Ready or not, the new banks are here

The rules of the road apply to banks as well. Always look what’s coming ahead otherwise you will be run over. Admittedly, it is much easier to only look at what’s there today and not use it to anticipate what is around the next corner. However, that is exactly the reason why so many great companies have fallen between the cracks of two S-Curves, from Kodak (who invented digital photography but did not see the potential in it) to Nokia (who looked at the iPhone but chose not to accept that the future of mobile phones was no longer hardware but software). For banks this means to accept that the notion of the so called GAFA banks (Google, Amazon, Facebook, Apple) is a very real one. In fact, it is already reality today.

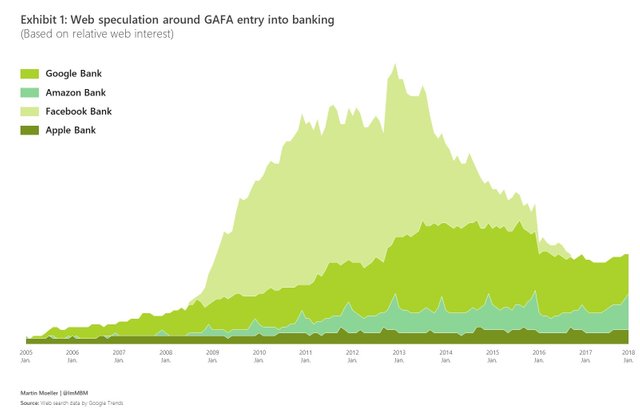

There has been ample speculation among expert when these tech giants might enter banking, as well as a great deal interest in the matter from a broader audience for many years now (see below). 2017, however, was the year where the actions of Google, Amazon, Facebook and Apple spoke a lot louder than any words or expert analyses could.

Oddly enough, Google is the last one in the lineup to make its proper move on banking, beyond its already existing play in the payments space with Google Wallet and Android Pay. Way back in 2006 the Google Finance portal was launched, which however remained in beta until 2009 and did not really evolved much since then. This has now changed. Google quietly discontinued the stand-alone service and launched a revamped “Google Finance” tab directly in Google Search. It provides people financial information based on their interest as well as additional insights linked to individual stocks, local markets or world markets and alters people to relevant market movements. In short, it provides the insights retail and affluent clients would otherwise get from their bank. This is especially important as this kind of financial advisory function is part of the fee-based elements of the banking value chain. Contrary to transactional and custody functions, this is where the future of banking lies, as clients value such services most i.e. their willingness to pay for such offerings is highest.

