We are in the midst of what would likely become the greatest transfer of wealth. For the last 70 years at least, wealth has been concentrated in a manner determined largely by the international monetary order established after the Second World War, at the Bretton Woods Conference in 1944, and the various modifications that came after.

It was at this conference that the US dollar was crowned the king of the currencies, or in other words, became the reserve currency of the world. The US dollar became the standard by which wealth was measured. This further increased US influence and power in a world that was already US dominated, due to the outcome of the Second World War.

As part of the Bretton Woods agreement, the US would exchange US dollars at a rate of $35 per ounce to other nations, and the nations would hold (mostly) US dollars as part of the foreign reserves instead of (mostly) gold (US became the banker to other countries). This was the critical part of the agreement for it gave the dollar legitimacy (start of the dollar standard), and the dollar was now known to be “as good as gold” – therefore, the US dollar now occupied the position gold formally held in the international monetary system.

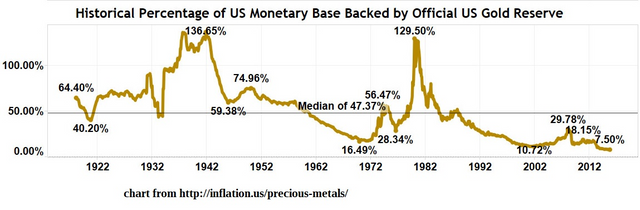

At the time the, Bretton Woods agreement was made, the US had the world’s largest gold reserves, and the dollar’s gold backing was around 100% (see chart below). The bank (the US) was thus fully capitalized and solvent.

Below, is a chart from inflation.us, that shows the historical percentage of US Monetary Base (which is US dollars in existence) backed by official US gold reserve:

On the chart you can see that they immediately started flooding the world with dollars, to the extent where they only had a 16% backing of gold for the number of dollars in existence, in the early 70s.

Eventually, they were unable to honour their agreement to exchange gold at a price of $35 per ounce to nation states, and therefore, ended the convertibility of US dollars to gold. In other words, they were insolvent, due to the fact that they had issued way more dollars than what they were good for in gold.

Despite this, the US dollar did not lose its dominant position, even to this day (or at least to around 2014). However, they had to pay a cost to continue their role as the International Banker, and those were higher interest rates on their Treasury bonds. The creation of the Petrodollar was also significant in their quest to keep the dollar standard going.

Due to the end of the convertibility, gold was now providing an account of the extent to which the US dollar was being debased, by rising in price (although often with some lag – which is what we are experiencing now). Therefore, you can see how the ratio (or backing) started rising after 1971/1972 (see the chart above), to where gold caught up and even exceeded the amount of US dollars issued, around 1980.

Since 1980, the US has continued to debase the currency by flooding the world with even greater amounts of dollars. Today, it is much worse than what it was in the early 70s, with the gold backing around 7.5% (2015/2016 numbers if I am not mistaken). In fact, today conditions in the market (especially the gold and stock market) are actually very similar to how it was in the early 70s when the US defaulted.

Gold will again (soon) rise as it did in the 70s in order to catch up with the massive amounts of dollars issued. Gold would have to rise to at least $15 000 per ounce to establish a 100% backing; this is assuming that they have the 8 133 tonnes of gold they claim. Furthermore, gold is likely to rise to the extent where the backing exceeds 100%, just like it did in the 30s and the 80s, and this would mean even higher prices.

This (reset) will only cover the issue of the excess dollars out there, and not the much greater issue of US debt (not just government debt). To put this in perspective, we are talking about a $4 trillion issue versus a $40 trillion issue.

The gold price catching up to the amount of US dollars in existence is only one element which will transfer significant wealth from holders of dollars to physical gold owners. When the debt bubble bursts, the dollar will eventually be worthless (and so will every other fiat currency), and the gold price in dollars will become irrelevant – this will be an even greater transfer of wealth (but more on this another time).

If you enjoyed the post Upvote, Resteem and Follow.

When the reset happens it will be interesting to see what happens to the cryptocurrencies out there since they are pegged to the usd.... perhaps they will be pegged to precious metals...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes, that is going to be very interesting and it is difficult to predict.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This issue should be taught in school economics along with what the federal reserve is really about.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

it is kept out on purpose.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I learned about coming off of the gold standard in school but I didn't learn about the fed that I recall

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

What are your thoughts about Harry Dent, in particular, his bet that metals move much lower FIRST before moving higher?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

how low is he saying?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

he still says $700, But! the cost of production is well over that, so it will not go that low

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

the bottom is in already (2015)...not going lower

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think Russia and China will have a gold backed crypto currency in the near future. Fiat crypto will be good at Walmart, Amazon and will buy all the GMO food, Big pharma poison and all the other junk the world bankers want you to have.

PM's will buy the organic farm. Real money.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

that sounds nice, but the banksters will stop it, probably

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

interesting view. Russia and China definitely has something coming up..their BRICS monetary order

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I have been reading about this for 10 years now, so is there any news on when it might happen? Cuz I sure wish I had put the money into the bitcoin when I first heard of it, but got convinced by the gold sellers that crypto wasn't real cuz it's not phyzz! I ended up buying some btc when it was 200, and I have booked a nice profit on that, but if I had not been invested in the gold and silver, waiting for the mythic 'moonshot', I would have put more into btc, and I would be a multi-millionaire now. But no, I had to listen to all the metal guys!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yea, gold is not for people looking to make a quick buck.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well, if you've still held your gold/silver, good for you! There's nothing like diversification. Occasionally I keep adding to the stack, but just getting my toes wet in crypto. It never hurts to have a bit of everything LOL... something is bound to work. Although, yes, there is little doubt that the fiat dollar, backed by air, will fall. What's that saying? 90% of the movement happens in 10% of the time? ...or something like that... hang in there.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The fiat dollar is not backed by air, but oil. I am not convinced of any of the arguments for a new monetary system to be rolled out after a crash, I think that is hopium. Gold could be added to the SDR, but it does not show up even as a pending decision by the IMF. If I could be convinced that the cryptos will just create a parallel system that will not be outlawed by TPTB I could have more faith in it. But the bankers want it under their control, so how would that be better than what we have now?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great article. I stack silver on the dips. I trade the fake up or down. So my plan is to trade fake money on fake contravts to make fake profits to purchade real money.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

as long as you're getting that real money.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice post... I do feel however that Pocket Change is our only hope of paying off the National Debt... One Cent should pay off One Dollars worth of Debt, because the buying power of the Paper Fiat Dollars has lost (in my opinion) 99% of it's Buying Power...

@pocketechange

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit