On June 14, 2018, William Hinman, Director of the SEC’s Division of Corporation Finance, made the following remarks at the Yahoo Finance All Markets Summit: Crypto in San Francisco, CA: “[B]ased on my understanding of the present state of Ether, the Ethereum network and its decentralized structure, current offers and sales of Ether are not securities transactions.”William Hinman, Digital Asset Transactions: When Howey Met Gary Plastic), U.S. Securities and Exchange Commission (June 14, 2018), https://www.sec.gov/news/speech/speech-hinman-061418 Later in that same speech, he made this pronouncement which has been lovingly dubbed the "Hinman Rule" by some members of the crypto legal community:

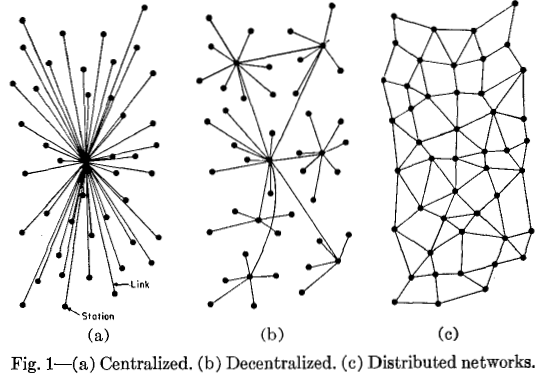

If the network on which the token or coin is to function is sufficiently decentralized – where purchasers would no longer reasonably expect a person or group to carry out essential managerial or entrepreneurial efforts – the assets may not represent an investment contract.

William Hinman, Digital Asset Transactions: When Howey Met Gary Plastic), U.S. Securities and Exchange Commission (June 14, 2018), https://www.sec.gov/news/speech/speech-hinman-061418 (emphasis added).

Since giving that speech, much digital ink has been spilled debating the usefulness of a "sufficiently decentralized" standard, with some commentators suggesting that "[i]nnovators should take comfort that this standard for decentralization, properly understood, is not overly burdensome or unrealistic, and seems to permit projects to have significant, necessary centralized leadership"Blockchain Association, Understanding the SEC’s Guidance on Digital Tokens: The Hinman Token Standard, Medium (Jan. 10, 2019), https://medium.com/@BlockchainAssoc/understanding-the-secs-guidance-on-digital-tokens-the-hinman-token-standard-dd51c6105e2a while others argue that "it is highly problematic to use 'decentralized' as a legal standard, for a variety of reasons, from our poor understanding of the concept, to its inevitably shifting nature."Angela Walch, Deconstructing 'Decentralization': Exploring the Core Claim of Crypto Systems, Crypto Assets: Legal and Monetary Perspectives (OUP, Forthcoming) (Jan. 30, 2019), available at SSRN: https://ssrn.com/abstract=3326244

The problem with focusing on the phrase "sufficiently decentralized" is that even in the context of blockchain protocols, “there is often a lot of confusion as to what this word [decentralization] actually means.”Vitalik Buterin, The Meaning of Decentralization, Medium (Feb. 6, 2017), https://medium.com/@VitalikButerin/the-meaning-of-decentralization-a0c92b76a274 As a result, attempting to craft a meaningful legal standard based that term, at least as it is understood in the blockchain/crypto space, is something of a fool's errand.

In fact, whether a blockchain network is “sufficiently decentralized” for purposes of securities law has far less to do with blockchain technology or even “decentralization” and instead has much more to do with the fundamentals of securities law, which are designed, as Director Hinman put it, “to remove the information asymmetry between promoters and investors.”William Hinman, Digital Asset Transactions: When Howey Met Gary Plastic), U.S. Securities and Exchange Commission (June 14, 2018), https://www.sec.gov/news/speech/speech-hinman-061418 In particular,

[W]hen the efforts of the third party are no longer a key factor for determining the enterprise’s success, material information asymmetries recede. As a network becomes truly decentralized, the ability to identify an issuer or promoter to make the requisite disclosures becomes difficult, and less meaningful.

William Hinman, Digital Asset Transactions: When Howey Met Gary Plastic), U.S. Securities and Exchange Commission (June 14, 2018), https://www.sec.gov/news/speech/speech-hinman-061418.

Since the entire foundation of U.S. securities legislation is based on the concept of disclosure, it only makes sense to enforce those laws when doing so will have any meaningful impact. To put it another way, if there is material non-public information about a blockchain network that is only known to a small group of developers or other "insiders" (including the fact that if those developers or insiders all decided to abandon the project the entire network would collapse), then it would at least arguably make sense, assuming all the other prongs of the "investment contract" test enunciated in S.E.C. v. W.J. Howey Co., 328 U.S. 293 (1946) are met, to require that this material information be disclosed publicly prior to the network and its related cryptocurrency being promoted to potential investors/purchasers. In that case, the network would fail to meet the "sufficiently decentralized" standard.

If you have questions about how this standard might apply to your own blockchain or cryptocurrency project, be sure to contact a qualified attorney, as the information presented on this website is meant for educational and informational purposes only and is not intended as legal advice.

Posted from Gulovsen Law Office: https://gulovsen.io/what-is-the-meaning-of-sufficiently-decentralized/