It’s a bit like Gold prospecting.

The Gold Rush, Tulip Mania and the Railway Boom created a golden epoch, a time of unsustainable, rash exuberance.

The Gold Rush happened globally in the late 19th Century with new gold deposits being uncovered in the new world: United States, Canada, Australia and South Africa. Any common individual, with a shovel, a gold pan and a handful of dollars could stake for gold. The mass Gold Rush pushed up land prices, food, with mass demand for bars, hotels and mining equipment. Early investors and monopoly service providers grew exceedingly rich in a short span of time.

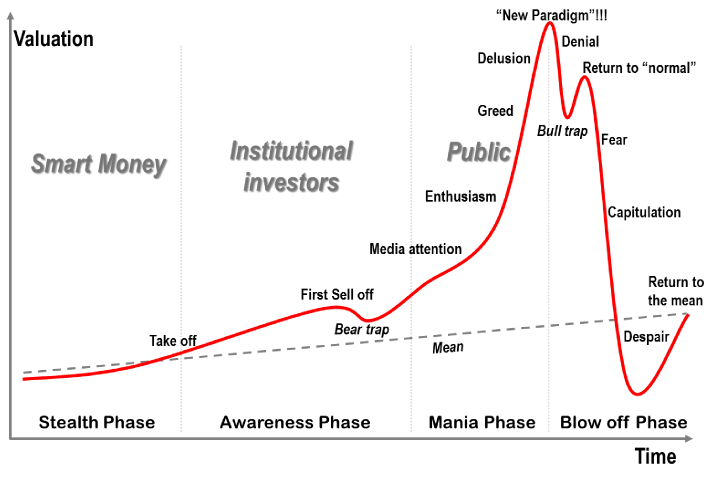

We now fast forward to the 21st century, the emergence of Bitcoin, Blockchain technology and the Initial Coin Offering (ICO). Many have likened Bitcoin to “digital gold”. For some who appreciate the history of bubbles and manias, the current crypto space resembles, in some form, a period of FOMO (fear of missing out) economics, a period of extreme hype.

If you juxtaposition, the Gold Rush to Crypto: Outrageously profitable returns, the flood of easy investment money and the rise of scams in all shapes and forms (send your Ether wallet private keys here) all accumulates in an unsustainable period, where risk is priced cheaply and not taken into account properly. We do not have to look far in history to see this at work. The recent Global Financial Crises in US real estate prices posits a relevant example. Those who benefitted from the crash, hedged their bets.

Being an active crypto-trader, banking risk professional and fintech advisor, it is always easy to enter the crypto market, just as it was for gold prospectors up until the house of cards came crashing down. Various entry techniques and tools can be used to successfully enter a trade position, such as technical analysis (the use of pattern analysis, charting indicators, volume and price) and financial modelling. Financial models such as the Monte Carlo Simulation use quantitative analysis, to help predict likely outcomes under periods of uncertainty.

These have shown to be successful in the traditional and crypto investment space for short-term entry positions. The success ratio can be around 75–80 per cent provided you are an experience technical analyst but for the layman, this is significantly lower.

Fundamental analysis (deals with balance sheet analysis, economics, the companies ambition and leadership) is still finding its feet in the crypto space, as most of the income generating assets, Tokens and Coins are intangible assets or services, yet to be created.

In terms of an investment exit strategy, used to lock-in profits, how do you know when have you reached the peak price? and what about the peak, of that peak?

What is the tipping point in a market of irrational, emotionally-driven FOMO speculators, trader’s investors and the Unknown, Unknowns?

The answer is, as Frank H. Knight (1921), so succinctly put it: “You really don’t know.”

Black swan events, the unknown, ‘unknowns’ (changes in regulation, geopolitical tension), crypto hard-forks , unpredictable investor behaviour and investment bias, all cloud our judgement when it comes to profit taking. Benjamin Grahams’ (1949), ‘The Intelligent Investor’, explains the characteristics of successful investing. This entails covering positions at peaks and troughs to shield against destructive downside risk and to protect upside profits in under both bull/bear market conditions.

The crypto markets are characterised by price breakouts and violent volatility spikes. Even the notable, “Blue Chip Cryptos” exceeding USD 500 million in size (Ethereum, Zcash, Bitcoin, NEM, Ripple) have experienced these effects whilst growing their market capitalisation. Ethereum has surged more than 5000 per cent (June, 2017) since January 2017 and NEM 10000 per cent in the last two years.

The only protection an intelligent investor can have is using Hedging instruments and techniques to cover these exposures. Price drawdowns can result in additional time from the peak, needed to recoup your investment loses, and thus, your investment opportunity being ineffectively used.

The infant crypto market still needs to develop the correct Risk pricing. This is where Hedge Token fits in. Hedge token specialised in a “basket” of cryptos tracking an index, allowing for risk diversification, cost reduction and an instrument for hedging.

Let’s face it, when price point of inflections are near and your investment returns are on the edge, hedge.

About Hedge Project

Hedge Project is focused on developing the platform for hedge instruments for crypto markets that will enable crowdsale supporters, technology evangelists, and crypto investors to manage the risk exposure they have on the market. The platform will include the possibility to trade indices, basket of cryptocurrencies or single derivatives.

Vanguard is a pioneer in index tracking funds and ETF, with over USD 4 trillion in assets under management. Hedge Token will be the Vanguard of Crypto ETF’s.

The financial instruments we are creating are Crypto-Indices, Index Instruments and Crypto Investment Platform.

Keywords: Risk Diversification, Crypro-Indices, Hedge, FOMO Economics, Risk pricing, Vanguard

Can you imagine if you had a hedge?

Congratulations @hedgetoken! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit