Suppression of the gold price has been a much-debated topic in the gold space. In all corners of the community analyses can be read that allege the metal is way cheaper that it should be. But is this true?

First of all, we must distinguish between manipulation, which can be up or down but is always short-term noise, and suppression, long term downward pressure. The former has been proven time and again, but is not of much interest to me (a long term hodler of gold). The latter is the holy grail.

To know if the price is suppressed we need hard-core proof, nothing less. Zero Hedge published a piece the other day that states, 'It's Not A "Conspiracy Theory": Here's How Central Banks Actively Suppress The Price Of Gold'. https://www.zerohedge.com/news/2018-03-04/its-not-conspiracy-theory-heres-how-central-banks-actively-suppress-price-gold Is this finally the proof we've been waiting for? Yes and no.

The article on Zero Hedge is about 'gold swaps', which are more or less gold loans, by central banks. (For more info on gold swaps read: https://www.bullionstar.com/blogs/koos-jansen/gofo-and-the-gold-wholesale-market/.) Surely, when central banks lend out their gold, supply in the open market is increased and the price will fall. There's just one detail that is often neglected.

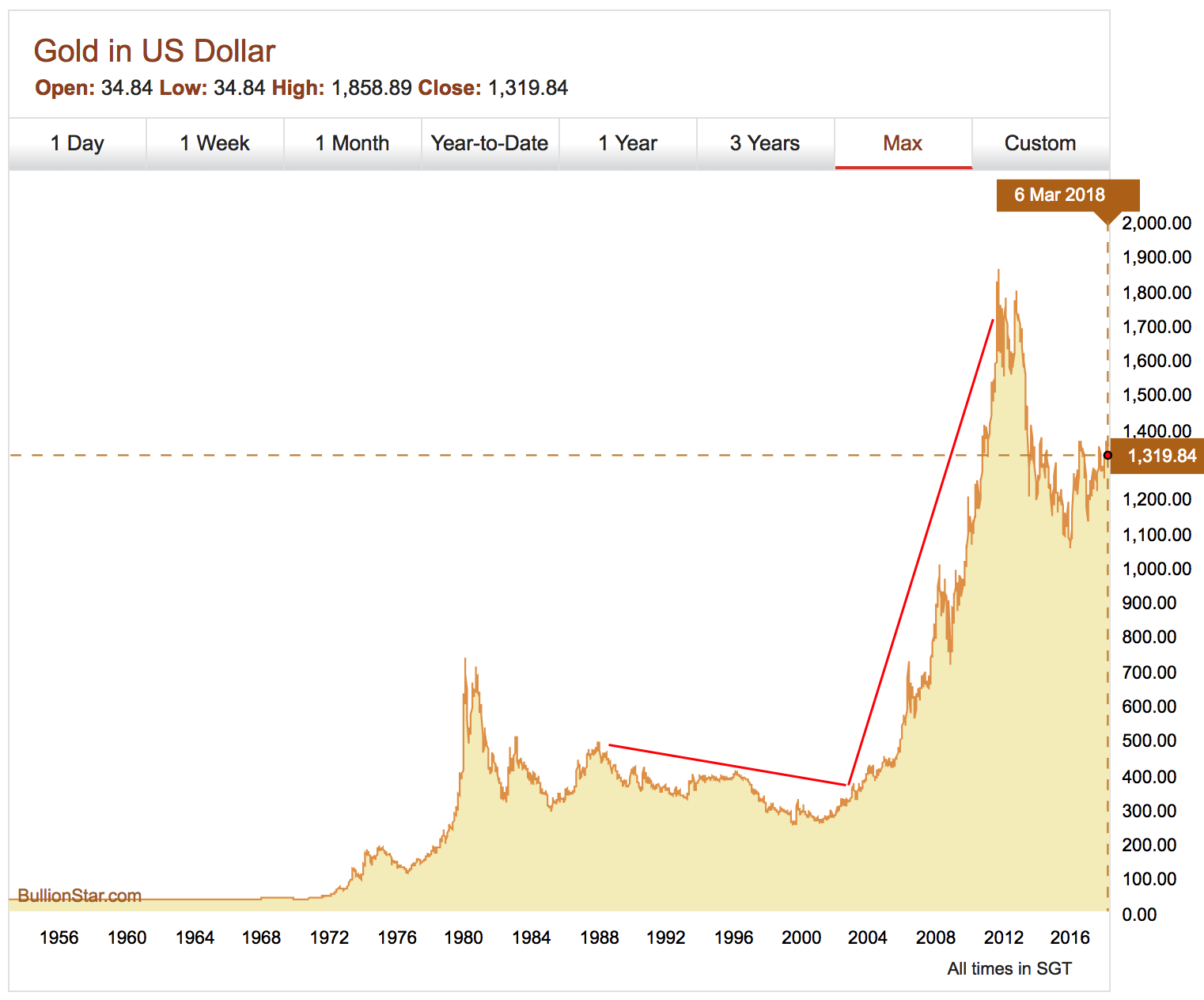

Loans do not extend into eternity. The moment a gold loan is issued the price will get hammered. But what happens when the loans are repaid? Gold lending (mostly by Western) central banks is said to really have kicked off in the late 1980s - although, admittedly, I don't have the exact data myself. Throughout the 1990s the gold price, indeed, was relatively low. See for yourself in the chart below.

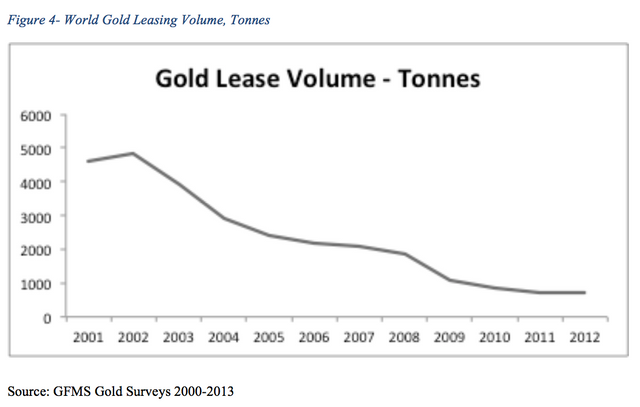

In the new millennia, however, central banks started to reverse their course and stopped lending. Data by GFMS shows that since 2001 loans (leases) have been declining. And in the chart above we see that around then the gold price has been increasing.

So, lending out gold by central banks has suppressed the price of gold, the question is, to what extent is that currently happening? At this moment I think not many central banks are lending metal out. The Dutch central bank, for example, has stated it ceased lending gold completely in 2009, of course due to the financial crisis in 08. If central banks are covertly lending gold I'm still investigating.

Although gold lending is important to keep an eye on, at this point I don't think central banks have many thousands of tonnes on lease.

Other suppression tricks that ZeroHedge mentioned will be covered in a next steem!

Thanks Koos! May I humbly offer some unsolicited advice? If you use all 5 tags your article will receive more exposure. Looking forward to more orginal content here on steemit from you:)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks! I'm just playing around here. Seeing if Steemit is the future ;-)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think you will enjoy it! It is generally a positive environment and there could be a lot more gold experts on here as of now it is more crypto people. Welcome!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice article. Thanks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good move to Steemit Koos!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit