Leading Crypto Asset Manager Reveals New Assets Under Consideration for Future Investment Products

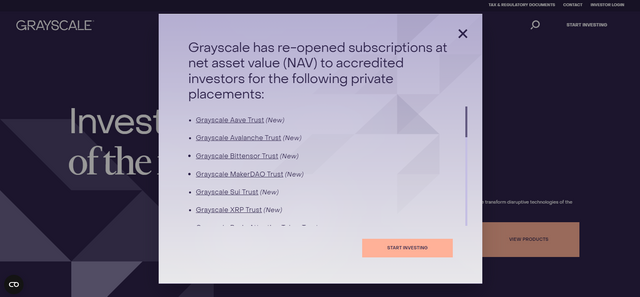

Grayscale Investments, one of the leading digital asset managers, announced an updated list of cryptocurrencies that they are considering for future investment products. This expansion reflects Grayscale’s commitment to offering investors a wide range of options within the growing crypto investment ecosystem.

Find out what they are and explore the wide range of options available in Grayscale's portfolio

New Assets on the Horizon

The list of assets under consideration includes a variety of cryptocurrencies with different functions and applications. Among them, the following stand out as new assets for crypto investments with Grayscale:

Kaspa (KAS): A consensus platform that seeks to improve the scalability and decentralization of transactions.

Mantle (MNT): A layer-two scalability solution for the Ethereum network.

Neon (NEON): An Ethereum-compatible smart contract platform.

Jupiter (JUP): A decentralized exchange (DEX) protocol on the Cosmos blockchain.

Broad Range of Existing Products

In addition to the new assets under consideration, Grayscale has a robust portfolio of crypto investment products. Some of the most notable assets include:

Bitcoin (BTC)

Ethereum (ETH)

Bitcoin Cash (BCH)

Litecoin (LTC)

Stellar Lumens (XLM)

XRP (XRP)

Zcash (ZEC)

Avalanche (AVAX)

Cardano (ADA)

Polkadot (DOT)

Solana (SOL)

Aave (AAVE)

MakerDao (MKR)

Synthetix (SNX)

Uniswap (UNI)

Commitment to Innovation

Grayscale continues to expand its investment product offering as the crypto ecosystem evolves. The company is committed to staying at the forefront of innovation and offering investors diversified investment opportunities in the cryptocurrency space.

Disclaimer: This information is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies involves risks and readers are advised to conduct their own research before making any investment decisions.