Yesterday, I used a U.S.-based bullion dealer and bought gold eagles, worth tens of thousands of dollars. The reason for this purchase is two-fold in nature, and I want to make sure you understand why this story should be on your front burner.

I’m in Southern Europe right now, and in the past week, I’ve asked the locals to share with me their history as it relates to bank closures, bank holidays, government restrictions on withdrawing cash, and other irregularities.

After hearing more than 17 personal accounts of horror, my stomach had turned. Literally, 65-yr old people were standing, mid-August, outside the branch of their banks for several hours, only to be notified they could just take €50 to €100 for the day or week.

This is absurd and proves that we, the bank account beneficiaries don’t truly own our national currencies. They are, in essence, ours to use freely, until the government decides otherwise.

What a joke!

The purpose of gold ownership is to store wealth or cash outside the traditional banking system, by purchasing a highly liquid monetary metal, which has a robust market, full of buyers and sellers.

Since 1971, when the price of gold ceased to be fixed compared with the U.S. Dollar, owning gold, instead of fiat currency has been a no-brainer.

The same one ounce of gold from 1971, which cost $35 back then, cost me $1,210 yesterday and I was happy to pay it.

For one, the Dollar has been strong this year, so, in contrast, it takes fewer units of it to purchase one ounce of gold. On the flip side, though, the reasons to own gold today are the same as they’ve been since 1971 – to hedge the inflation of fiat currency.

In 2018, though, this is accentuated, as the U.S. administration is running record deficits and in the EU-block, cash savings are yielding nothing.

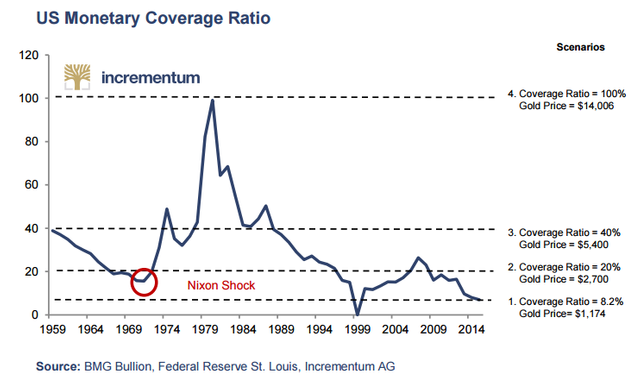

One way to measure how attractive the price is today is to look at my favorite gauge, the coverage ratio. This calculates how much of our currency supply is backed by gold, or, in other words, what the price of gold would be, had it accounted for the entire USD that is circulating.

Right now, gold covers around 7% of the available fiat dollars, so, to me, what this implies is that it has the potential to be worth around $3,600 soon, as the classic coverage ratio is about 20%.

I bought a lot of gold for two reasons, then:

- It is cheap compared with the classic coverage ratio, not to mention the 1980 coverage ratio of 100%, in which case it would be priced for $17,000.

- The potential of a market discountenance, a bank holiday, or a currency debasement event, which governments are notorious for, is alive and well today, and I want to be properly hedged.

If you don’t own any gold, look into acquiring some right now.

Of course, another option is to own physical silver, since it has stood the test of time very well.

Best Regards,

Brad Robbins

President, PureBlockchainWealth.com