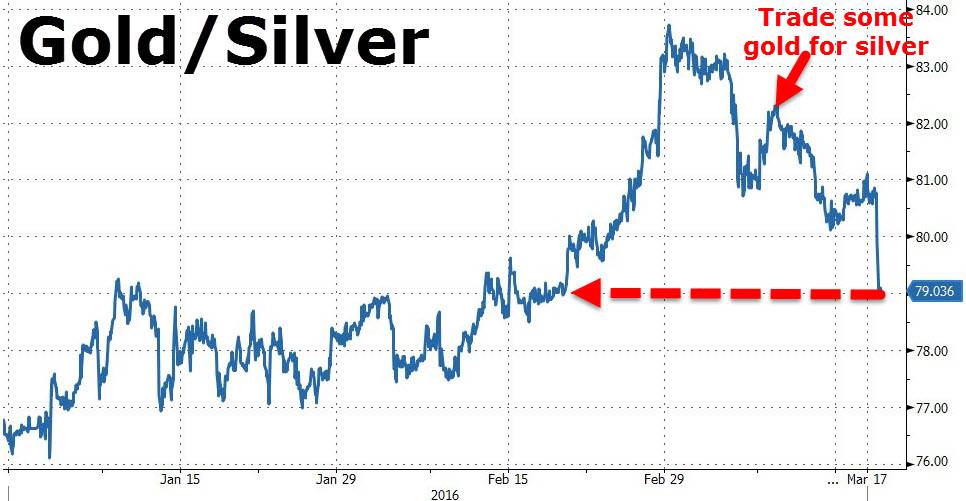

I am a big advocate of the gold-silver ratio. @joshsigurdson and I did a video back in March 2016 about how the ratio was predicting a coming market calamity. It's been years now and nothing has happened.

So what is going on?

It is pretty obvious what is happening. The markets has been rigged and the Gold-Silver Ratio is still high predicting a collapse in the markets. So it is still predicting the inevitable while markets continues to be held up by cheap currency floating into the global economy from reckless banksters and economists.

What will happen now in 2018? I see a lot of dark clouds surrounding the FED and other Central Banks around the world. Their policies are collapsing as they are trying to fix policies that are failing in the first place. Manipulators like the Exchange Stabilization Fund that is there to make sure markets are kept afloat are still lurking in the shadow off the books derivative markets around the world manipulating the stability of the global fiat system to keep it alive for another day.

As the demolition of the current monetary system happens will the gold silver ratio go back to it's historical average of 15:1 again?

We are nearing the end of yet another Central Bank cycle and Gold, Silver and now the Fiat Fractional Reserve System nemesis the decentralized cryptocurrencies will destroy the remnants of the yet again failing system.

2018 could be the year when the system finally collapse and out of the ashes a free market Phoenix will arise!

I've noticed the ratio starting to fall, at the same time silver is lagging. This could mean that gold might be getting a bit ahead of itself and thus a correction is due. However, in the longer term silver really has some catching up to do. It's been lagging gold since mid-2016 so we could see it explode to the upside in the coming months as gold continues to increase and the ratio falls.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The manipulation of gold and silver is so blatent I don't know how they get away with it. I haven't done much research lately but Zerohedge always used to have articles showing the shenanigans.

For example there was repeatedly random sellers that would sell like 2-3 billion in gold futures overnight when most markets were closed and crash the price on low volume. This would of course activate peoples stops and there would be additional selling pressure.

Of course when you think about it nobody with that kind of money would sell that amount of futures like that. To get top price you would sell slowly during high volume times so the price wouldn't dip very much. In other words, it was intentional price manipulation in the downwards direction.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Don't forget it can be manipulated to the upside too, once those in control decide that's where they intend to make profit. Dollar strength is less important under the Trump regime so we could see a multi-year fall in the dollar from here forward resulting in manipulation of metals to the upside. Once the short covering starts hold on to your hat!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

But if that happens, we will not need Manipulation to the Up Side! Unless you consider "letting the free market" do what it does "manipulation" by the absence of downward pressure. It has been driven down for so long that all they need to do is "cease and desist" and prices will skyrocket!

usdebtclock.org indicates that PM prices will be extreme, if we just normalize prices to the available dollars, last I checked Silver would be $730/ozT for example.

Also, note that GSR ;) Lots closer than 15:1 :D

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Absolutely they can move it both ways. I just only see examples of downwards manipulation lately.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm almost considering not even trading in my silver for fiat but instead playing the gold silver ratio. trading in my silver for gold at around 1/15 then if the ratio is out of whack again in the future, trading that gold in for silver.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I have done this as well

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Has it worked well? I imagine it can be hard to time.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good pointing that out, guys. Makes sense. And silver is also used in electronics!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Pure Gold is my choice.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

gold>silver any day of the week!simple as that

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great video!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit