Foreword

Cryptodollar is one of the largest use cases in the crypto world. Blue Fox notes found that, according to CMC's statistics, yesterday's trading volume of USDT exceeded BTC, which is the sum of BCT+LTC+EOS. Crypto-dollars are transferred in large numbers on the blockchain every day. So, why are there so many crypto dollars flowing on the blockchain? What benefits can they generate? What channels are used to generate revenue? Exchanges, institutions or retail accounts, open financial lending agreements, automated market makers, and crypto-derivative exchanges can all generate revenue for crypto-dollars. These revenues are generally higher than those of the traditional world in U.S. dollars, which attracts more and more Of funds enter the crypto world. The author of this article, dYdX, was translated by "SIEN" from the "Blue Fox Notes" community.

One of the biggest driving forces of the new demand for cryptocurrencies is, and will always be, that compared to the returns of most investors in the traditional financial system, in the crypto field, they can earn many times higher dollar returns. These benefits are related to the crypto economy's demand for U.S. dollars, and also related to the difficulty of fiat currency entering the ecosystem. The most commonly used financial services that generate USD revenue include exchanges, centralized lenders, open financial lending agreements, automated market maker models, and crypto derivatives.

These service platforms are unique, and they vary based on a number of different factors, including liquidity, counterparty risk, custody, and potential returns. One thing these platforms have in common is that they are all backed by crypto dollars. The scale and form of the encrypted dollar vary, but its basic premise is that it is a digital asset whose value is pegged to the U.S. dollar. The most novel thing is that encrypted dollars are programmable. They can be transferred to any corner of the world and can be seamlessly integrated into any blockchain-based financial application. An interesting comparison is that the crypto dollar is regarded as a Venmo dollar-which can eventually be used in other financial applications.

So far, the most noteworthy aspect of the opportunities for crypto-dollars to generate revenue has always been how much higher they are than traditional fields. For example, the U.S. 1-year Treasury bond yield in 2019 was 2.57%, while the USDC loan on dYdX had an annual yield of 4.86% in the same time frame. The premiums are related to the fact that the crypto market has been bullish in history, but more importantly, they reflect the difficulty of investing dollars in the crypto ecosystem. Investors who need dollar finance understand the rapid changes in the price of crypto assets, so they are more willing to pay a premium for faster liquidity. In the early days, the only way to borrow and lend U.S. dollars in the crypto space was through Bitfinex's margin order book. Yields fluctuate greatly because it is difficult for crypto exchanges to obtain bank partnerships.

The lack of banking makes it difficult for supplies to enter the market, so when demand suddenly increases, there is not much neutralizing power here. In order to solve the problem of its banking partners, Bitfinex created Tether in 2014. With Tether, the value on behalf of the U.S. dollar can be sent in the crypto ecosystem, investors can use it to trade with cryptocurrencies, and those who cannot access banking services can gain exposure to U.S. dollars by holding Tether. In 2017, Tether's market capitalization surged by 1400%, because it was already obvious at the time: USD on the chain is processed more efficiently than USD in the traditional system.

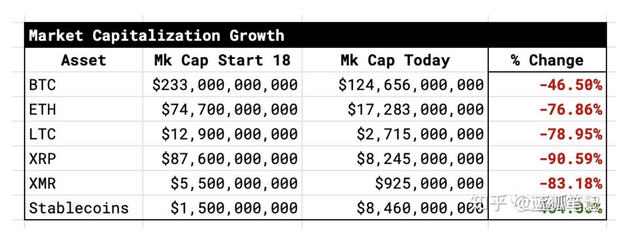

Since then, stablecoins have gained a firm foothold. (Blue Fox Note: Regarding the growth trend of the encrypted dollar, you can also refer to the previous article "Crypto Dollar: Is the Trojan Horse of the Crypto World?" by Blue Fox Note) In terms of growth, stablecoins have been the fastest growing since the beginning of 2018. Of encrypted assets. In the past two years or so, the assets with the highest market value have fallen by approximately 46% to 83%, while the market value of all stablecoins has risen by 464%.

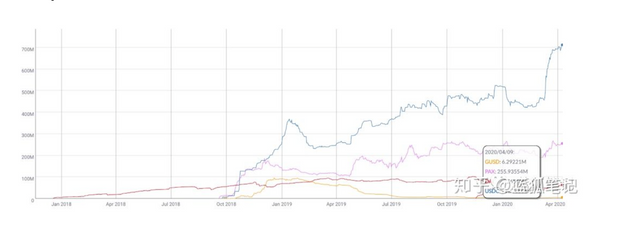

Much of this growth can be attributed to the fact that many new lending markets were built on stablecoins in 2018, which allowed them to lend at high interest rates . High interest rates greatly encouraged the conversion of traditional U.S. dollars into encrypted U.S. dollars, which was proven in the market value growth of stablecoins in the lending market at that time, including USDC, Dai, Pax, and GUSD.

From a macro perspective, the interest rate conditions in the traditional system have greatly reduced the opportunity cost associated with holding US dollars in conventional banks. There is not much loss in converting U.S. dollars into crypto dollars. Since the beginning of 2018, the 10-year Treasury bond yield has fallen from 2.4% to 0.73%, and the savings potential has fallen by 70%. This is only the situation in the United States. Some European countries, such as Germany, the United Kingdom, and France, have 10-year government bond yields of -0.36%, 0.3%, and 0.09%, respectively. The world has never been so hungry for yields.

Crypto-dollar earnings are not completely immune to the influence of a world of low interest rates. Following the market crash on March 12, USDC's loan interest rate dropped from an annualized return of about 4% to an annualized return of 0.45%, a plunge of more than 80%.

Fortunately, crypto-dollar gains do not directly respond to the central bank, but mainly depend on market sentiment. If the crypto market can still remain irrelevant to the traditional market, then there is a good chance that the crypto dollar revenue will continue to be much higher than the revenue provided by the traditional world. In addition to basic stable currency lending, there are many other more complex financial instruments that can make crypto-dollars generate revenue.

Through more complex financial instruments, there are opportunities for higher returns, but, of course, there are also higher risks. This article will introduce the most widely used channels in the encryption ecosystem, through which users can earn US dollars. It will also introduce the trade-offs and risks associated with each channel, as well as the potential benefits. In almost the entire crypto industry, speculation has always been the most demanded use case. Therefore, the exchange has become the biggest beneficiary of the explosive growth of the ecology. As the exchange sought ways to expand its business and found revenue streams associated with less volatility, it was soon and obvious that building a vertically integrated crypto bank became its winning business model.

They already have user relationships and assets, and the next step is to provide them with a full set of financial services. After all, the crypto world is about new forms of currency. Naturally, it is not difficult for exchanges to expand users' ability to earn interest on their assets. Users usually choose to keep their assets on the platform, and there is already a demand for borrowing on the exchange. This demand is conducive to the formation of a lending market. The most common opportunity to earn interest on the exchange is the margin financing pool, in which users lend their assets to speculative traders, or interest accounts, in which the exchange guarantees a certain annualized income to users. The exchange is then free to lend these assets at higher interest rates. The former is more like margin financing in the traditional world, and the latter is more like CD.