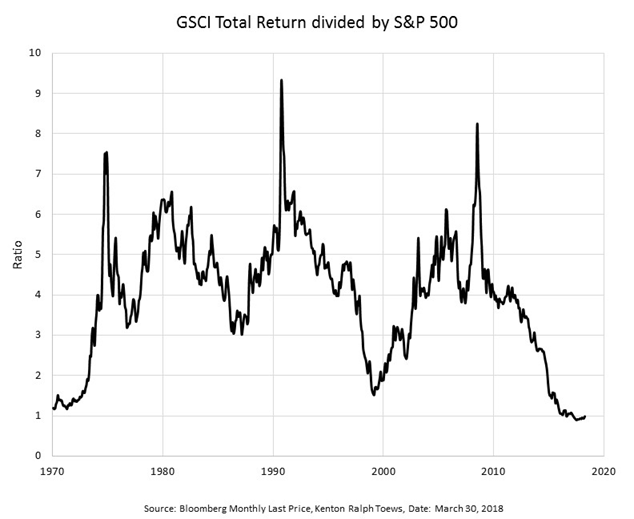

The chart below has been making its rounds as of late. It is a ratio of the S&P GSCI Total Return Index, a basket of commodities, to the S&P 500. It paints a very interesting picture of where commodity prices are in relation to general equities. Relative to general equities, commodities are the cheapest they have been in almost 50 years.

TOTAL RETURN VS. PRICE RETURN

Notice the GSCI is a total return index and the S&P 500 is a price return index. Hence, the chart above compares a total return index with a price return index. A total return index accounts for the effects of compounding by including the reinvestment of cash distributions and dividends. By contrast, a price return index does not take into account cash distributions and dividends and, therefore, ignores the effects of compounding.

For these reasons, over time, a total return index will outperform its corresponding price return index.

You may be thinking commodities do not pay dividends therefore what income is there to compound in a total return index? The GSCI is an index based on commodity futures contracts. Since a futures contract needs to be paid only at its maturity, cash collateral is set aside in anticipation of meeting the payout at expiration of the contract, and the cash earns interest for that time period. The GSCI total return index takes into account the interest earned on the cash collateral and re-invests it.

TAKING ANOTHER LOOK: GSCI VS S&P 500

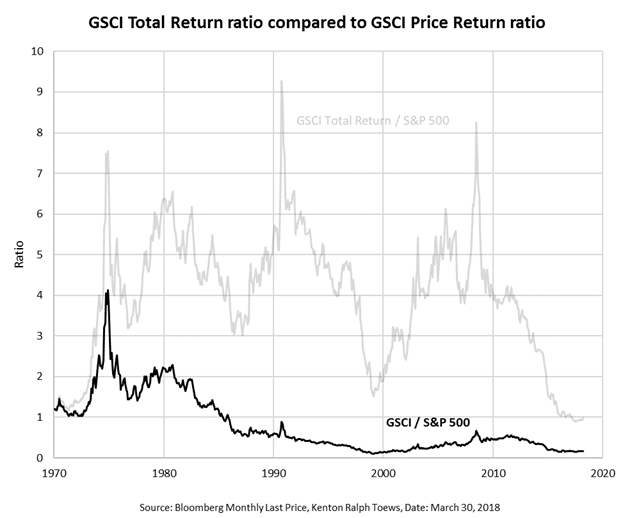

For consistency, when comparing two indexes we should consider either the total return or the price return of both. The popularity of the S&P 500 price return index suggests a good starting place.

The price return comparison of the GSCI and S&P 500 paints a much different picture than the original, widely publicized, chart. This chart suggests that commodities, relative to general equities, are even cheaper than reported. Furthermore, the commodity bull market of the 2000s barely registers a blip on this chart — it was nothing compared to the commodities bull market of the 1970s.

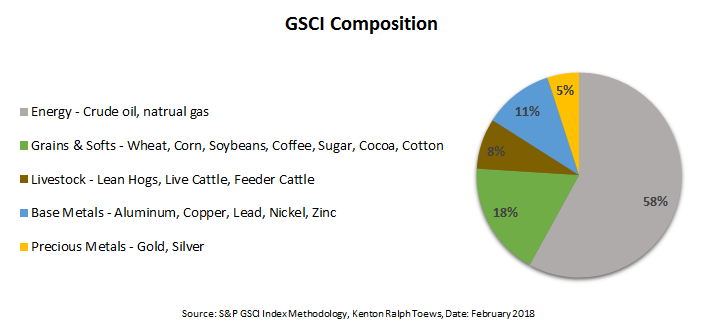

BREAKING DOWN THE GSCI

To put the above charts in context, we should break down the GSCI. The GSCI is an index composed of individual commodity prices.

Energy is by far the largest component at 58% followed by agriculture at 26%. Together, the two components represent 84% of the index. By contrast, precious and base metals, Sprott's specialty, only comprise 16% of the Index. Therefore, it is more appropriate to say energy and agricultural products relative to general equities are the cheapest they have been in the last several decades.

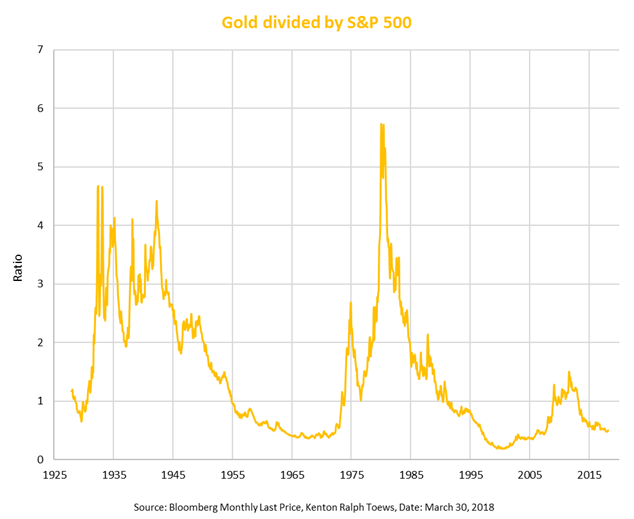

WHAT ABOUT GOLD?

How cheap is gold relative to general equities right now?

Right now, the Gold/S&P 500 ratio is approximately 0.5, which means one ounce of gold will buy half a unit of the S&P 500.

Over the last 90 years, the average Gold/S&P 500 ratio is 1.4.

Seventy-seven percent of the time, the Gold/S&P 500 ratio is above 0.5. Fifty percent of the time, the ratio is above 1.0. To keep the math simple and to be conservative let us assume mean regression will take that ratio to 1.0 at some point.

As I write, gold is approximately $1,335 a troy ounce and the S&P 500 is around 2,685 To achieve a Gold/S&P 500 ratio of 1.0 at the current S&P 500 level, the gold price would have to double to $2,670. On the other hand, if gold stays constant at $1,335, the ratio implies an S&P 500 at half its current level.

Ultimately, it does not matter whether the S&P 500 goes up or down. If history is a guide, and the ratio trends upward, gold will outperform general equities from a relative point of view.

For comments or questions please feel free to contact me.

Congratulations @kentonralphtoews! You have received a personal award!

Click on the badge to view your Board of Honor.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @kentonralphtoews! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit