Gold prices are at a 2-1/2-month high thanks to the recent stock market selloff as risk-averse investors bought up gold due to gold’s safe haven attributes in times of political and economic uncertainty. Other factors giving gold leg up recently is new tension between the Western countries and Saudi Arabia over the missing jSaudi Arabian journalist Jamal Khashoggi, a critic of the government who lived in self-imposed exile in the United States, mid-term election uncertainties and slowing global growth.

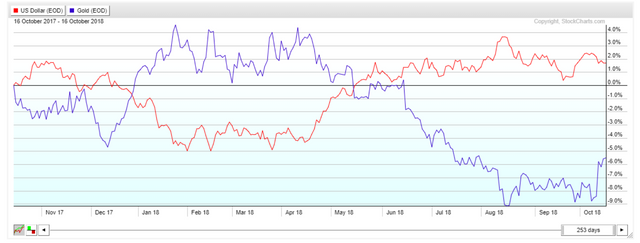

Since gold and the US dollar are inversely correlated, it doesn’t hurt that Trump is criticizing the Feds about rising interest rates which is putting downward pressure on the US dollar. However, the Fed has hiked interest rates three times this year and Wall Street has baked in a fourth rate hike before year-end at this point, which could provide a ceiling for gold prices if the US dollar starts to head back up.

When you mix that all in a pot to make some gumbo, you have the makings for gold to head higher.

NOTE: I realize gumbo has nothing to do with this post, but I just came back from New Orleans and along with the fried catfish, everywhere I ate gumbo, it was to die for.

Sorry I got side-tracked, lets go to the charts to see how high gold prices can go short term and what test/levels lie ahead for gold prices.

Monthly Chart (Curve) - price recently dipped its toe in the monthly demand at $1150 and is just now pulling back.

Weekly Chart (Trend) - after basing for nearly one month, price final broke the down trendline that was established in April. In addition, RSI has exited oversold territory.

Daily Chart (Entry) - price broke out of that mess in white recently. However, there is a bull trap just above at the daily supply at $1245. If price can take out that trap, momentum can take price up to the weekly supply at $1320.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Published on

by rollandthomas

I have been evaluating my exposure to gold (and silver) and lack some liquidity so I am looking getting some more here but have been struggling whether to get directly into the commodity ETF or using the miners for some dividends... Maybe a diverisifed view is best...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great thought, I will try to do a post on the miners in the near future.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

setting up nicely still

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit