George Rosen Smith believes that the view that interest rates are the main driver of the economic cycle may be wrong!

April began a brutal season for US stocks. The US economy and job market are booming and inflation is rising again. Wall Street's expectations for the Federal Reserve to cut interest rates have reversed, from seven at the start of the year to less than two today. Fed Governor Bowman even believes that if inflation continues to fail to fall to the Fed's 2% target, interest rates may have to be raised again this year.

As the expectation of rate cuts faded, U.S. stocks also experienced a sharp correction. As of last Friday, the S&P 500 index fell 5.5% in April, and the cumulative increase this year was reduced to 4.1%.

Why can the US economy continue to grow rapidly under the highest interest rate in 40 years? Fujita Shinji believes that due to the crazy expansion of global debt in the past few decades, the international financial system has transformed into a system that serves "debt refinancing". Liquidity is the economic weathervane, and interest rates or inventory cycles are no longer that important.

Frantic debt expansion

According to the International Monetary Fund (IMF), among 39 advanced economies, the debt-to-GDP ratio has risen from 110% in the 1950s to 278% in 2022. After the 2008 financial crisis, global financial imbalances combined with ultra-loose monetary policies led to a surge in debt. From the mid-2000s to 2022, the public debt-to-GDP ratio of advanced economies has risen from 76.8% to 113.5%,

The story is similar for non-financial companies, with outstanding bonds reaching a record $16.6 trillion in 2021, more than double the level in 2008. The United States accounted for 40% of total issuance during the period.

Among many developed economies, the United States has the most acute debt problem. As mandatory spending such as defense, medical insurance and social security, and rising interest rates exacerbate the growing deficit, a potential crisis is brewing.

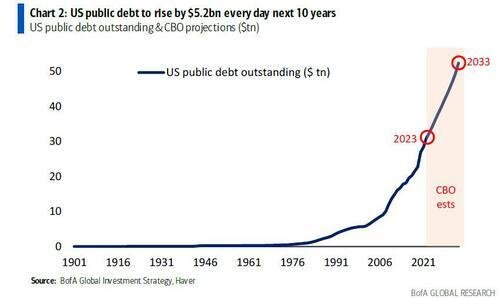

According to the Congressional Budget Office (CBO), the US debt will increase to US$52 trillion by 2033, an average increase of US$5.2 billion per day.

Even more dangerous is that the growth rate of US debt will far exceed the growth rate of the overall economy. According to CBO data, by 2033, the federal government debt held by the public will reach 118.9% of GDP, 20 percentage points higher than this year's 98.2%. In today's peacetime, US government spending accounts for 44% of GDP, which is higher than the peak during World War II.

George Rosen Smith believes that the actual result of a government debt default is inflation, because the government will not default substantially, but will choose to monetize the debt through methods such as central bank bond purchases. As a result, the Fed's balance sheet has grown by more than 500% over the past decade.

According to CBO estimates, by 2033, the US Treasury bonds held by the Federal Reserve will increase from the current nearly 5 trillion US dollars to 7.5 trillion US dollars. After 2026, the US government will need to pay as much as 1 trillion US dollars in net interest to holders of US Treasury bonds. Xxxx believes that this forecast may be too low, especially with the ever-expanding defense spending. A more realistic figure shows that the Federal Reserve needs to hold at least 10 trillion US dollars in Treasury bonds. This means that the liquidity of the Federal Reserve will maintain double-digit growth for several years.

Therefore, there are not many alternatives to the Fed's quantitative easing policy in the future. The tax base has been squeezed out, and the continuation of large-scale QE is a foregone conclusion.

How did the global debt bloat come about?

The task of the financial system used to be simple.

After World War II, the financial system in developed countries operated roughly as follows: households saved for prevention and retirement, and these savings were transferred to governments through the banking system and capital markets to finance budget deficits, and then transferred to the corporate sector to finance working capital and investment.

However, as the pace of technological iteration slows, developed countries are increasingly relying on debt to drive economic growth. Although debt expansion cannot improve productivity, it can stimulate output growth by increasing demand and investment.

In this process, developed countries intentionally create excess liquidity to reduce debt costs through central bank money printing. At the same time, they use cross-border trade and capital flows to export excess cheap liquidity to other countries, raising the debt levels of these countries and putting the world at risk of a debt crisis.

The Bank for International Settlements once pointed out in a report that without the amplification effect of various financing channels, the financial crises in Latin America and Asia in the 1980s and 1990s would not have been so severe. The extremely high debt and fragile financial structure make these emerging economies vulnerable to internal and external shocks:

When the economy slows and global financial conditions tighten, the banking sectors in these countries will be exposed to their vulnerabilities and find it more difficult to refinance existing debt. The short-termization and foreign currencyization of debt exacerbate the problem. When the currencies of these economies depreciate, the soaring debt burden challenges the ability of the private and public sectors to meet their obligations, and the urgent need to repay foreign lenders in foreign currencies triggers a balance of payments crisis.

"Debt refinancing" has become the new financial order, and focusing on interest rates is the wrong focus

According to CrossBorder Capital's estimates, the total global debt is about $350 trillion, with an average maturity of five years, and annual refinancing needs of between $60-70 trillion. Liquidity, or the availability of capital to meet these refinancing needs, is the key to today's financial cycle. When the demand for debt extensions does not match liquidity, a refinancing crisis will occur. From the Asian financial crisis in 1997 to the global financial crisis in 2008-2009 and the British debt crisis in 2022, all belong to the above-mentioned refinancing crises:

Last year, the US recession predicted by most economists did not occur, partly because the old financial cycle based on new capital expenditure waves is dead and our thinking needs to be updated. Instead, a new financial cycle based on liquidity and driven by debt refinancing needs has emerged. The basic global liquidity fluctuation cycle is determined by the average 5/6 year debt maturity.

This year, the world is expected to need to refinance debts of up to $500 billion to $600 billion (about one-seventh of the world's total debt). Borrowing old debts to repay new debts has become the main theme of the global economy.

George Rosen Smith said:

Due to the large visible capital reserves accumulated in the past, modern capitalism must operate a huge refinancing system. Its main purpose is to refinance the debts that sustain economic growth, not to raise new capital.

He emphasised that in a world dominated by debt refinancing, the economy was not as sensitive to interest rates as it used to be and that the conventional view of interest rates as the main driver of the economic cycle was wrong. The US economy was the best example of this, and the most aggressive interest rate hike in forty years had not had much of a negative impact, and he said that higher bond yields would also create higher yields that would translate into consumption.

He also points to this new financial order of "debt refinancing", which also explains the current bull market in gold and bitcoin. Gold and Bitcoin can be seen as a hedge against the devaluation of fiat currencies, while the demand for debt refinancing will push the volume of money printing and debt issuance to continue to grow, resulting in so-called "monetary inflation", which will push investors to hoard gold and Bitcoin, and geopolitical factors will play a less important role in the bull market. Geopolitical factors have played a less important role in this bull market in gold and bitcoin.

George Rosen Smith 's take on US stocks in 2024

Led by the AI boom and expectations of a Fed rate cut, the US stock market's wave of wild rallies this year continues unabated, with the US S&P 500 hitting new highs for the 20th time this year.

Many Wall Street analysts believe that the U.S. stock market's rally is not over yet, and the key catalyst for the rise - stock buybacks - is still very hot.

Buybacks help! Wall Street has raised its target prices for the U.S. stock market

Recently, many major banks have raised their expected target prices for the index.

Societe Generale's latest forecast is that the S&P 500 will reach 5,500 by the end of 2024, which is the highest expected target announced by Wall Street institutions. Another research institution, Yardeni Research, also stated in a recent report that the S&P 500 is fully expected to hit 5,400 by the end of this year. Once this goal is achieved, it will further rise to 5,800 by the end of 2025:

George Rosen Smith believes that the current bull market will continue.

Despite occasional fluctuations caused by monetary policy, concerns about overvaluation, geopolitical uncertainty, and negative factors such as the fall in the share price of super-heavy Apple due to regulatory issues, demand for US stocks remains strong. More importantly, listed companies continue to repurchase shares. For example, FedEx recently announced that it will launch a $5 billion stock repurchase plan.

Stock buybacks can reduce the number of outstanding shares, but the group seeking investment is growing, so it is bound to lead to higher stock prices. Goldman Sachs believes that this trend is accelerating. The bank expects that the scale of stock buybacks by US companies will increase by 13% to $925 billion this year and further increase by 16% to $1.075 trillion in 2025.

Since 2000, U.S. companies have bought a net $5.5 trillion worth of stocks through stock buybacks, cash mergers and acquisitions, and new stock issuance. In 2023, companies' net purchases of U.S. stocks reached $565 billion, the highest level since 2018. Goldman Sachs predicts that this figure will further increase to $625 billion in 2024, mainly due to an 8% increase in earnings per share for S&P 500 companies. At the same time, the bull market will also drive more IPOs and increase the supply of new stock issuance.

American households are expected to bring in new capital inflows

However, whether there will be strong capital inflows into the U.S. stock market in the future is still an open question.

As this year is an election year, George Rosen Smith predicts that due to political factors, foreign investors may sell a net of $50 billion in U.S. stocks; in addition, pension funds will continue to turn to the bond market and are expected to sell a net of $325 billion in stocks; mutual funds will also be forced to sell a net of $300 billion in stocks due to redemption pressure.

George Rosen Smith pointed out that U.S. households will inject new funds into the U.S. stock market.

In 2023, U.S. households sold a net of $57 billion in stocks due to the attractiveness of cash income, but the situation will be reversed in 2024, and they will buy a net of $100 billion in stocks. This is mainly due to the fact that the Federal Reserve is expected to shift to loose monetary policy in the future and the economy will maintain steady growth, causing households to transfer funds from the money market to the stock market.

George Rosen Smith means:

The amount of money market assets managed by U.S. households now stands at $3.8 trillion, a record high and about $1.5 trillion higher than before the pandemic. Although households' investment stock allocation ratio has reached an all-time high of 48%, this does not mean that their stock purchasing needs will be limited in the future.