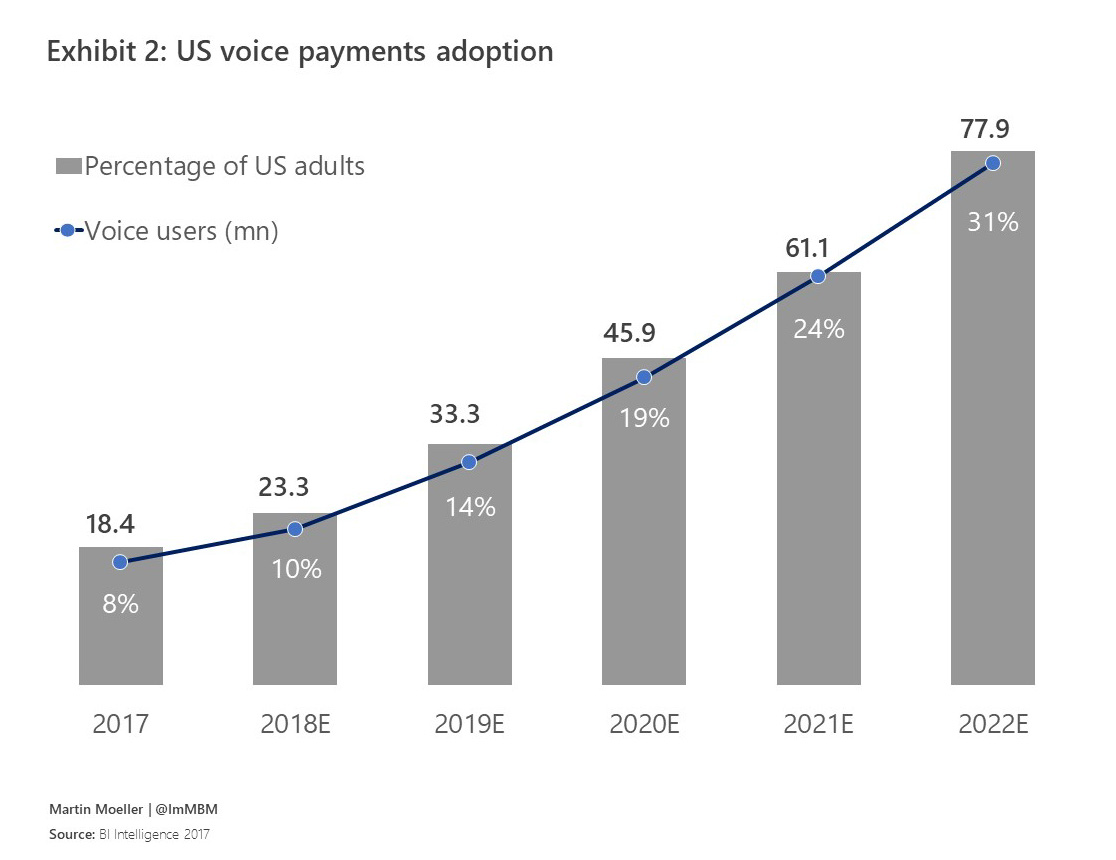

The second of the GAFAs, Amazon, is betting big on lending as its main beachhead for disrupting finance. Mid of 2017 it revealed that the small business lending arm it launched quietly in 2011 had surpassed the $3 billion mark and was accelerating its pace significantly, having added $1 billion of new loans in the preceding 12 months alone. Amazon’s second line of attack is payments. Amazon Pay, which has recently been added to the Echo’s/Alexa’s skill set, is set to receive a major boost by tapping into the market of voice payments. A market which is projected to be used ~78 billion users by 2022 in the US alone (see exhibit 2).

Apple is, of course, the biggest force reshaping banking from the payment side of the value chain. Having sold more than 200 million iPhones per year for the last three years running, it has a vast user base and is growing its payments business accordingly. Apple pay now has an estimated 86 million users up from only 15 million in 2015, a staggering 473% increase. Since December Apple also enabled payments directly via its messenger which is built into every one of its iPhones. If history is any judge, users will follow convenience and with nothing being easier than paying people through the device you handle permanently in any case, Apple Pay figures are in line for new heights in 2018.

Next to Google and Amazon, Facebook will perhaps turn out to be the biggest challenger to banks. It is fully embracing the notion of platform business i.e. not creating new solutions itself, but partnering with others in a true ecosystem approach in order to bring new services to its 1.4 billion active daily users (yes, this is a user base larger than the population of China). Like Apple, Facebook sees its beachhead into banking in payments. It has been offering peer-to-peer payments for some time already and in a bit to expand its business, Facebook acquired a license to provide e-money services across Europe just last December. Moreover, true to Zuckerberg’s “We'll partner with everyone who does payments” statement, Facebook announced a cooperation with PayPal last October. However, Facebook’s strategy is a much broader play to become the future hub for people’s entire money side of life. For example, it is already been working hard to become our home for the future shopping. It launched Facebook Marketplace where stores and merchants can offer their products and it is letting every user post their own items for sale as well (simultaneously taking on Amazon and ebay).

Turning all of this into a coherent whole will be Facebook's AI powered assistant “M”, which is now effectively part of the Messenger and the company plans to turn into everybody's personal concierge. You may have wondered (or not) why back in 2015 Facebook forcibly split the Messenger from its main social networking platform. The reason is simple, conversations are the core of our life and while social networks with profile pages might go out of fashion at some point, people’s need to communicate will not.

Conversations are also the most convenient and natural way for people to consume new services from Facebook. What could be easier than “M” automatically ordering an Uber as you speak about meeting up with friends for dinner (which is already reality today) as well as automatically paying said dinner as you leave the restaurant and splitting the bill between all of you, as the respective “M”’s are of course linked. Now fast forward just a little bit, you might see a really nice house somewhere and text your partner about it, who loves it too. However, as you talk about it, you realize it is out of your budget. In comes “M”. Linked to a local property market comparison side it can calculate not just the price of the house today but also over time and then presents you with different options to make our dream come true, from investing money to grow your savings to taking one of several different mortgages available. This is Facebook’s vision, building a concierge for all aspects of our life, living in the natural place for it, our conversations. That is why Facebook split the Messenger from its social media platform (and why it bought the other main communication platform in the world, WhatsApp). It is also why it is now adding banking features, in order to take its vision one step closer to completion.

Some might say all this is a tech dystopia, people won’t stand for it and therefore the GAFA challenge to banking will soon disappear all by itself. I am not so sure. In any case, keeping your fingers crossed is not a sound business strategy. Denial never helps, as James Surowiecki put it nicely in his article about the fall of Nokia. The company was, at its heart, a hardware company rather than a software company and thus dominated by hardware engineers. Nokia looked at Apple’s challenge but simply asserted that people will never value software in a phone over hardware and continued its business strategy as usual. Nokia reacting to Apple's new world software challenge with hardware answers is like banks trying to counter GAFA’s advanced tech challenge with a 0.5% interest rate increase on savings (subject to terms and conditions of course).

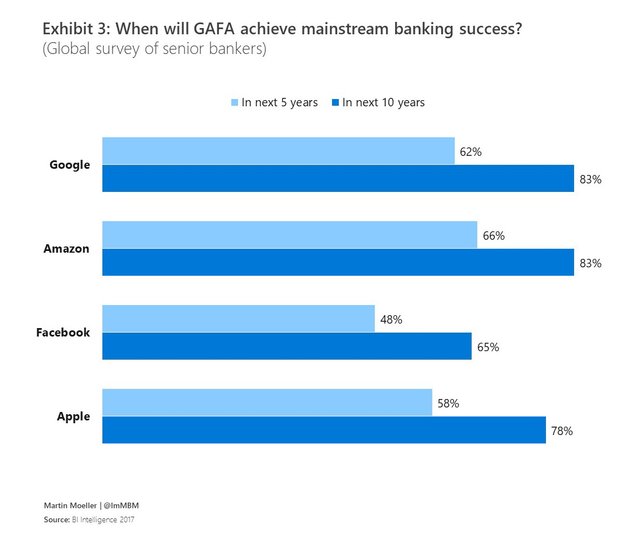

It does seem though that the financial sector is now waking up to this new reality. A recent survey among senior bankers found that the majority now realize that Google, Amazon, Facebook and Apple are indeed the new big banking challengers (see exhibit 3).

However, there are still some who don't see it this way. Only recently Crédit Agricole’ CEO Philippe Brassac said in an interview with the Financial Times that big tech challengers have no chance. They don’t have the full service offer of large banks, nor do they enjoy customer’s trust and therefore they will never succeed in banking.

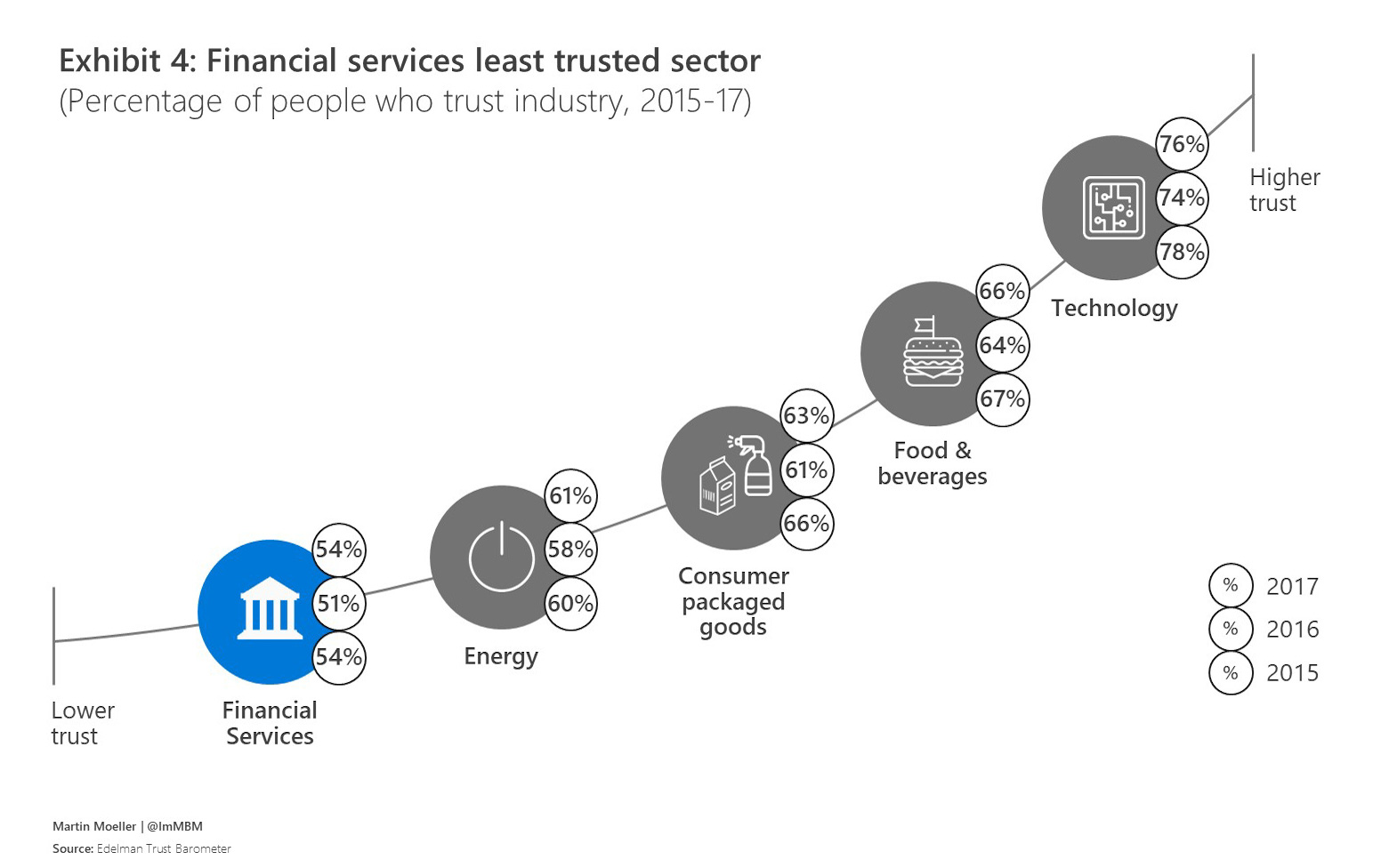

Mr. Brassac is right to point out that trust is crucial to any business and especially banking. The question is though, do customers still trust banks? The answer is sadly very clear. The 2017 Edelman Trust Barometer showed that Financial Services rank at the bottom of all industries (the same as in previous years), with only 54% of people actually trusting banks (see below).

Of course, people are becoming increasingly weary of the data collection especially by Google and Facebook. While this may in time undermine trust in them, there is a countervailing force working in their favour: People seek convenience. Yes, they are aware that Facebook and Google collect and use their data, but that does not stop 1.4 billion people to share their personal updates daily on Facebook, nor does it stop 64 thousand people using Google Search every second.

