There is a 50/50 chance we will have a government shutdown over the weekend and a 100% chance we cannot pay off our national debt, no matter what transpires in the foreseeable future. In the meantime, our Romanesque politicians and mainstream media fake news refuse to adequately cover the U.S. sovereign debt and unfunded liabilities issue, which are driving our country into the biggest “shithole” you may ever experience.

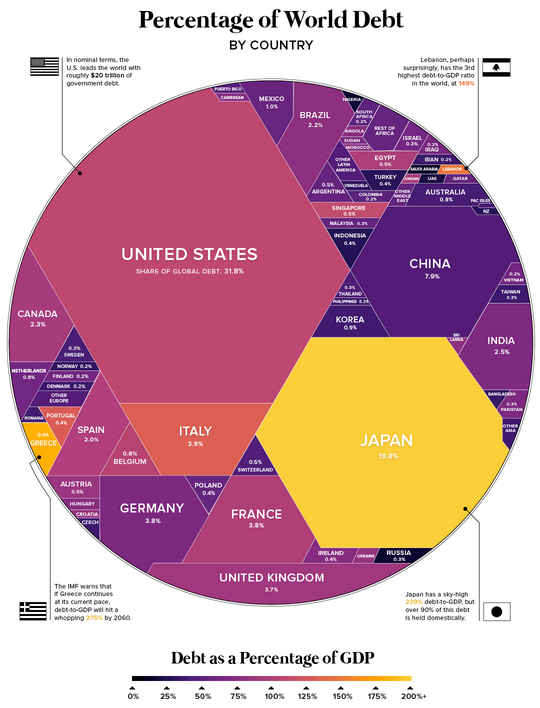

And it’s a global problem, folks, not just bad spending habits dreamed up by Uncle Sam all by his lonesome. Global debt hit a record $233 trillion. Is a debt jubilee possible? Very unlikely. Shooting wars are a nice distraction, though, rather than solving political issues that parade as money problems.

Scapegoats are easy, but solving a country’s problems is not. The political class and shadow governments have enabled the current monetary mayhem since 1913.

Chinese credit agency has downgraded the United States’ credit rating from A- to BBB+_… _“Dagong Global Credit Rating Co., one of China’s largest firms, said in a statement Tuesday that it had given the U.S. sovereign ratings a negative outlook, specifically citing the GOP’s recently-passed tax-reform plan as a reason why. Dagong also hits the U.S. for ‘political deficiencies,’ as well as the U.S.’ reliance on debt-driven economics, which it says are hindering further economic development. The government did not discover from the financial crises that it is the debt-driven mode of economic development that has hindered the country from making ends meet… Deficiencies in the current U.S. political ecology make it difficult for the efficient administration of the federal government, so the national economic development derails from the right track… will lead to the federal government being forced to raise the debt ceiling with more frequency.” – The Hill, Jan. 16

Fitch reiterates U.S. downgrade warning… “Fitch reiterated its warning on Wednesday that the United States**** could lose its prized triple-A credit rating if the country’s debt ceiling is not raised in the coming months. The U.S. Treasury Department will exhaust all of its borrowing options and run dry of cash to pay its bills by late March or early April if Congress does not raise its borrowing limit, the Congressional Budget Office has said. Fitch’s head of sovereign ratings James McCormack told Reuters that even if Washington then continued to make interest payments on its main government bonds, not meeting other domestic obligations ‘would not be compatible with ‘‘AAA’’ status.’ During the debt ceiling showdown in August 2011, Standard & Poor’s stripped the United States of its highest rating. It has since then kept a slightly less sterling grade of AA+ on the world’s largest economy.” – Reuters, Jan. 10

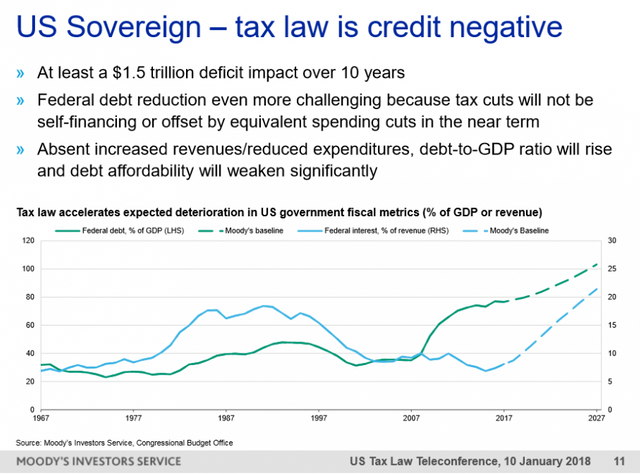

Moody’s Warns Washington – USA Credit Rating At Risk Over Trump Tax Cuts… “In an ironic twist, on the same day as Chinese officials, reviewing the nation’s foreign-exchange holdings have recommended slowing or halting purchases of U.S. Treasuries, Moody’s warns that US tax cuts are seen as a credit negative for the USA Sovereign rating.” – ZeroHedge, Jan. 10

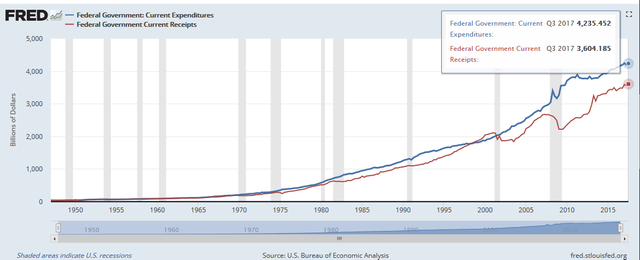

Graph of U.S. expenditures vs. revenue via the St. Louis Fed…

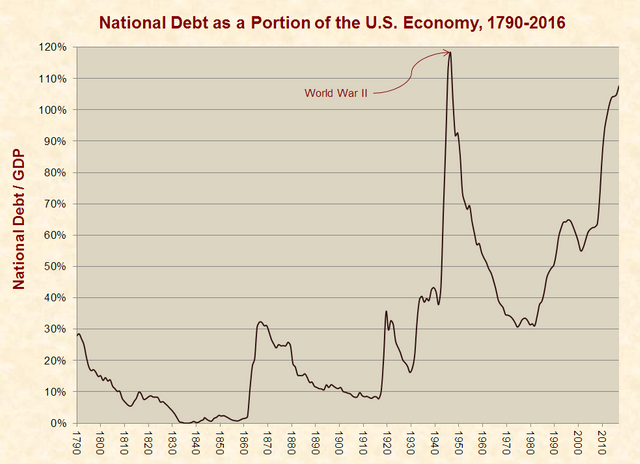

The following two charts and data points listed below are from Just Facts Daily…

As of January 4, 2018, the official debt of the United States Government is $20.5 trillion ($20,493,371,220,439). This amounts to:

- $62,676 for every person living in the U.S.

- $162,357 for every household in the U.S.

- 105% of the U.S. gross domestic product.

- 569% of annual federal revenues.

At the close of the Federal Government’s 2016 fiscal year (September 30, 2016), it had roughly:

- $8.5 trillion ($8,542,000,000,000) in liabilities that are not accounted for in the publicly-held national debt, such as federal employee retirement benefits, accounts payable, and environmental/disposal liabilities.

- $29.0 trillion ($29,038,000,000,000) in obligations for current Social Security participants above and beyond projected revenues from their payroll and benefit taxes, certain transfers from the general fund of the U.S. Treasury, and assets of the Social Security trust fund.

- $32.9 trillion ($32,900,000,000,000) in obligations for current Medicare participants above and beyond projected revenues from their payroll taxes, benefit taxes, premium payments, and assets of the Medicare trust fund.

The figures above are determined in a manner that approximates how publicly-traded companies are required to calculate their liabilities and obligations. The obligations for Social Security and Medicare represent how much money must be immediately placed in interest-bearing investments to cover the projected shortfalls between dedicated revenues and expenditures for all current participants in these programs (both taxpayers and beneficiaries).

Combining the figures above with the national debt and subtracting the value of federal assets, the Federal Government had about $84.3 trillion ($84,306,000,000,000) in debts, liabilities, and unfunded obligations at the close of its 2016 fiscal year.

This $84.3 trillion shortfall is 93% of the combined net worth of all U.S. households and nonprofit organizations, including all assets in savings, real estate, corporate stocks, private businesses, and consumer durable goods, such as automobiles and furniture. This shortfall equates to:

- $260,382 for every person living in the U.S.

- $670,058 for every household in the U.S.

- 451% of the U.S. gross domestic product.

- 2,370% of annual federal revenues.

———————–

Chinese credit agency puts US sovereign rating on par with Turkmenistan… “BRICS countries – Brazil, Russia, India, China and South Africa – have complained that US-based credit agencies such as Fitch, Moody’s and S&P Global are artificially downgrading the ratings of emerging economies and turn a blind eye on economic setback in the US and other Western countries.. ‘In the Western countries, they use the credit rating as a tool to protect their own profits, their own interests,’** Guan said, adding that the 2008 financial crisis was partly due to the wrong assessment of the US economy**.” – RT, Jan. 16

A TV ad to chew on, produced by Citizens Against Government Waste (CAGW) in 2010: United States Owes China.

No country is immune to TaperCaper ownership, including China. Let’s examine central banks’ balance sheets.

Balance Sheet Ballyhoo – Bond Market Perspectives – Forbes, Sep. 2017

The ‘Japanification’ Of America – 720Global, Dec. 2017

As currency wars, trade wars, shooting wars, and sovereign debt issues loom, here is the ecology-dominating Capital Hill nowadays…

Investors Spooked at Specter of Central Banks Halting Bond-Buying Spree_ – NYT, Jan. 11_

“Shithole-Gate” Might Lead To Government Shutdown As Democrats Balk At Deal… “The Democrats’ critics on the left are demanding that the minority party use all of its leverage to stymie the Trump agenda, even if that means forcing a government shutdown. Fortunately, more mainstream party members can now use Trump’s ‘Shithole’ comment as a pretext to drop their support for an immigration compromise in the hope of eventually coaxing Republicans into a better deal. Meanwhile, the GOP had concluded that it would be unable to reach a long-term spending accord by the Friday deadline, which means that chances of a government shutdown have increased this week as yet (update Jan. 18 another ‘stop-gap’ deal) is the only option. The government has been operating on short-term spending authorizations since the last two-year budget expired in September. The current short-term spending bill expires Friday at midnight.” – ZeroHedge, Jan. 16

Trump Fires Trade War Shots: “If There Is A Trade War With China, There Is”– Zerohedge, Jan. 17

** ****Showdown Over a Gov’t Shutdown — Blame Dems, Not GOP**_ – Investors Business Daily, Jan. 18_

Trump opposes GOP’s approach to avoid government shutdown_ – Washington Examiner, Jan. 18_

McConnell plans for shutdown… “The Senate leader intends to keep his chamber in session and stage a series of votes designed to embarrass vulnerable Democrats.” – Politico, Jan. 18

Our inability to pay up without incurring additional debt is on the shoulders of our current and future labor force…

Older Workers Account for All Net Job Growth Since 2000_ – St. Louis Fed, Jan. 16_

How is the economy really doing, so we can muster up enough cash to meet our obligations, despite the current QE-generated housing and stock market bubbles? The velocity of money and real GDP remain in a crapper of a downtrend…

What all the infighting, drama, and name calling on Capitol Hill remind me of right now is a spoof of the famous “Mr. Pink” scene from the cult classic Reservoir Dogs. Everyone is going to lose this argument, no matter your country, party, color, or lifestyle.

The bottom line to remember is that those holding the most gold after all the triggers are pulled will rule the emerging global monetary agenda.

Plan Your Trade, Trade Your Plan

TraderStef on Twitter

What a nice and cool post ,thanks for sharing the motivating post to us ,upvote and comment @waldoros post

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Something (like the economy and monetary system) that is based on endless growth has to collapse at the end.

Nothing on earth is endless - everything will end.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thoughtful analysis. I wonder where cryptocurrency fits into this picture. Definitely a global jubilee would be an interesting time...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It is great that posts like this packed with good information and numbers are put out to jar people into realizing the situation. The more people that wake up to the monetary scam the better.

I think we need to move towards informing people to the point where they realize that all paper currencies are a scam. There will be a critical mass at some point of people who just exit this system. That will be the only path forward.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit