Active versus Passive Investment Strategies.

At Hedge Token, we pride ourselves in becoming the leader in our field, being the pioneer in Crypto Exchange Traded Funds (ETF) , Indexing and in hedging instruments.

We not only care about our product offering but we believe in educating investors, traders, speculators and the wider crypto community. We provide this information, so that any investor can make smart investment decisions.

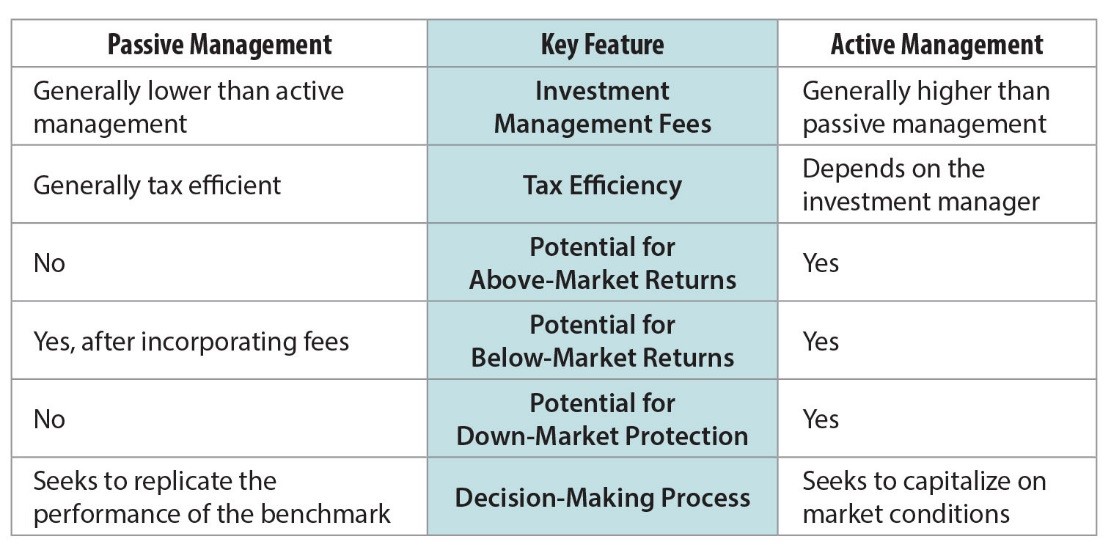

There is perhaps no controversy in the investing world more contentious than active versus passive investment strategies. This is not only relevant to the traditional equity market but relevant to crypto markets. This article is written in terms of current financial products but the word ‘share/equity’ in this context, is synonymous with ‘crypto’.

These two opposing Schools of Thought often clash, with one strategy often trying to outwit the other, in terms of long-term capital appreciation and wealth accumulation for their respective investors.

In this article we explain the difference, the advantages and disadvantages of each strategy and how Hedge Token fits into the picture.

Active Investment Strategies rely on delivering Alpha

Alpha, in investment jargon, gauges the performance of an investment against a market index. This mainly applies to actively managed investments which utilise mixed asset selections (ETF, SICAV-‘Société d'Investissement À Capital Variable’, Shares, Mutual Funds and Bonds etc.)

These portfolio constructions are also referend to as ‘stock picking’ and selecting ‘winners’ in generating alpha returns. The reason for a benchmark comparison is to see the performance of the investment in contrast to, the performance of the market's movement as a whole - a type of opportunity cost (the next best alternative). Any surplus above the market return is known as alpha. In order to generate alpha, active managers compile research on share prices and financial projections. Due to the extensive research and analysis involved in beating index returns, actively managed investment fees are much greater than passively managed investments. Although some active managers create alpha for their clients, only a few are able to beat the markets consistently, however, there are a few market anomalies exceeding the index, such as Warren Buffet and George Soros. The Financial Times (2017), outlines some startling facts on active management:

“…Over 10 years, 83 per cent of active funds in the US fail to match their chosen benchmarks; 40 per cent stumble so badly that they are terminated before the 10-year period is completed and 64 per cent of funds drift away from their originally declared style of investing.”

These are some active global asset managers: Orbis.com , Franklin Templeton, Blackrock, State Street Global Advisors, PIMCO, Aberdeen Asset Management and most Investment bank product offerings.

The advantages of active management include:

The ability to apply quality standards when selecting investments to achieve desired levels of liquidity, leverage, profitability and return on equity, i.e. subjectivity and choice.

Control over avoiding portfolio concentrations. To some degree, risk can be managed by limiting exposure to certain sectors, industries or companies.

Tax efficiency. Enables the collection of capital losses for tax deductions that offset capital gains.

There are however, some distinct disadvantages:

Company-specific concentration risk. Because active portfolios involve far fewer stocks than passive funds, a decline in one stock has a proportionately greater negative effect than in a passive fund.

Far higher expenses because of trading costs

Management fees

Loss of investment choice and investment control as an investor, up to the discretion of the portfolio manager.

Passive Investment Strategies reinforce the Random Walk Hypothesis (RWH)

The RWH posits that markets are efficient in the long-term expounding on the Efficient-Market Hypothesis(EMH). The EMH and RWH prove that performance is a staggered random walk, and that one cannot consistently generate alpha returns in excess of the equity market in the long-term. Therefore, actively managed investments will lose their ‘winning’ streak the long-run.

John C Bogle, advocated the use of passive management investment strategies, where he creating the first retail indexed ETF in 1976. Near 42 years later, here we are today, with the pioneer of index and ETF’s the HMS Vanguard (1787). This iconic ship is the brand of the Vanguard Group, which has over USD 4 Trillion in assets under management.

Passive strategies set out to follow a rule-book approach, an index or collection of shares with the same, diverse or a bundle of characteristics, depending on the index’ purpose. These indices mimic these rules and are not subject to personal ‘Stock Picking’. Not to get confused with investment strategy and investment instrument: ETFs, are a subset of indexed funds. Mutual Funds (SICAV for the Europeans) usually fall under actively managed investment strategies.

Most notable index’ are S&P 500, Russel 2000, FTSE 100, Euro Stoxx 50 and Dow Jones Industrial Average(Dow 30), Nikkei 500, Hang Seng Composite Index, Australian Stock Exchange All Ordinaries Index to name a few. These Indices have predetermined calculation rules and inclusivity rules. E.g. the S&P 500, consists of 500 large capitalisation U.S companies, with a market value weighted index rule. This index is seen as a leading indicator of the U.S stock market and a common benchmark for international stock markets.

These are some passive global managers in the Index Fund and ETF market: Vanguard, Blackrock, MSCI, FTSE Russel Index funds and Fidelity Index.

The advantages of passive management include:

Low expenses and fees, as there is no need to analyse securities in the index.

Risk diversification as you have bought the ‘market’ as opposed to a single share.

Clearly denied rule-book, governance and transparency.

Tax efficiency - because the index fund’s buy-and-hold style does not trigger large annual capital gains tax (country dependent).

There are however, some distinct disadvantages:

The potential for unintended concentrations in some sectors, i.e. during the dot.com bubble, high concentrations of technology companies in large-cap indexes, exposing investors to significant risk.

Performance limitations. ETF and Indices are built to mimic a groups of stocks rather than to outperform them.

Overall market risk, increased Beta (the measure of exposure to market movements). If the index declines, so does the ETF/Index, as you bought the ‘market’.

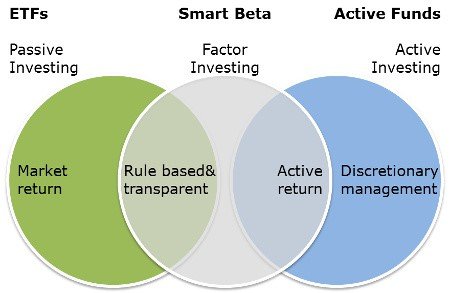

Why not take both approaches?

The article by CNBC (2017), outlines that when using these two approaches in conjunction, one can deliver the best of both worlds while compensating for the downsides of each strategy, Smart Beta-See Venn diagram below.

According to Wharton Business School (2017),

“Passive management generally works best for easily traded, well-known holdings like stocks in large U.S. corporations ...(’i.e. Apple’).., because so much is known about those firms that active managers are unlikely to gain any special insight. “You should almost never pay for active management for those things.”

“..But in certain niche markets, like emerging-market and small-company stocks, where assets are less liquid, highly volatile and fewer people are watching, it is possible for an active manager to spot diamonds in the rough”.

I could not have put it more succinctly.

Why Hedge Token?

At Hedge Token, we have set out to create a platform for hedge instruments, indices and ETF which fulfils the risk reduction needs, demanded, by the crypto markets.

Utilising a combination of active and passive Crypto trading strategies in tandem, will increase your risk adjusted return.

Join us today, The Vanguard of Crypto.

You can pre-register for our Token Crowd sale on 15 September 2017 or sign up to our newsletter.

If you want to know more about us or the team go to www.hedge-crypto.com