In the classic children's Food,

Hot Potato, players sit in a circle and toss a small object (often a potato) around while music is playing. Once the music stops, the player left holding the potato loses the game.

Are you holding a hot potato or a scarce asset?

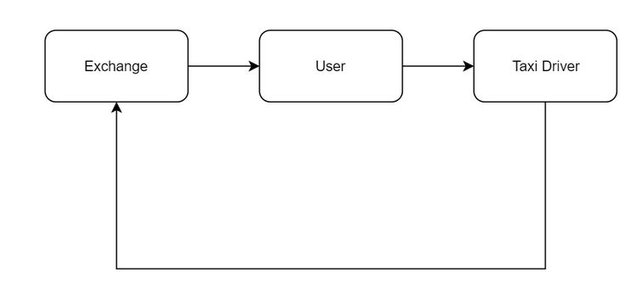

Using this simple analogy, it helps to consider the holding time (H) of the asset you are buying into. For example, a decentralised taxi coin TAXI that is used to access taxis has a short holding time. You, as a user would buy it from an exchange, use it to pay the driver, who would then immediately sell it back to the exchange.

This arrangement creates continuous selling pressure on TAXI, where no player is incentivised to hold the token and simply passes it on to the next player, like a hot potato. Vitalik has a great post on this where he mathematically defines (H) and states:

if someone creates a very efficient exchange, which allows users to purchase an appcoin in real time and then immediately use it in the application, then allowing sellers to immediately cash out, then the market cap would drop precipitously.

Simple tokens whose utility could be replaced by another token or fiat are weakly coupled to the economy, and are prone to economic collapse or at the least, poor gains.

HODL Tokens

Like musical chairs, some tokens are designed with strong incentives to hold, where there is an economic advantage to hoarding as many of the tokens as possible. This acts as an economic sink, where the available token supply decreases with time. William Mougayar has a great post where he describes how the utility of tokens can be built. In it, he states simply that

Usage without value linkage is a waste

In other words, a simple medium of exchange, 'use it and lose it' token could lead to economic failure.