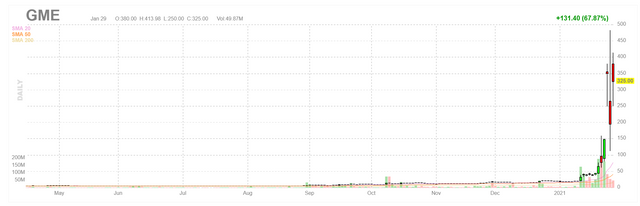

I was silent for a while. I didn't manage to find time to publish articles. But here's one saga happening right now which is just too good to not share(and kind of business-related). As far as I understood, /r/wallstreetbets and some other folks started buying GameStop stocks for whatever reason. GameStop was a stock that was always shorted due to its dying business model for years by nearly all the hedge funds. When the stock price started going up in the last weeks, large funds started seeing this as an opportunity and shorted again.

But this time, most people kept the stock, even if the news around the stock started coming out from all the news sources in a really negative manner after short-selling started. Not only that, people started buying the stock at incredible prices ~70-80 dollars and more. Don't forget this is a stock that was <10$ not so long ago, and there are no big updates to business, Steam and Gog are still up and Ps and Xbox have a version that only supports digital downloads as far as I know.

What comes next? Of course, the shorted positions are coming to an end, and need to be fulfilled. So most of the short sellers found themselves in a really weird position(not sure if this is entirely called short squeeze or not). At this point, some other large players also saw the opportunity and also longed for the stock, which made everything more interesting.

In the meantime, Melvin Capital Management was one of the largest short sellers of GME stock. Yesterday Citadel invested in them to save their risky positions:

And today, people are still keeping their stocks(and buying more, currently the stock is at ~$150). Most of those short calls need to be closed this Friday but It seems like there might be not that many stocks left in the market on Friday to buy back from. Interesting is a really weak term to describe what's happening, but it's all that I can do right now.

I have few points to take with me watching this event unfold for now maybe they will change after Friday.

1 - All that happened here was swarm behavior with horrible communication channels(Reddit, messaging boards, etc). Imagine a central authority managing the entire scheme. A large enough but also not that large amount of money used in a manipulative manner by many, simply made the market behave incredibly weird(10,32B total GME market cap). I can't imagine what people or smaller groups with similar amounts of money were pulling off for years.

2 - How do "cryptocurrencies are just a pyramid scheme", "bitcoin is not predictable" people(including me!) feeling about this event? I still don't know how to feel. Where were the checks and balances again? Where is the difference?

3 - It's kind of romantic to think some people are shooting down one of the most capitalistic structures(hedge funds), with a tool that's probably just as much capitalistic(stock future options). If this stock value goes up and ends up bankrupting(or hurting really bad) some hedge funds on Friday, this can be one of the largest transfers of capital from rich to poor that I've seen in my life. In a way, this is a story of robin hood(literally mostly robinhood.com) is stealing from the king with a bow and arrow made from future options. And whichever ending this saga will have, it is going to be interesting to watch for sure.