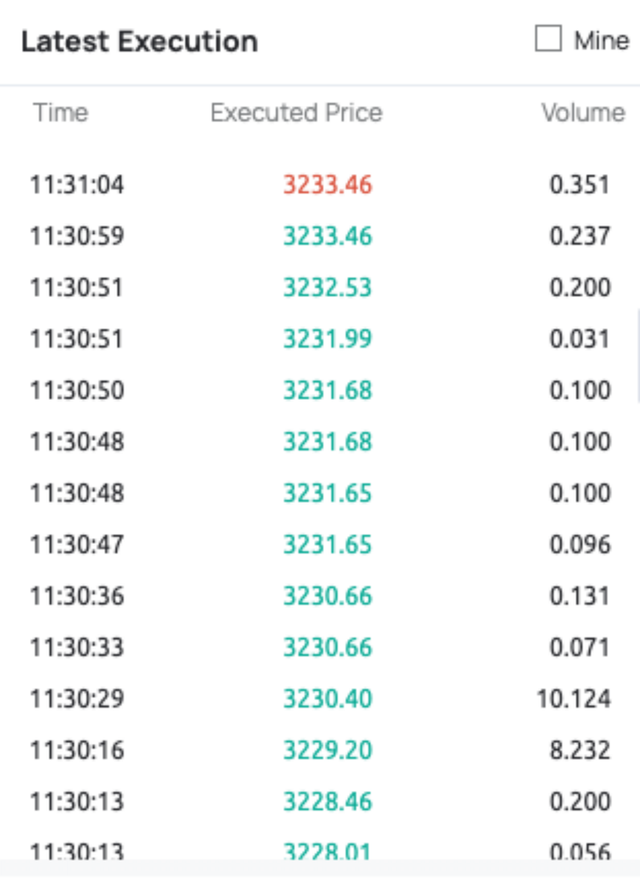

Latest Executed Price

The Latest Execution Price refers to the price at which the latest order (the bottom order of the execution list on the futures page) is executed in the market. The price allows us to check the execution status of the current market.

Index Price

The Index Price is a mechanism introduced by crypto exchanges that help prevent losses arising from abnormal price fluctuations on a single platform. The Index Price specified on a crypto exchange is often determined according to the spot price of multiple exchanges through weighted calculation. The advantage of the Index Price is that it is a price reference based on the spot price of multiple exchanges, rather than that recorded by a single exchange. Since multiple markets are less likely to be manipulated than a single market, the price reflects the true market price more fairly and could serve as a better reference for investment.

On CoinEx, the Index Price accounts for the spot price of a selection of mainstream exchanges and is updated every 5 seconds. If the pricing crypto of a trading pair cannot be found on one of these exchanges, CoinEx will convert the crypto into one that is supported by the Index Price according to the latest exchange ratio. Where the latest price and trading volume recorded by one of such exchanges are not updated in 15 minutes, or if it is undergoing system maintenance, the exchange will be temporarily excluded and its weight will be shared by the remaining exchanges.

Mark Price

The Mark Price adds the Funding Fee based on the Index Price. On CoinEx, the Mark Price is calculated as follows:

Mark Price = Index Price*(1+Funding Fee Basis); Funding Fee Basis = Funding Fee of the Last Settlement Hour — (Time Until the Next Payment Hour/Funding Rate Interval)

The Mark Price is a more reasonable estimation of the futures price. In a conventional futures market, profits & losses and liquidation are primarily determined by the Latest Executed Price. However, in a market of crypto futures, the basis of forced liquidation is often the Mark Price, rather than the Latest Executed Price. This is the case because once an exchange faces insufficient liquidity or significant price swings due to market manipulation, some positions might suffer unnecessary liquidation if the Latest Executed Price was used as the basis of forced liquidation.

Therefore, it is more reasonable to rely on the Mark Price as the basis for futures liquidation. This approach protects users from unnecessary liquidations as well as losses and makes the futures market stable.

Having learned the primary differences between the three prices in futures trading, don’t forget to distinguish between them to make better investment decisions.