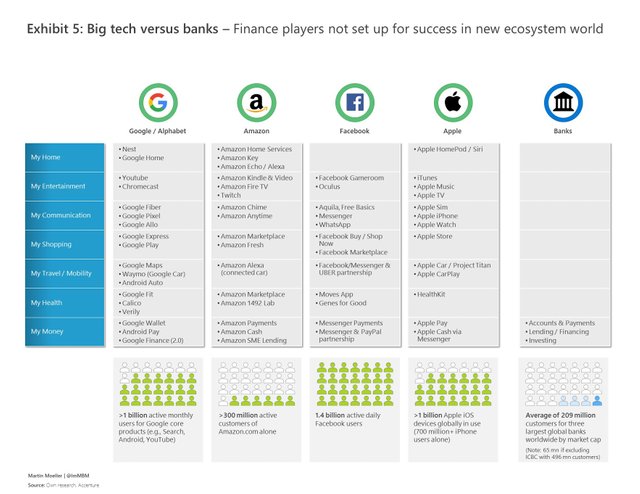

What Google, Amazon, Facebook and Apple have realized is the power of ecosystems. These are easy to enter as they conveniently bring everything you need together in one place (see below). This not only makes them difficult to leave again, it also makes expansion into new business lines very easy, as illustrated above in the example of Facebook’s growth strategy.

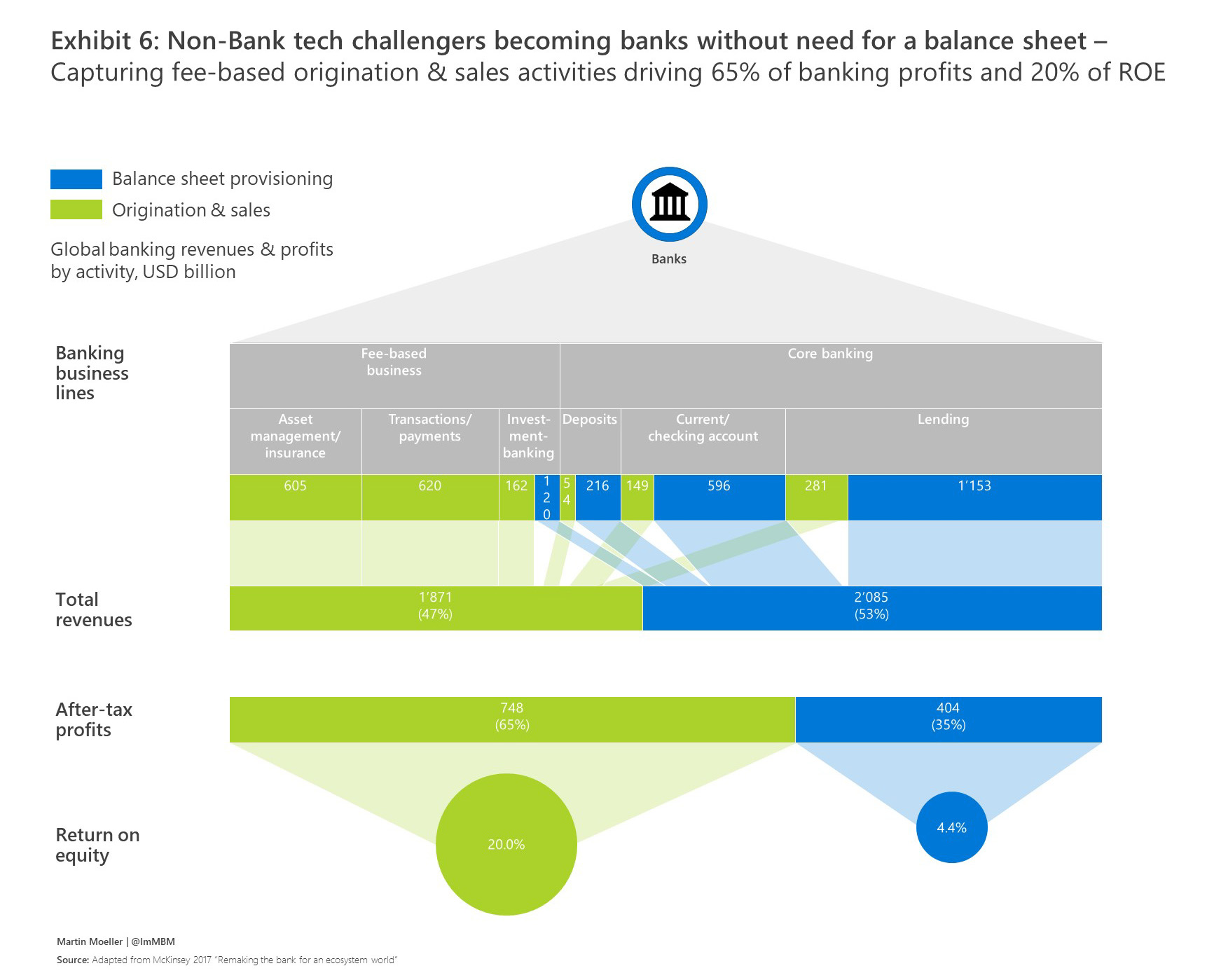

When it comes to the assertion that the GAFA challengers to not offer the full spectrum of services that today’s banks have, that is absolutely correct. It is, however, also beside the point. Google, Amazon, Facebook and Apple do want to enter banking, but they don’t want to become banks. They target the revenue rich parts of the banking value chain while leaving the regulatory heavy parts with incumbent banks. Why take the whole pie if you can cherry pick? As McKinsey recently pointed out, with this strategy the non-banking challengers like GAFA put up to 65% of banks’ revenues at risk as well 20% of ROE (see exhibit 6). In the same way that Airbnb has become the largest rented accommodation provider in the world without owning a single property, or Uber has become the world’s largest personal transportation company without owning a single car, Google, Amazon, Facebook and Apple are set to become the largest banking providers without needing a cent worth of balance sheet.

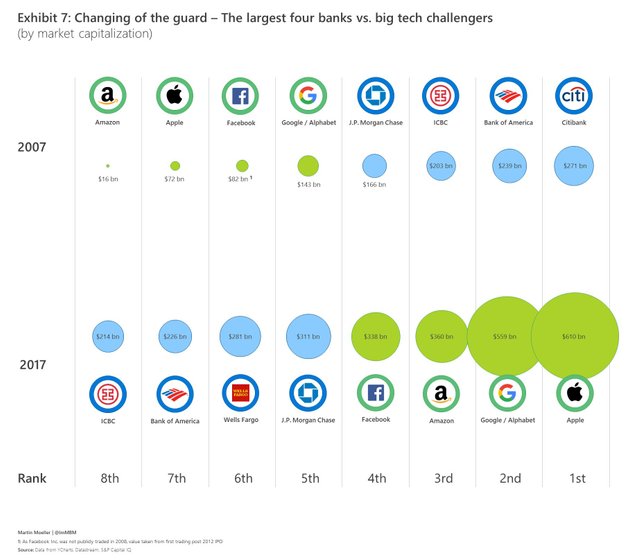

Banks offer only banking. Google, Amazon, Facebook and Apple on the other hand are building ecosystems for your entire life. This convenience factor is why they are attracting so many people. This is also why over the past ten years the tables have turned in the market. What we see today is a compete inversion of the past, with Google, Amazon, Facebook and Apple being worth more than any bank in the world (see below).

Banks thus no longer have the comfort of time. The challenge is not one that will materialize in the distant future. Waiting and continuing business as usual is already causing banks to fall bit by bit between the gaps of the S-Curves. If there has ever been a time for great strategy, then, for banks, it is now.

Hi @eug8n I see you are using 100% power up option. You might not want to do that. I wrote a detailed post explaining why, you should read it.

DON'T USE 100% POWER UP - You Will Lose a Lot of Money

thank me later ;)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.linkedin.com/pulse/ready-new-banks-here-martin-moeller/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @eug8n! You have received a personal award!

Click on the badge to view your Board of Honor.

Do not miss the last post from @steemitboard:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @eug8n! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit