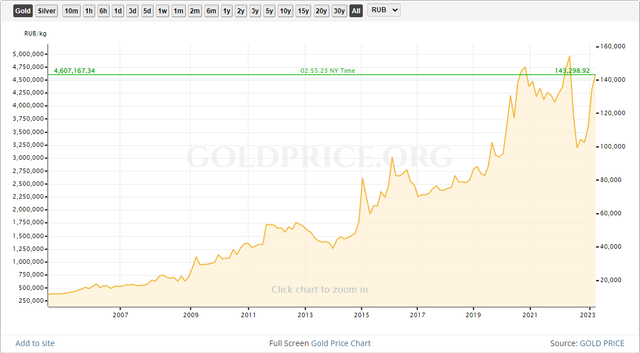

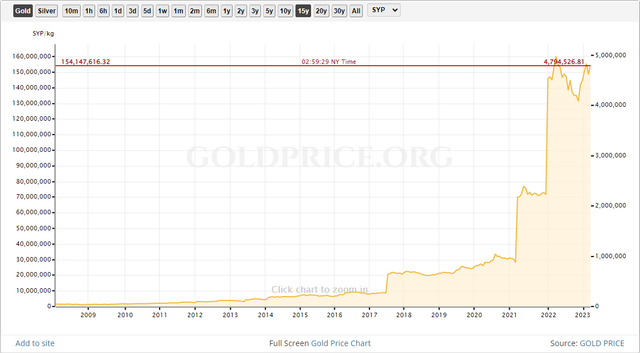

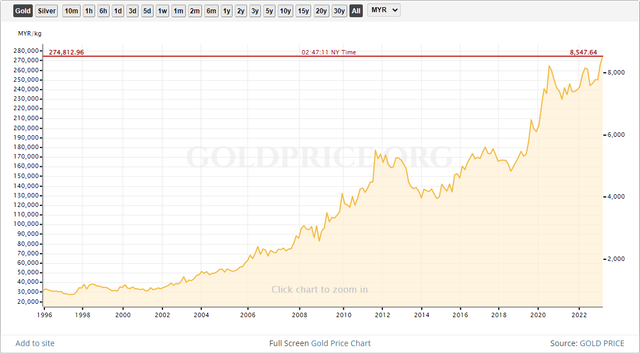

Check out these 36 charts! The price of gold (aka the devaluation of fiat currencies) has surged to new highs in almost every country. Stimulus and printing, to paper over the Covid lockdowns, and high-profile bank collapses in the USA last week, are pushing the "barbarous relic" up up and away.

Data source: Goldprice

Here are charts showing at least 15 years of gold's price in many of the world's fiat currencies.

Close to breakout

These are some of the currencies that are losing purchasing power against real assets like gold bullion.

American dollar:

Brazilian real:

Canadian dollar:

Chilean peso:

Chinese yuan:

Hong Kong dollar:

Indonesian rupiah:

Iranian rial:

Iraqi dinar:

Mexican peso:

Russian ruble:

Singapore dollar:

Swiss franc:

Syrian pound:

Already fallen

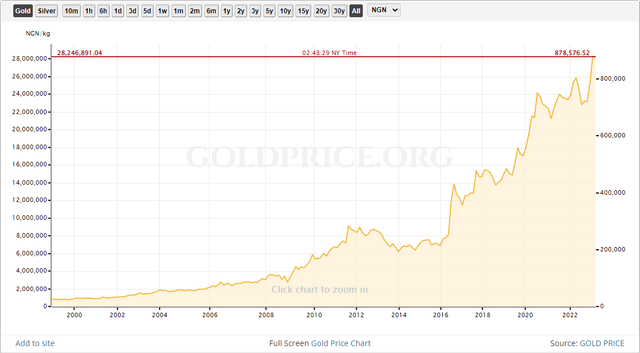

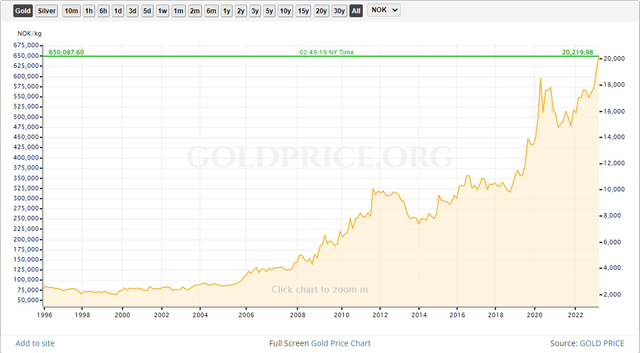

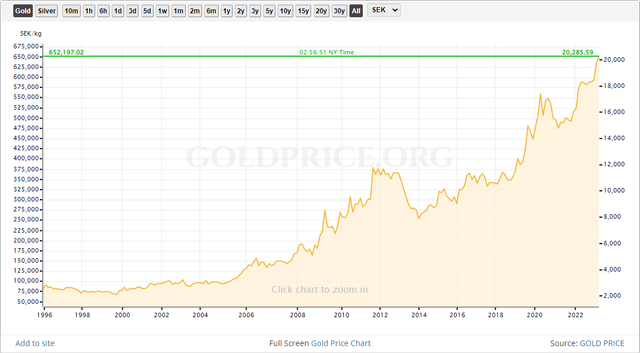

Here are some of the world's noteworthy currencies that have recently plunged in value, sending the price of gold to a new all-time high.

Australian dollar:

Bangladeshi taka:

Colombian peso:

Danish krone:

Euro:

Great Britain pound:

Indian rupee:

Israeli sheqel:

Japanese yen:

Libyan dinar:

Malaysian ringgit:

Mongolian tugrik:

New Zealand dollar:

Nigerian naira:

Norwegian krone:

Philippine peso:

Polish zloty:

South African rand:

Swedish krona:

Thai baht:

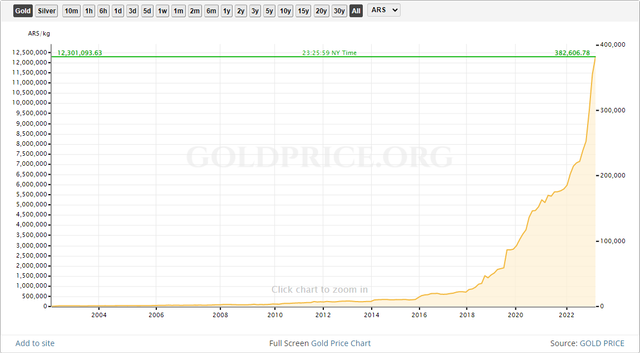

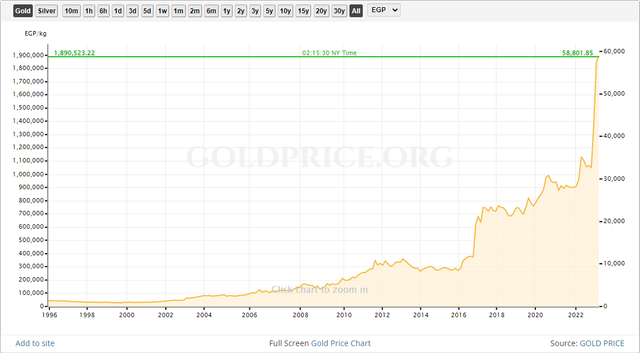

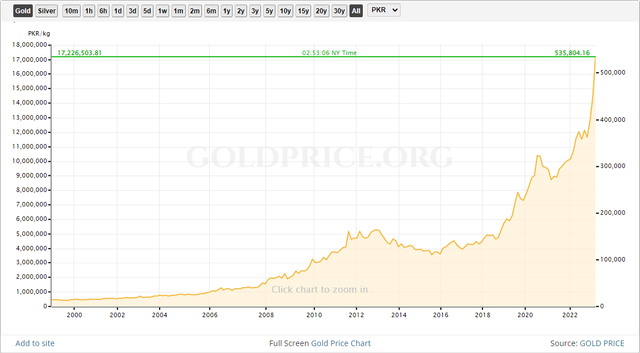

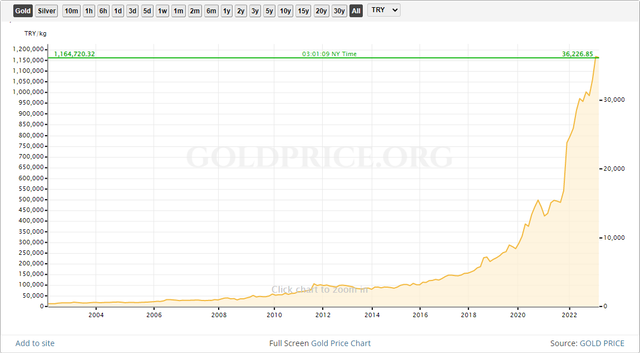

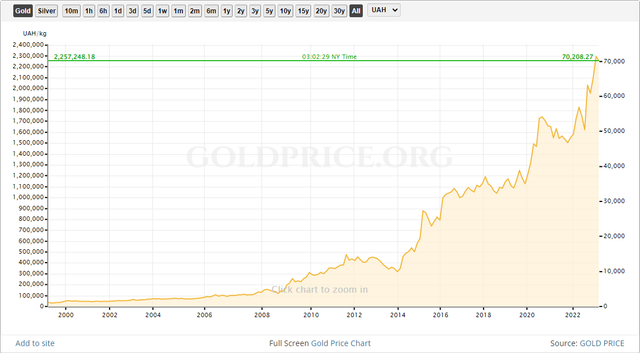

Hyperinflation

These are just a handful of the currencies that have completely collapsed in the last month:

Argentina peso:

Egyptian pound:

Pakistani rupee:

Turkish lira:

Ukrainian hryvnia:

After looking through more than 100 currencies this evening, it is clear that nowhere in the world is experiencing deflation. Literally every country on the planet is inflating their currency away. It's only a matter of how quickly they're doing it. Gold has a 5000+ year history as sound money. An ounce of gold will always be an ounce of gold, and it can't be created out of thin air by corrupt governments, so it will continue to hold value - and go up in price against paper and electronic fiat currencies. This is the news you don't see on the news.

DRutter