Where from here? – Reconsider your decision to follow Cryptocurrencies

Caution!! What you are going to read today will change the way you look at cryptocurrencies.

I can bet you a 1 BTC that if you are reading this you must be checking Coinmarketcap.com every morning the moment you open your eyes.

According to the popular website there are around 1515 currencies which are listed on 8578 markets right now, as am writing this piece of time wasting crap. But wait it will be too soon to close this page because a lot is coming your way.

Why?

When I started writing this I was wondering why I am wasting my time doing research and writing something that might not make any sense to majority of the population. But the idea to bring change in this world encouraged me to sip my beer and make you people realize that why exactly are we doing this and where are we headed from here.

This all started with the revolutionary idea of Blockchain technology to make a distributed and decentralized mode of transaction. With the introduction of Bitcoin, the first of its kind and name, very few people realized that it might turn out to be an answer to create a next generation of economy.

But no technology is perfect, the same applies to Bitcoin. Bitcoin was introduced in 2009 and everybody started talking about it after it revealed its true nature in late 2017 when its price reached to 20000 USD.

Many enthusiasts found it as an opportunity to make money overnight and many looked at it as an opportunity to improve the financial system. Why bitcoin? Unfortunately, I have to mention that bitcoin will never be able to replace fiat currencies. It can’t be used as mode of asset transfer or a medium of performing transactions.

I am incomplete - Bitcoin (BTC)

Bitcoin is based on a Blockchain and works on the principle of Proof of Work. It has already been decided that only 21 million BTC can be created or mined by its anonymous creator Satoshi Nakamoto.

Mining is the process of verifying the transactions that occur on Bitcoin network. A few miners verify the Bitcoin transaction using their computing powers and in return they earn a Bitcoin as a reward, they also contribute in maintaining the decentralized network and earning a small transaction fee.

It’s clear and easy to understand that only 21 million Bitcoins can be mined. So what will happen when it will reach its limit?

Understand that miners maintain the network and there will be no more mining if it reaches its limit which is predicted to happen by the year 2140. When it happens the price of Bitcoin will deflate and the network will depend on transaction fees. For faster transactions one would have to pay higher transaction fees which will turn bitcoin into gold. But we don’t use gold as a daily transaction medium.

I am slow – Bitcoin (BTC)

When a transaction is broadcasted on the Bitcoin network it might appear to the recipient in a few seconds or might take hours to perform the required verifications from miners. This also makes it irrelevant for daily transactions as nobody wants to wait for an hour after ordering their favorite pizza and pint of beer. In any situation a purchaser could transmit two conflicting transactions using the same Bitcoin at the same time, one to pay the seller, and a second transaction to pay themselves. The seller might see the first transaction initially, and consider the order paid without waiting for the transaction to confirm. Then the second transaction becomes permanently confirmed in the blockchain which will invalidate the first transaction. In this case, the seller is basically the victim.

Now what – New generation of Cryptocurrencies

Our hope to change the economic system doesn’t seem to be promising. Now what are the options?

An idea that shook the banking system and also paved a new way for those who wanted a change.

Now is the time of the next generation of Cryptocurrencies.

In 2011 Charles Lee an engineer created Litcoin (LTC). Litcoin works on the same principle of bitcoin i.e. Proof of Work (mining).

.gif)

Litcoin follows the Scrypt Algorithm (password based key) to mine new blocks which is easier than that of Bitcoin’s SHA-256 algorithm. This makes Litcoin transactions super-fast to be verified on network in comparison to Bitcoin.

Ethereum (ETH)

With the introduction of Ethereum in 2015, it also introduced a new concept known as smart contracts.

.gif)

Ethereum also inherited the same properties of blockchain from Bitcoin but with a twist. Ethereum offers Ethereum virtual machine which is peer-to-peer global system. One who consumes computing power pays in virtual token known as Ether and one who provides it gets paid.

Ethereum introduced itself as a powerful anonymous global infrastructure to provide a platform to those who want to build their own cryptocurrencies to run special applications known as smart contracts. This leads us to the second generation of cryptocurrencies known as Alternative coins (alt coins).

We going to change everything- Ripple and Stellar

In the present day we use fiat currencies to perform transactions that include selling, buying and practically everything. This is how this world is in motion, but our ancestors never had the privilege to use fiat currencies. In ancient time there was no banks, no state issued currencies they used to follow the system known as Barter system (system of exchange). To perform larger transactions, they made a complex yet simple infrastructure which is known as system of Hawala.

Hawala – version 2

Now days whenever we need to buy anything we involve our banks and request them to allow us to spend our money, we also pay some amount of our money to our banks to provide us banking services.

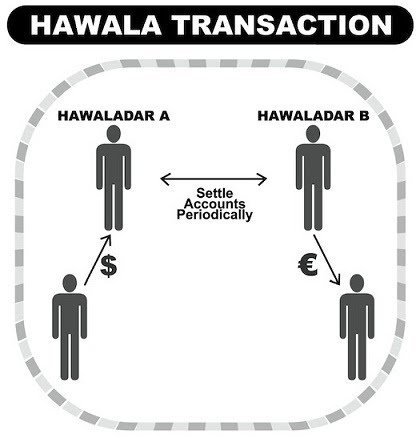

In system of Hawala a middle man or institution replaces the banks. They replace them for good as this system is based on trust.

Now use your imagination and look at the picture below, think of a situation in which you want to send some money to your grandmother rather than going through your traditional banking system you choose to go through the system of Hawala.

You asked your agent to send money, your agent will use his means and ask your grandmother’s agent to transfer money to your grandmother.

Notice that in this structure money didn’t actually move from your agent to your grandmother’s agent. It is blind trust and hope to get same or more amount of transaction in the coming future. So, if you look at the picture again your agent owes money to your grandmother’s agent and your grandmother’s agent is trusting and hoping to get same or more amount of transaction in future but in the opposite direction.

Now if you digitalize the same system and apply it to blockchain you will get Ripple (XRP).

Ripple (XRP) – A change or System to replace banks.

Cryptocurrency rose 36000% in year 2017, yes that’s true Ripple is the number 3 cryptocurrency on the merit of market cap evaluation.

Ripple labs Inc. was founded by Chris Larsen and Jed McCaleb in 2012 with the idea to digitalize ages old Hawala system with the help of blockchain. They created ripple payment protocol widely known as Ripple (XRP).

Ripple payment protocol connects with a wide range of banks and payment institutions and provides them service to process transactions at the rate of 1500 transactions per second. Also the system registers every transaction on decentralized Ripple (cryptocurrency) ledger. And all this is happening 24*7 without any breaks at negligible transaction fee in comparison to fiat banking system.

Interesting isn’t it? Yes it is, this could be an answer to how we can move our economic structure from today’s banking system to cyptocurrencies using blockchain.

But- Am I actually decentralized?

The whole idea of blockchain and cryptocurrencies is to decentralize today’s banking system. To make people do faster and cheaper transactions, ripple could be an answer to this situation.

But what if I say that Ripple Labs Inc. is a privately owned organization that is working to make profit. No doubt ripple transactions are being recorded on the public ledger. But Ripple (XRP) doesn’t involve any mining, Ripple labs Inc. already generated 100 billion XRP and they have full control over its circulation. It means that they can decide at what point of time how much ripple should be in the market.

This complicates the situation, would you like to take power from one structure and give it to another or would you like to take the charge and decide what will be the course of history?

I am still alive- Stellar (XLM)

Ironically Stellar is another payment protocol system co-founded by same person responsible for Ripple, Jed McCaleb in 2014.

.gif)

Stellar.org is a non-profit organisation run by very few cryptocurrency experts. The company doesn’t own any XLM or Lumen (name given to token to differentiate it from stellar.org) and it works on the same structure of ripple. To explain it I can say that stellar is the same as ripple but more decentralised and distributed. It is already decided that at the rate of 1% every year Lumen will come into stellar network for circulation. As in total 100 billion Lumens have already been generated, Stellar.org is planning to bring every Lumen into circulation in approximately 10 years.

What makes it more promising is its decentralized structure as no individual or company has control over it and it is also fulfilling all the needs to replace the fiat banking system.

The whole idea is to bring the power of money to people to take power from private or government owned institutions and distribute it among people. Cryptocurrencies are making it possible with help of blockchain technology. At the end it is just the beginning, there is a lot to come, it’s your turn to Reconsider your decision to follow Cryptocurrencies.