Uncertainty is a fact of life. It is even more important in business, where failure or success can hinge on any number of circumstances beyond our control. Risk management describes the different practices we use to mitigate the effects of this uncertainty, which in many cases means turning to the insurance and derivative market. Insurance is an essential part of modern life and the market economy; however, it can be very inefficient and inflexible, and is accompanied by bad behaviour on both sides. The insurance derivative market, often preferred by larger businesses, has its own problems, such as a lack of methodological transparency.

That blockchain technology could be used to solve many of the insurance industry's problems is an increasingly common proposition. However, Global Risk Exchange (GRE) offers something more revolutionary. Its idea is to create a decentralised, blockchain-based risk management marketplace, where individuals and companies will create and trade risk management contracts directly with each other to suit their personal needs.

How will it work?

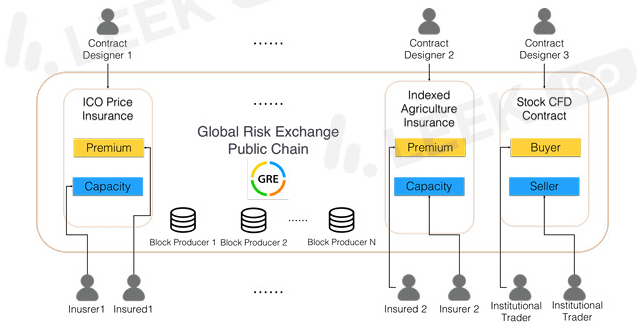

The GRE platform is being built on the Graphene blockchain library and will use a special RISK utility token. Users will be able to access the platform through an app or a website. A central part in the platform's function will be played by the Reference Database of Hazard Identification (RDHI), which defines the elements of a risk management contract for a particular type of risk event. Any user will be able to propose Hazard Identification (HI) candidates, including descriptive information, a contract template, a trustworthy data source through which the event's results could be verified (to be integrated in the platform's centralised oracle) and the result format. Candidates will be reviewed by the GRE team or by volunteers who will be rewarded with RISK. Accepted templates could then be used by users to create risk management contracts, including a due date, a risk capital pool, premium rates and odds. Contracts could be made private or open, and those who create them will likewise be rewarded in tokens in proportion to the fees their contracts raise.

Clients (whether individuals or companies) will thus be able to create their own contracts from scratch or use existing templates, simply adding their own (encrypted) personal information. They can then offer those contracts to other clients (ordinary users as well as insurance companies), establishing a smart contract and paying the required premium. A special matching engine will match offers of premium with offers of insurance capacity. If the event occurs, the insuree will be automatically compensated by the insurer. GRE also intend to establish a secondary market where it will be possible to transfer the risk management contracts you hold to third parties.

While all transaction fees will be paid in RISK (with some proportion going to the insurers), the transactions themselves could be done with RISK or with Fiat-Pegged Tokens (FPT) issued by exchange dealers by locking up a certain amount of RISK (the total market value of locked RISK must exceed that of the issued FPT). All transactions and risk events will be collected, signed and broadcast by block producers. Users will be able to comment on all of their contracts to aid in assessment and optimisation. Any required personal information will be encrypted and stored in a secure distributed database.

How can you profit from GRE?

GRE's main advantage for prospective insurees is its flexibility. It allows them to tailor their risk management contracts to their individual needs and means, while also ensuring transparency and reliability in their transactions and reducing money and time costs. Potential insurers will be able to use the GRE platform to find new customers, while also saving considerably on their own overhead and reducing the risk of insurance fraud. Offering capacity for risks you think are unlikely to manifest, particularly ones that have to do with company defaults and similar events, could also be viewed as a form of investment. And other users, particularly those with actuarial training or some other sort of relevant expertise, will be able to share in the platform's profits by drafting new contracts that would find demand among the customers.

What are GRE's advantages?

GRE is an innovative concept that meets a real demand for an easier and more reliable way of acquiring (or providing) insurance, as well as creating unique new possibilities for devising and trading risk management contracts. It makes good use of cutting edge technology, including the Graphene library and various integrated programs, to facilitate transactions and verify information. By using a public blockchain and an online trading platform, GRE offers a number of advantages over the standard way of getting insurance, such as flexibility, transparency, reliability and speed. It also relies on market mechanisms, augmented by both technology and human intervention, to ensure that more rational prices and contracts will remain prevalent on the platform and in the insurance market in general.

Token sale details

The sale of RISK tokens (RISK) ended early as the hard cap was reached by May 24th. 40% of the tokens were sold, while 10% went to the foundation management fund, 30% to the community development fund, and 20% to team members. The project budget allocation is as follows: 40% to core development, 10% to security, 15% to operation of the platform, 15% to marketing and PR and 5% to legal and compliance.

The future of insurance?

Insurance is a broad ecosystem that, at least potentially, might include every person and organisation in modern society. Together with the insurance derivative market, it covers a large share of the risk management practices used to stave off the unforeseen. Without it, business as we know it would be impossible.

Moving risk management from the hands of insurance companies to an online decentralised marketplace is a very ambitious endeavour and one that relies heavily on buy-in from a sufficient amount of insurers, insurees and contract writers. Without a sufficiently large starting ecosystem, the GRE platform simply won't take off (and the complaints about its relative lack of activity since the ICO are even more concerning when viewed from this perspective). With it, though, it will have potentially infinite room for expansion, as insurance is a universal requirement in all fields; and it may be able to completely change the way we go about managing uncertainty and risk.

Links

Website: https://www.gref.io/

WhitePaper: https://shimo.im/docs/z3hxFLzpYVgxj1SB

Telegram: https://t.me/GREF_EN

Facebook: https://www.facebook.com/GRE-Foundation-2080066572230352/

Twitter: https://twitter.com/GRE_RISK

Medium: https://medium.com/series/aa50bbc44814

ANN: https://bitcointalk.org/index.php?topic=3178591.0

Author: https://bitcointalk.org/index.php?action=profile;u=980049

Disclaimer

This review by Bonanza Kreep is all opinion and analysis, not investment advice.

Nice to see you and I Upvoted you :) !

:

“Nothing is as irritating to a shy man as a confident girl.” ====> Mokokoma Mokhonoana

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

We're glad you read our reviews. Thanks for your feedback.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit