Quarterly pound fundamental forecast

Nothing lasts forever. Slower rate hikes in Australia and Canada than expected and signals of a dovish turn by the ECB were the first signs that the cycle of coordinated monetary restriction is coming to an end. The rates ceiling is close, and there should be a pause or a very slow monetary tightening after it is reached. Traders should clearly see what currencies are good to bet on and how to act in the changing market situation.

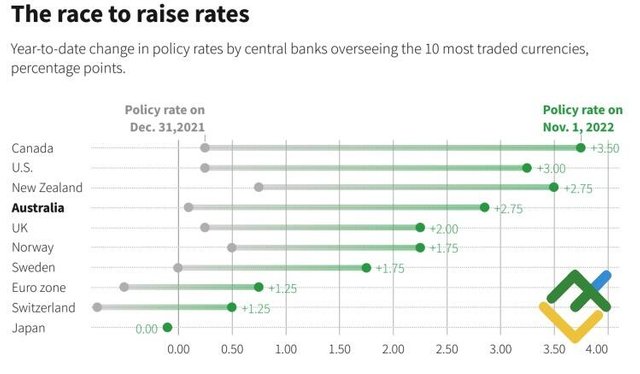

In order to correctly predict the future, one should look into the past. Central banks in 2022 are acting in sync, being led by the Fed. However, the most aggressive monetary tightening has so far been marked not by the US central bank, but by the Bank of Canada. The BoC has raised its overnight rate by 350 basis points to 3.75%. As a result, the CAD has been the second best-performing currency among G10 since the beginning of the year. In contrast, the Bank of Japan did not budge at all, and the Riksbank increased its borrowing costs by only 175 basis points to 1.75%. The yen sank 28%, and the Swedish krona has been down by 22%. These currencies are clear outsiders.

Pace of monetary tightening by central banks overseeing G10

For more information follow the link to the website of the LiteForex