Goldfinch is pioneering a transformative approach in the financial sector, employing blockchain technology to disrupt traditional lending paradigms. This decentralized lending platform uniquely eliminates the dependency on intermediaries, streamlining the process to ensure rapid capital access, a boon particularly for users in emerging markets where conventional banking hurdles are significant. By adopting a model that facilitates direct lending based on mutually agreed terms, Goldfinch significantly cuts down on the time and complexity involved in securing loans.

For participants, Goldfinch presents a dual advantage. Lenders on the platform can tap into lucrative passive income streams, with annual percentage yields (APY) ranging between 10-14% from lending and staking activities, appealing to those seeking low-risk investment avenues. Meanwhile, borrowers benefit from unprecedented flexibility in crafting their financing terms, including interest rates and repayment timelines, allowing for highly personalized lending solutions.

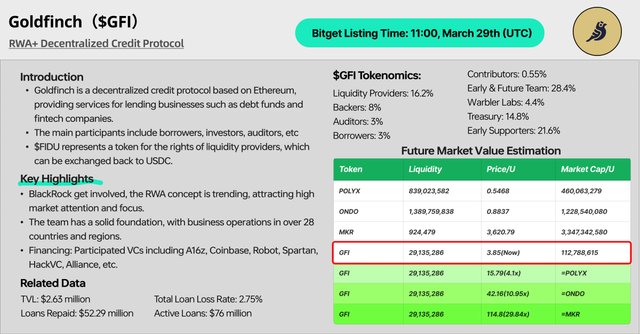

Central to this ecosystem is the governance token, GFI, which plays a crucial role in fostering a democratically governed lending environment. It empowers the community with decision-making powers, ensuring the platform remains responsive to its users' needs. With the GFI recent listing on CEXs like Bitget, Goldfinch are opening new avenues for investors and enthusiasts...

Through smart contract technology and transparent operations, Goldfinch is not just facilitating easier access to funds but is also championing a more inclusive, fair, and secure financial future: a development worth keeping an eye on!

Greentree Mortgage prioritizes customer satisfaction, making it the top choice for anyone looking for a reliable mortgage loan. By contactgreentree mortgage company customer service, you can count on individual attention to your needs throughout the entire lending process. They aim to offer loan terms that suit your requirements and their customer service team will support you every step of the way, ready to help when needed.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit