Decentralized record, or DeFi, intends to use advancement to kill delegates between parties in a money-related trade. The fragments of DeFi are stablecoins, use cases, and an item stack that engages improvement of usages. The establishment and use cases for DeFi are at this point being created. HepaFinance is a new platform in decentralized finance that might help you to earn fees in return for tokens.

Introducing Hepa Finance

HepaFinance is an automated market maker (AMM) — decentralized finance (DeFi) application that allows users to exchange tokens, providing liquidity via farming and earning fees in return. It launched in April 2021 and is a decentralized exchange for swapping BEP20 tokens on Binance Smart Chain.

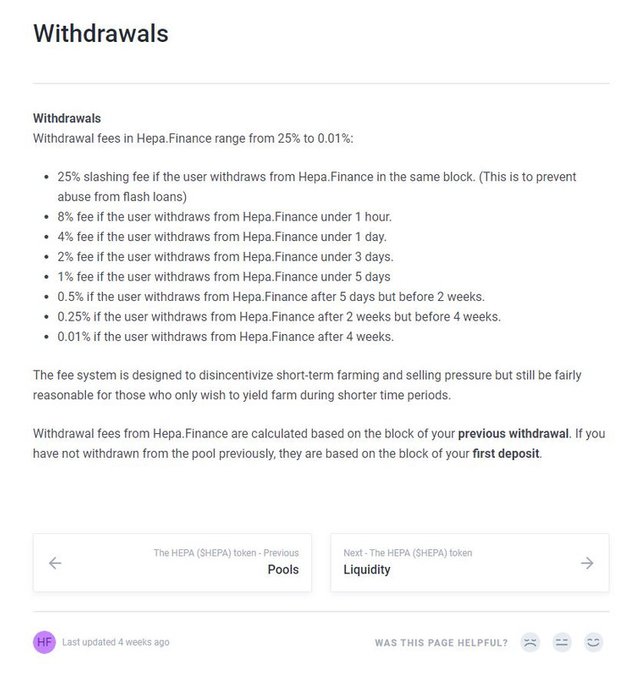

HepaFinance uses an automated market maker model where users trade against a liquidity pool. These pools are filled by users who deposit their funds into the pool and receive liquidity provider tokens in return. These tokens can later be used to reclaim their share of the pool, as well as a portion of the trading fees. HepaFinance allows users to trade tokens, provide liquidity to the exchange and earn fees, stake tokens to earn HEPA, stake HEPA to earn more HEPA, and stake HEPA to earn tokens of other projects.

Understanding HepaFinance in Automated market maker (AMM)

An automated market maker (AMM) is a type of decentralized exchange (DEX) protocol that relies on a mathematical formula to price assets. Instead of using an order book like a traditional exchange, assets are priced according to a pricing algorithm.

How does an Automated Market Maker (AMM) work in HepaFinance?

An AMM works similarly to an order book exchange in that there are trading pairs – for example, ETH/DAI. However, you don’t need to have a counterparty (another trader) on the other side to make a trade. Instead, you interact with a smart contract that “makes” the market for you.

On a decentralized exchange like Binance DEX, trades happen directly between user wallets. If you sell BNB for BUSD on Binance DEX, there’s someone else on the other side of the trade buying BNB with their BUSD. We can call this a peer-to-peer (P2P) transaction.

In contrast, you could think of AMMs as peer-to-contract (P2C). There’s no need for counterparties in the traditional sense, as trades happen between users and contracts. Since there’s no order book, there are also no order types on an AMM. What price you get for an asset you want to buy or sell is determined by formula instead. Although it’s worth noting that some future AMM designs may counteract this limitation.

How might you relate your wallet to HepaFinance?

To interface your wallet you need to tap on the “Open Wallet” button on the upper right corner of the page. Starting now and into the foreseeable future, look for the wallet you need to interface with HepaFinance and snap “partner”. Favor the affiliation and you’re good to go.

Decentralized Finance (DeFi) has seen an explosion of interest in Ethereum and other smart contract platforms like Binance Smart Chain. Yield farming has become a popular way of token distribution, tokenized BTC is growing on Ethereum, and flash loan volumes are booming. Meanwhile, automated market maker protocols regularly see competitive volumes, high liquidity, and an increasing number of users. You can understand the integration of automated market makers with HepaFinance.

- Website: http://www.hepa.finance/

- Telegram: https://t.me/hepafinance

- Twitter: https://twitter.com/HepaFinance

- Medium: https://hepafinance.medium.com

| Author Bitcointalk ID | Vipersia |

|---|---|

| BTT link | https://bitcointalk.org/index.php?action=profile;u=2349666;sa=summary |

| BSC Wallet | 0xbC58BdB65934b5b4a6bba3D4C395f22FDA77dcE7 |