I realize that this is Steemit and I am well aware of the type of investing that a vast majority of you (us) are interested in. However, for those of you that have ever been curious about the more traditional type of legalized gambling, here is a cheat sheet that was once taught to me in one of the only helpful college courses that I ever took.

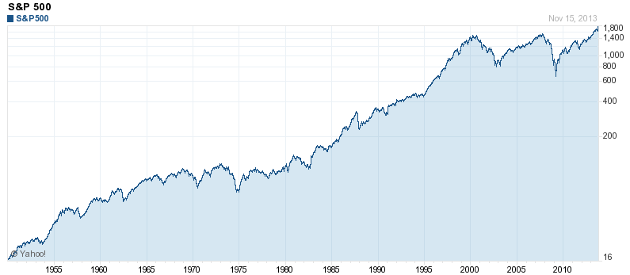

That graphic above pretty much says it all however there is just a little bit more to it. The safest and failsafe way to guarantee returns is to invest in something called an Index fund.

Buy index funds if you are going to buy anything!

There are many of these but the one I found that continually made me money (and continues to) is called an S&P 500 Index fund. Mine is with Vanguard but there are many other options. They each have different minimum buy-in's but the basic starting point is $1000. Look for the ones that don't charge fees. If they are charging a fee, it is likely a sham designed so that you wont make much.

The Index 500 funds invest equally accross the 500 largest companies in the world. Most of these companies have incredible management and will likely be around forever. Even if one of them falls, there is an almost certain chance that someone else in the top 500 sells pretty much the same thing and the disappearance of one will result in the other doing better. Think Coke vs. Pepsi, or Intel vs. AMD.

There has only been one instance of a series of 10 years (including during the Great Depression) that the S&P 500 didn't gain in value. Even during this one instance, the market quickly recovered. You will make money, although at a slower rate than by gambling on individual stocks. The beauty of this is that you are all but completely insulated against losses.

Then if you are patient (and you really should be, as this is not meant to be a short-term thing) you can (and should) reinvest all the proceeds you receive in the form of capital gains. Mainly this is because the government will tax you 30% or something like that if you try to pull out your earnings and another reason is the magic of compound interest. At the time that i set up my funds nearly 20 years ago, It was established (and you are grandfathered in, in my situation) that after the age of 65, I can withdraw the funds tax-free. So I am going to wait until i am 65 because I don't like giving g-men 30% of my profits.

So this is an easy way to make some sort of future for yourself. It has worked for me for the past 20 years and will continue to stay there for another 20 at which point it is projected i will withdraw around 7x what I originally put in there due to the magic of compound interest.

NEXT: If you must invest in individual stocks, and i suggest you don't because it is risky, invest only in products that you believe in.

Love Budweiser? Get a few shares in that. Have a penchant for Harley Davidson Motorcycles? Buy some of that action. Are you stuck in line at Starbucks every day? Get some of this.

Whatever you do, use an online self-brokerage firm like Scottrade or something along those lines. It is easy and costs something absurdly low like $4 a trade.

It's simple really. Unless you are a weirdo and like things that no one else does, there is a better-than-average chance that other people feel the same way. I followed this advice years ago and bought stock in products that i use and was happy with, all of them have gained.

One thing I definitely don't recommend anyone doing is to follow the advice of some Bloomberg expert or things you read in the Wall Street Journal-for example. I am a bit of a conspiracy theory guy but not the "Alex Jones believes lizard people control the world!" type or anything. However, i do believe that false information is intentionally put out there to force consumers to behave in a certain way so that the real insiders can reap huge rewards at the common man's expense. I used to work for a company that was owned by Tyco, and after years of having a "stock purchasing incentive program" the value of the company dropped 80% in a few months. The people on the inside knew this was going to happen and fortunately, some of these people were prosecuted.

I honestly believe you can't really trust anyone anymore, especially if they are involved in the media

kinda disclaimer: I am not a finance guy. This is information i received from one of the few professors I respect from my time in college and it worked for me. If you are young, it is at least worth looking into further

One good thing about index funds is that a lot of the companies they invest in are global, so when the piper turns up to demand the trillions of debt the US owes, those companies will be best placed to weather the run on the US dollar that will inevitably follow.

And as you suggest, downturns like that are generally only temporary anyway, so long term holders can await an inevitable recovery anyway.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I upvoted your post.

Best regards,

@Council

Posted using https://Steeming.com condenser site.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for your article, my friends are using S & P 500

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks! Good tips.

Posted using Partiko Android

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit