NOTE: My view in this article over the long term or with physical gold has not changed. But in the short-term, the paper price of gold (in US dollars) may fall during the next liquidity crunch wave down of the stock market at began on 4/20/20.

I’ve pounded the table to buy gold. I’ve preached to everybody who would listen to me, that they need to buy gold.

I’ve screamed the stock market is overvalued. Don’t sell everything but put new money into gold. Or take profits off your winners and move a percentage to gold.

At least 10% of your portfolio. But gold is so cheap, I’d suggest 20%.

In my book, Gen X & Millennials: Protect Your Money and Prosper, I explained how an 80% drop in 80% of your portfolio, offset by a 500% increase on the 20% of your portfolio in gold, you’d still make 16%.

The stock market crashed the past couple weeks. We’re officially in a bear market. Here’s my article on the stock market and the direction I believe it’s headed.

But gold didn’t go up. My favorite hedge failed.

From February 24th, at 1,676 an ounce, to March 13th, at 1,516 an ounce, gold dropped 9.5%.

But I wasn’t wrong. In fact, I bought more gold.

Social Health Chaos Differs from Financial Chaos

The coronavirus is a health pandemic. It’s serious. And the economy will suffer significantly.

But the coronavirus is not an economic crisis. Or a financial crisis.

The next four weeks will feel odd, weird, and tough. Then, as I wrote in this article, the virus will pass. We’ll return to normal.

But right now, there’s social chaos. Because this is new and we don’t have testing, there’s uncertainty. And overreaction everywhere.

Banks aren’t freezing up or closing. They may limit the number of people in the lobby at one time.

But the dollar isn’t collapsing, it’s strengthening (that’s the part that worries and confuses me). And I don’t believe this is “the” big stock market collapse I’ve predicted, although it may appear that way.

The stock market was due for a correction, and randomly timed with the coronavirus pandemic. The uncertainty around the end of the pandemic in the US, is propelling the stock markets lower.

Gold is a financial chaos hedge. Or collapse of the dollar hedge. Not a social health chaos hedge – unless the crisis continues for many months.

But the pandemic will end quickly, I hope and believe. If, as I wrote, everyone overreacted properly.

Everything Sells Initially

When the stock market starts to correct, everything moves lower. Especially in fast moves out of panic.

The reason? Margin.

Margin is debt borrowed against other investments. If the value of your investments tank, the amount you’re allowed to borrow gets reduced.

Traders need to close out losing trades or deposit more cash.

Typically, traders sell investments that have gains to cover margin calls. Gold’s up this year. Sell gold and cover margin calls.

Also, the general fear in huge stock market drops drives everyone to cash. Even chaos hedges get sold during the panic selling.

Finally, gold was due for a correction. I’ve touted gold is in a major bull market. But gold’s like any investment. Investments pull back after moving too high, too fast.

And gold rose 28.8% from May 2019 to February 2020.

That’s a big move in a short period for the shiny metal. Gold needed to correct.

Rocket Fuel Poured on the Gold Fire

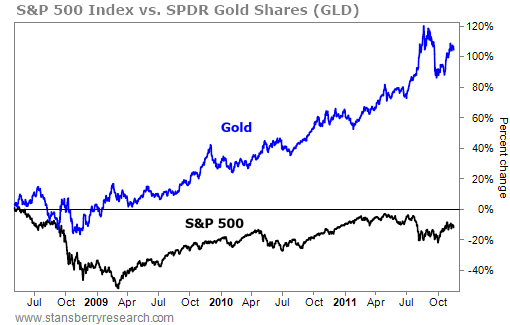

Once certainty forms in the market, mass selling everywhere stops, and stocks start bottoming, then gold takes off. That’s exactly what happened in 2008 and 2009. Look at this chart from Steve Sjuggerud at Stansberry Research.

Gold dropped initially with the stock market, then shot up.

There are several reasons.

Once certainty forms, there’s still fear because the market just tanked. Smart money starts moving to safety, gold. Because gold’s a financial hedge.

And the government typically devalues the dollar after huge market drops. In order to prevent or slow recessions, the Fed lowers interest rates – the Fed’s number one weapon – and quantitative easing begins.

The price of gold is measured against dollars. When the dollar goes down, gold goes up.

You saw this two weeks ago. The stock market fell from February 24th to February 28th. Gold dropped 6.5% during this period. Then, the Fed lowered rates 50 bps and gold jumped 6.9%, almost immediately.

Gold fell again during the March 13th to March 16th stock market crash. But out came the stimulus.

The Fed dropped rates to zero – Warren Buffet argued against gold for years that gold has no yield – now the dollar has practically no yield. And the Fed introduced new quantitative easing.

The White House proposed stimulus to pump into the economy – rumors of $1,000 checks cut to every individual, small business interruption insurance, and travel industry bailouts.

In other words, more federal debt and more inflation.

I believe gold sails past the previous all-time high of $1,900 in the next year. A 25% increase from gold’s price on March 13th.

“The” Financial Crisis Scares Me

I don’t care if gold drops from $1,516 to $1,400 in two weeks. You need to allocate money to gold now. And if you want to speculate for big gains, move a small amount to gold mining stocks.

I believe stocks will rebound. Unless everything I hear about this virus is wrong.

But only for the intermediate term.

I wrote an entire book in 2016 that detailed why you need to worry about the financial markets. I predicted a financial crisis in three to seven years. In other words, 2019-2023.

I don’t believe this crash is “the” impending financial collapse I predicted. But I also wasn’t expecting a black swan event like the coronavirus. As I wrote here, if we don’t test patients and remove uncertainty soon, this social pandemic could trigger “the” impending financial collapse.

But we’re not there yet. And I don’t hope or think we’ll get there.

Regardless, this social panic is making the financial environment more susceptible to disaster. And I thought 2008 and 2009 doomed the financial stability of the world.

But now the government will backstop all impacted industries (which could be countless), removing all fear of failure.

The exact time the financial conditions for a collapse of the dollar and stock market become worse …

• dropping interest rates to zero

• introducing new QE

• adding to the currently unsustainable debt

… money from the stimulus, low interest rates, and a quick virus recovery will flood back into the stock market.

This will lead to the euphoric blow-up top I’ve predicted. But the Fed will have no tools remaining. The government won’t either as faith in the dollar is diminished. Gold will soar.

Researchers that I trust are generally worried about the credit markets right now. They could blow up now if we don’t solve the social crisis.

But even if we do, the credit markets are about to become more vulnerable. Because they get bailed out by the government.

“The” actual financial crisis scares me more than originally. And may come earlier than I thought. This may be “the” financial crisis if I’m wrong.

Take advantage of this crash and buy gold. And a basket of gold mining stocks.

Join the community in our migration to Hive, a community built blockchain for the community. All Steem account holders will receive equivalent stake on the new Hive blockchain.

Please follow @innerhive on twitter for more information.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit