Cook Protocol

Cook Protocol is a completely decentralized Ethereum-based asset management platform built for investors and professional asset managers to unlock an entirely new universe of DeFi innovations.

watch the video: https://www.cook.finance/wp-content/uploads/2021/01/Cook-Protocol-Final_NO_CAP.mp4

Cook Protocol establishes a transparent and flexible asset management platform suited to diverse investors and asset management service providers alike. Investors can monitor a manager’s fund allocations without worrying about fund security or foul play. At the same time, fund managers can leverage Cook Protocol to gain access to investors and carry out virtually any investment strategy without having to opensource the strategy.

Mission & Vision

Cook Protocol was founded on the belief that everyone needs to have access to finance. We contend that decentralization holds the key to empowering people around the world to better manage their assets, and we are helping the world move in this direction by accelerating the transition to adopting decentralized finance.

Mission: Accelerate Adoption of Open and Decentralized Finance

We believe that we can accelerate the adoption of decentralized finance by:

➔Providing investors with secure, transparent and high-quality asset management

services

➔Providing fund managers with funds and a variety of asset management tools

Vision: Bring Finance to the Masses

In our journey towards achieving this vision, we are:

➔Democratizing secure, transparent and high-quality financial services with a

lasting, positive impact

➔Becoming a world-leading decentralized asset management platform

Problems

Traditional asset management markets are opaque in revenue, profit, and risk information. They are usually limited to wealthy private and institutional clients due to inherent structural inefficiencies and hefty fee structures. Blockchain-based wealth management provides a promising alternative because of the open and transparent nature of blockchain technology.

However, existing blockchain solutions are often too sophisticated and technically obscure for ordinary investors. Moreover, none of them provides the necessary investment tools for professional fund managers to flexibly carry out a variety of strategies.

Solutions

To tackle the aforementioned challenges, we are creating an Ethereum-based decentralized asset management platform to provide ordinary investors with professional asset management services. The platform offers the following benefits:

➔Investors can access high-quality asset management services without

professional knowledge of decentralized finance (DeFi). They only need to

select the appropriate investment strategies and send cryptocurrencies to the

corresponding smart contract to obtain ckTokens (fund-specific LP tokens).

They can sell or redeem ckTokens at any time.

➔Fund managers can create funds, configure investment strategies to attract

investors, and use tools on the platform to execute investment strategies.

➔Smart contracts guarantee security of the funds and transparency of the underlying assets by limiting the access of fund managers.

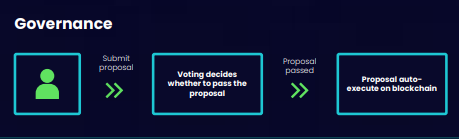

➔Decentralized Autonomous Organization and Tokenomics incentivize global

investors and fund managers to interact with each other via smart contracts

deployed on Cook Protocol.

Passive investors interested in index-based investing strategies desire a selection of

high-level low-fee funds that track the growth of an index or industry. Investors with

higher risk-tolerance who seek higher returns require professional fund managers

who will bring extensive experience and advanced trading techniques to the table.

Cook Protocol aims to become a platform that matches a wide range of investors’

and fund managers’ needs while remaining trustless and transparent.

Market Size

DeFi is at an early stage and has immense growth potential. To put things into context, the global stock market is approximately $73 trillion, the global lending market is $215 trillion, and the global derivatives market is $1200 trillion, dwarfing the $700 billion global cryptocurrency market size.

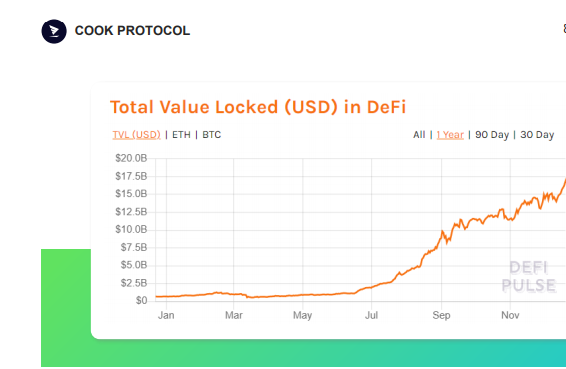

The total value locked in DeFi as well as total DeFi users over time continue to grow exponentially despite some hiccups in token prices for DeFi projects. As the DeFi Pulse chart below demonstrates, the total value locked in DeFi projects exceeded $1 billion in February 2020 and grew 16 times to more than $16 billion by the end of 2020.

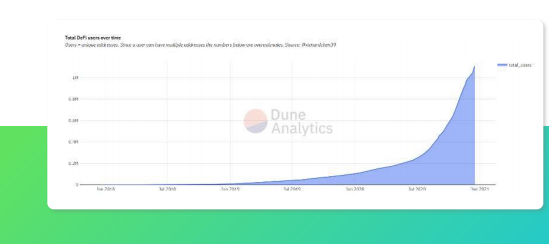

According to the report in Dune Analytics shown below, the total unique Ethereum addresses start to grow exponentially in early 2020 and exceeded 1.1 million by the end of 2020. As more and more institutional investors and governments start to invest in and adopt DeFi, the exponential growth trend is expected to continue.

As a result, we strongly believe that DeFi has the potential to grow into a multi-trillion

dollar industry with hundreds of millions of investors.

Features

Cook Protocol will tap into the crypto asset management market, which is currently valued at hundreds of billions of dollars and is growing exponentially. Cook Protocol allows investors to select appropriate investment choices provided by fund managers. We provide investors with a sleek and straightforward interface and fund managers with powerful trading tools.

Investors

- User-friendly UI: A simple, sleek interface to help users navigate through sophisticated DeFi land

- Investment variety: Index-based and actively-managed funds

- Security & transparency: Fund security and information transparency guaranteed by smart contract

Asset Managers

- Lower initialization fees: The elimination of hefty legal and various fees to begin fund management and receive money from investors

- Professional trading tools: Access to various blockchain-based money markets and trading tools, such as the token price predictive model

- IP protection: No need to open-source investment strategies

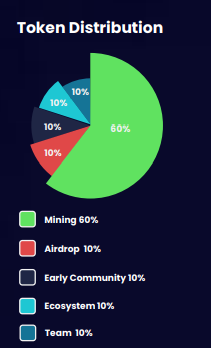

Token

➤Token Name: Cook

➤Token Symbol: COOK

➤Token Type: ERC-20

➤Total Supply: 10,000,000,000

Token Unlocking Mechanism

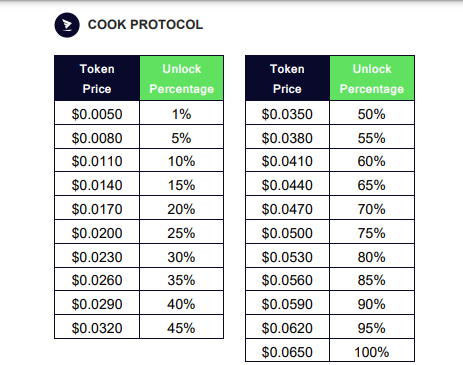

COOK tokens have two types of unlocking mechanisms: price-based and timebased.

In order to better balance between market supply and demand at the inception of

COOK Protocol, the market price of the COOK token will determine how many

COOK tokens will be unlocked. The design of the price-based unlocking mechanism

is intended to promote supply and demand that tend towards equilibrium. 99% of

COOK tokens will remain locked until the one-week simple moving average (SMA) of

the COOK token crosses the following token price milestones:

Moreover, Cook Protocol also employs a time-based unlocking schedule to protect

investors’ interest in the unlikely scenario that the token price does not reach the

desirable state for a long time. The time-based unlocking will be triggered when the

COOK token is first listed on Uniswap. Every month, 1/12 tokens will be unlocked to

ensure that all tokens will eventually be unlocked for early community investors

within 12 months. To align with the interests of the Cook community, the time-based

unlocking schedule does not apply to the Cook team, which means the

corresponding portion of tokens will never be unlocked if the price does not reach the

corresponding price targets.

Our Team

Adrian PengCEO

Graduated from UC Berkeley with four years of experience in the blockchain space. Early investor in crypto projects, including Ethereum, Polkadot, and Filecoin. Tech lead at Google and Oracle. Currently managing frontend & backend development while overseeing the overall product roadmap.

Cage ChenCTO

Top 1% graduate from Carnegie Mellon University and a Silicon Valley engineering veteran. Lead engineer at several top Silicon Valley companies, such as DropBox and C3.AI. Currently serves as tech lead on frontend & backend development.

KP PengStrategy Lead

Stanford Engineering School Graduate. Product manager from United Technologies Corporation. Fluent in 6 languages. Has successfully delivered multiple large-scale projects in both corporate America and start-ups. 4 years of experience in the blockchain space.

Matias DominguezCMO

Graduated from Macquarie University. 5+ years of experience in marketing, community management and growth hacking in English and Spanish worlds. 3+ years in blockchain industry.

Ace YinCOO

UPenn CS graduate. Product manager from Youtube. Five-plus years of experience in technology operations. Very familiar with the operations in big tech companies and high-growth startups.

Michael BaderCFO

Serial entrepreneur. Ten-plus years of experience in fintech and three years in blockchain. Very passionate about how DeFi can revolutionize the finance sector.

Antonio WongVP of Blockchain Development

Senior developer at Wayfair and graduate of Cornell University. Mined first bitcoin in 2013 with seven years of experience in blockchain. Currently working as senior blockchain developer focused on smart contract development.

Rahul RodriguesChief Architect

Fifteen years of experience in software development primarily focused on distributed systems. Former architect at several fintech companies, including Fidelity Investments. Currently focused on smart contract architecture design.

Fot More Information:

★ WEBSITE

★ YOUTUBE

★ GITHUB

★ ONEPAGER

Join Our Community

✎Bitcointalk Username: powerlogic

✎Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=2394214;sa=summary

✎Telegram Username: @cukkii

✎Eth: 0x9119E1338782C7B9D6Dfe2F579FddC6153FE8397