From the time of ancient civilizations to the modern era, gold has been the world's currency of choice. Today, investors buy gold mainly as a hedge against political unrest and inflation. In addition, many top investment advisors recommend a portfolio allocation in commodities, including gold, in order to lower overall portfolio risk.

We'll cover many of the opportunities for investing in gold, including bullion (i.e. gold bars) mutual funds, futures,mining companies, and jewelry. With few exceptions, only bullion, futures, and a handful of specialty funds provide a direct investment opportunity in gold. Other investments derive part of their value from other sources.

Gold Bullion

Gold Bullion

This is perhaps the best-known form of direct gold ownership. Many people think of gold bullion as the large gold bars held at Fort Knox. Actually, gold bullion is any form of pure, or nearly pure, gold that has been certified for its weight and purity. This includes coins, bars, etc., of any size. A serial number is commonly attached to gold bars as well, for security purposes.

While heavy gold bars are an impressive sight, their large size (up to 400 troy ounces) make them illiquid, and therefore costly to buy and sell. After all, if you own one large gold bar worth $100,000 as your entire holding in gold, and then decide to sell 10%, you can't exactly saw off the end of the bar and sell it. On the other hand, bullion held in smaller-sized bars and coins provides much more liquidity, and is quite common among gold owners.

Gold Coins

For decades, large quantities of gold coins have been issued by sovereign governments around the world. Coins are commonly bought by investors from private dealers at a premium of about 1-5% above their underlying gold value.

The advantages of bullion coins are:

Their prices are conveniently available in global financial publications.

Gold coins are often minted in smaller sizes (one ounce or less), making them a more convenient way to invest in gold than the larger bars.

Reputable dealers can be found with minimal searching, and are located in many large cities.

Caution: Older, rare gold coins have what is known as numismatic or 'collector's' value above and beyond the underlying value of the gold. To invest strictly in gold, focus on widely circulated coins, and leave the rare coins to collectors.

Some of the widely circulated gold coins include the South African krugerrand, the U.S. eagle, and the Canadian maple leaf.

The main problems with gold bullion are that the storage and insurance costs, and the relatively large markup from the dealer both hinder profit potential. Also, buying gold bullion is a direct investment in gold's value, and each dollar change in the price of gold will proportionally change the value of one's holdings. Other gold investments, such as mutual funds, may be made in smaller dollar amounts than bullion, and also may not have as much direct price exposure as bullion does.

Gold ETFs and Mutual Funds

One alternative to a direct purchase of gold bullion is to invest in one of the gold-based exchange-traded funds (ETFs).

Each share of these specialized instruments represents a fixed amount of gold, such as one-tenth of an ounce. These funds may be purchased or sold just like stocks, in any brokerage or IRA account.

This method is therefore easier and more cost-effective than owning bars or coins directly, especially for small investors, as the minimum investment is only the price of a single share of the ETF. The annual expense ratios of these funds are often less than 0.5%, much less than the fees and expenses on many other investments, including most mutual funds.

Many mutual funds own gold bullion and gold companies as part of their normal portfolios, but investors should be aware that only a few mutual funds focus solely on gold investing; most own a number of other commodities. The major advantages of the gold-only oriented mutual funds are:

Low cost and low minimum investment required.

Diversification among different companies.

Ease of ownership in a brokerage account or an IRA.

No individual company research needed.

Traditional mutual funds tend to be actively managed, while ETFs adhere to a passive index-tracking strategy, and therefore have lower expense ratios. For the average gold investor, however, mutual funds and ETFs are now generally the easiest and safest way to invest in gold.

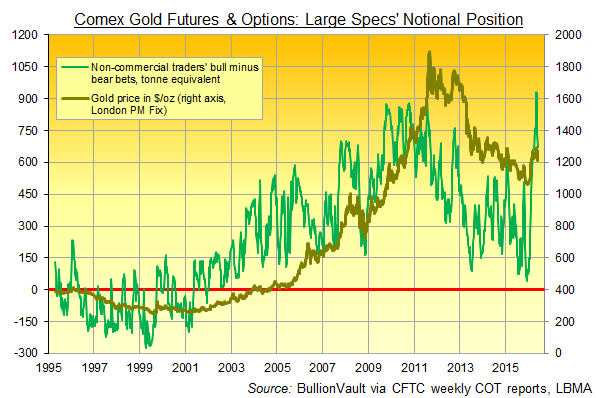

Gold Futures and Options

Futures are contracts to buy or sell a given amount of an item, in this case gold, on a particular date in the future. Futures are traded in contracts , not shares, and represent a predetermined amount of gold. As this amount can be large (for example, 100 troy ounces x $1,000/ounce = $100,000), futures are more suitable for experienced investors. People often use futures because the commissions are very low, and the margin requirements are much lower than with traditional equity investments. Some contracts settle in dollars, while others settle in gold, so investors must pay attention to the contract specifications to avoid having to take delivery of 100 ounces of gold on the settlement date.

Options on futures are an alternative to buying a futures contract outright. These give the owner of the option the right to buy the futures contract within a certain time frame, at a preset price. One benefit of an option is that it both leverages your original investment and limits losses to the price paid. A futures contract bought on margin can require more Capital than originally invested if losses mount quickly. Unlike with a futures investment, which is based on the current value of gold, the downside to an option is that the investor must pay a premium to the underlying value of the gold to own the option. Because of the volatile nature of futures and options, they may be unsuitable for many investors. Even so, futures remain the cheapest (commissions + interest expense) way to buy or sell gold when investing large sums.

Gold Mining Companies

Gold Mining Companies

Companies that specialize in mining and refining will also profit from a rising gold price. Investing in these types of companies can be an effective way to profit from gold, and can also carry lower risk than other investment methods.

The largest gold mining companies boast extensive global operations; therefore, business factors common to many other large companies play into the success of such an investment. As a result, these companies can still show profit in times of flat or declining gold prices. One way they do this is by hedging against a fall in gold prices as a normal part of their business. Some do this and some don't. Even so, gold mining companies may provide a safer way to invest in gold than through direct ownership of bullion. At the same time, the research into and selection of individual companies requires due diligence on the investor's part. As this is a time-consuming endeavor, it may not be feasible for many investors.

Gold Jewelry

Most of the global gold production is used to make jewelry. With global population and wealth growing annually, demand for gold used in jewelry production should increase over time. On the other hand, gold jewelry buyers are shown to be somewhat price-sensitive, buying less if the price rises swiftly.

Buying jewelry at retail prices involves a substantial markup – up to 400% over the underlying value of the gold. Better jewelry bargains may be found at estate sales and auctions. The advantage of buying jewelry this way is that there is no retail markup; the disadvantage is the time spent searching for valuable pieces. Nonetheless, jewelry ownership provides the most enjoyable way to own gold, even if it is not the most profitable from an investment standpoint. As an art form, gold jewelry is beautiful. As an investment, it is mediocre – unless you are the jeweler.

Conclusion:

Larger investors wishing to have direct exposure to the price of gold may prefer to invest in gold directly through bullion. There is also a level of comfort found in owning a physical asset instead of simply a piece of paper. The downside is the slight premium to the value of gold paid on the initial purchase, as well as the storage costs.

For investors who are a bit more aggressive, futures and options will certainly do the trick. But, buyer beware: these investments are derivatives of gold's price, and can see sharp moves up and down, especially when done on margin. On the other hand, futures are probably the most efficient way to invest in gold, except for the fact that contracts must be rolled over periodically as they expire.

The idea that jewelry is an investment is storied, but naïve. There is too much of a spread between the price of most jewelry and its gold value for it to be considered a true investment. Instead, the average gold investor should consider gold-oriented mutual funds and ETFs, as these securities generally provide the easiest and safest way to invest in gold.

Image source: pixabay

More specificly about gold investments you can read in latest Gold article:

https://steemit.com/gold/@goldeninvestor/what-is-gold-bullion-the-investors-guide#comments

You might be interested: The man behind two gold ETFs says this about bitcoin

Thanks for reading!

@goldeninvestor

My goal is to provide as much valuable information we could.

As a New Steemit community member I'm appreciate all upvotes . BIG thank you for help me to Grow!

Source

Plagiarism is the copying & pasting of others work without giving credit to the original author or artist. Plagiarized posts are considered spam.

Spam is discouraged by the community, and may result in action from the cheetah bot.

More information and tips on sharing content.

If you believe this comment is in error, please contact us in #disputes on Discord

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.investopedia.com/articles/basics/08/gold-strategies.asp

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Gold Has a Good Point Now

if Gold can begin a Bull again..we Can hope For begin Of that on crypto

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

yes, just need wait and we will see. Thanks for great comment!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good article, but for some reason gold still feels like a riskier investment to me than Bitcoin. Is that crazy?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello, thanks for reply. In my opinion Gold is less volatile and more stable (that is what historical data shows us). if we compare both gold and Bitcoin in a bull cycles.(Right now btc is not much volatile as it was on its peak). But i prefer bitcoin much more than gold and there are few reasons why. First of all you can stack your btc in a hardware wallet. and keep millions worth of btc safely in your pocket if you want. Other reason why i prefer btc is. Monetary system changing -and we moving to digital era faster and faster day by day. Of course there is much more reasons why i took more happily btc then gold. but i feel that you know very good -why ;) So if you fink that is crazy. Then I'm crazy too. But i will keep buying btc even if it drops to usd 1000. I believe in bright btc future @the4thmusketeer

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think Bitcoin is going to a great investment in a few years. I'm wondering however if I should invest in something like Digix Dao where they are tokenizing gold. It looks interesting, but I don't know much about it. I think keeping an open mind is going to be important, Bitcoin might lose it's top ranking someday. It's hard to say.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I did heard something about digix dao. Yes, it's looks interesting just wondering how much legit it is, and what's behind the project. A bit sceptical after all the ''ICO rush''

Future is unpredictible mate but we will see.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @goldeninvestor!

Your post was mentioned in the Steem Hit Parade for newcomers in the following category:

I also upvoted your post to increase its reward

If you like my work to promote newcomers and give them more visibility on the Steem blockchain, consider to vote for my witness!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit