Source: Digital Gold

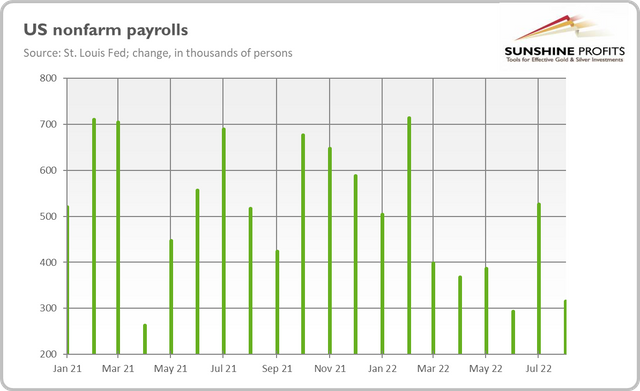

While the US economy successfully generated a lot of jobs in August (more than 300,000 jobs), the unemployment rate continues to increase with no sign of stopping soon. BLS, the official unemployment rate monitor, stated that the US unemployment rate rose to nearly 3.7% from 3.5% in August, rising more than 0.02%. The chart below doesn't tell the full story though, as other data sources tell us that the labor market is worse than reported by the US government.

Source: FXStreet.com

August jobs generation is not really a problem, since the number lines up with the prediction of many analysts. This doesn't change the fact that it is still lower than the number of jobs generated in July. Most of these jobs are generated in the professional and business services, health care, and retail trade.

Source: FXStreet.com

What is not expected is an increase in the labor participation rate. The labor force participation rate increased to 62.4% from 62.1% in July, which means more people are looking for jobs. In addition to this, it looks like the number of employment in the previous months were actually lower than what was initially reported.

In short, we can conclude that increase in the unemployment rate is primarily caused by the rise in the labor participation rate. The Fed's response to this is quite straightforward, they will fight against inflation by hiking the fed rate. The Fed will try anything it can to stop inflation, which affects other markets significantly.

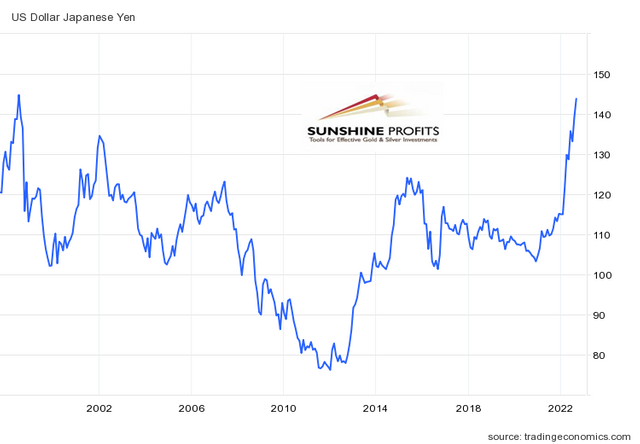

Another major blow for gold other than Fed rising interest rate is the continuous increase in the USD. One primary reason for this is the stance of other major central banks such as the ECB and Bank of Japan. Due to this reason, the Japanese yen fall to the level of 143 per dollar, which is historically the lowest level of the USD-YEN pairing since July 1998.

Source: FXStreet

At the same time, EUR is also showing an apparent weakness. It falls down below parity recently and reached the lowest pricing level since October 2002. The main reason for this is the current energy crisis that is happening around Europe, which is mainly caused by the shutting down of the key Nord Stream 1 pipeline by Russia, which causes higher gas prices due to low supply and increases the chance of a major recession.

Source: FXStreet.com

For many reasons above, analysts believe that gold will continue to struggle to remain above the key level of $1,700. The market also shares the same sentiment that gold is going to enter a major bear market, while at the same time contrarian believe that this is the best time to accumulate gold, just like what happened in 2015, 2008, and 2001. It is certainly a time of uncertainty, which makes a flexible trading plan necessary. One of the many ways to do this is to use Digital Gold.

Source: FXStreet

Buying a Digital Gold token will allow users to react quickly to market movement since the price of each token is highly correlated to gold. This will be necessary to avoid major pitfalls such as a heavy swing to bullish or bearish momentum in a very short amount of time. Digital Gold will allow users to trade anytime, and avoid traditional market lockout because the market is 'closed'.

At the end of the day, gold traders should plan carefully and look out for news 24/7. Make your own plan and trade at your own risk.

This article is written by joniboini.