"Corporate debt is the highest of all time." We get it NYT, it is bad. Leveraged debt gives us all flashbacks of the 2008 crisis and Margo Robbie explaining credit default swaps.

Understanding who is doing this and why, explains how we got here and where we are going.

Culprit #1: Netflix

Why: If I don’t use this cheap credit, my competitors will

Before I get into Netflix, I want to tell you a story about junk bonds.

Most bonds are considered safer investments than the stock market because there is a promised return at a specific date. Junk bonds are what the name implies. They are shitty bonds because the companies issuing them are over leveraged and run the risk of not paying up. They're a medium risk with a mehh reward.

Unlike traditional bonds, uncertainty scares investors away from junk bonds in bear markets.

The bond yield is the rate of return (interest) that investors get once the bond has matured. Higher rates mean higher returns. A junk bond historically hovered around a high yield of 10%. This attracted investors to the bond despite the risk of the company defaulting.

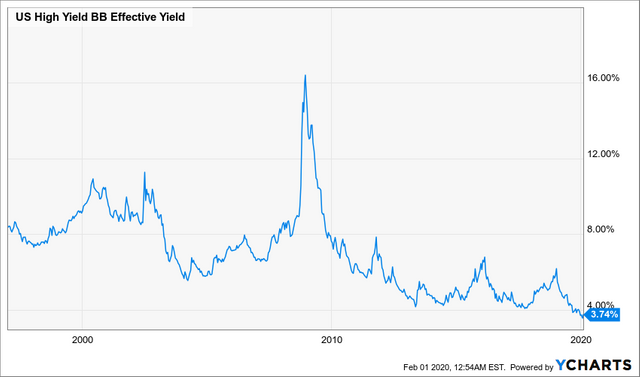

This chart shows that at the turn of the millennium, there was an interesting departure from that 10% yield trend:

US High Yield BB Effective Yield data by YCharts

You can see the yield skyrocket with the housing crisis of 2008. Demand for junk bonds picked up in 2009 once the stock market found a bottom.

But it kept picking up.

The question is why.

These bonds weren’t less risky prior to the housing bubble and 4% returns weren’t more attractive than the stock market.

The answer is that there was more money to gamble with. Slot machines see more action when there is more money in the casino. In the case of junk bonds, the source of that capital was the Federal Reserve. After the 2008 collapse, The Fed bought trillions of dollars of these toxic securities, artificially driving the demand and lowering the yield of junk bonds.

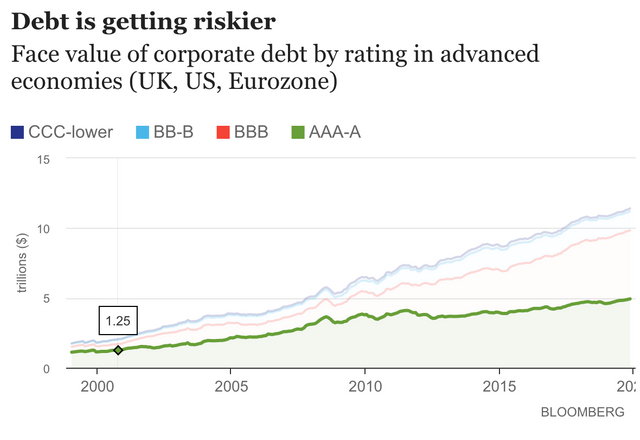

Over leveraged companies have been gorging from the buffet of credit for a decade now.

And it shows:

This brings us to Netflix.

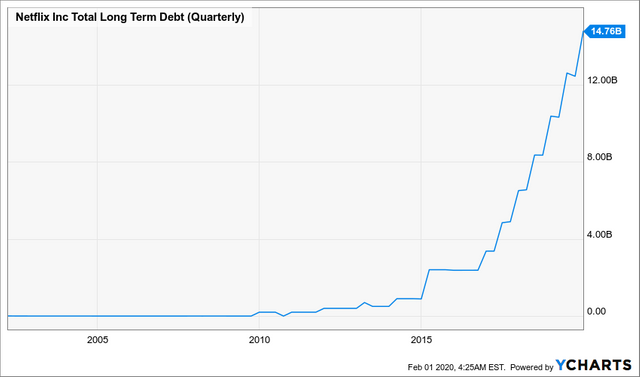

2014 is when interest rates were hitting record lows. This also happens to mark a sharp increase of Netflix’s debt:

2014 was definitely not a dark moment for Netflix. Netflix was disrupting the streaming industry while everyone was getting fat watching House of Cards. The question is, why risk going into debt when you are doing so well?

It is the same reason why famous baseball players take steroids. If they see other players using, then they would rather risk losing their career, instead of losing their spot as number one. The fear of missing out is the impulse behind every bubble and subsequent crash.

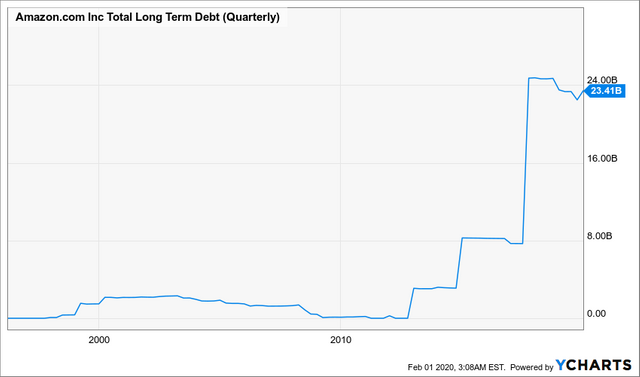

Netflix has used this money to produce culture defining pieces of art. El from Stranger Things was one of the most popular Halloween costumes last year. They have set the bar for streaming services, but competitors like Amazon Prime are catching up:

More and more streaming platforms are also racking up debt to produce their own content. Amazon’s debt bubble looks strangely familiar:

About 12 of the 14 billion dollars of Netflix debt is made of junk bonds. Netflix has had impressive growth since 2014. Its yearly net income has gone from 266 million to 1.8 billion. It will need to double that in order to pay its first round of bonds starting in 2027. Anything less than a continued parabolic growth for 7 more years is defeat. The real catch is, their competitors have to do the same thing. This article from The Verge explains how AT&T jumped head first into 151 billion dollars of debt through an attempt to buy out the streaming wars. AT&T saw what Netflix and others were doing and pulled the classic "hold my beer" move.

Let's Recap

So how did we get here?

The Fed threw a cocaine party for a bunch of coke addicts and said, “invest responsibly.”

Where are we going?

I am not going to speculate on Netflix’s success, but not everyone can win at black jack. The streaming wars are just a small sliver of this broader trend. Other companies are sitting at other back jack tables, using their junk bonds to bet that their hand is better than their competitors. Some people have to lose. The thing with a bond is, you can’t make the minimum payment and refinance in perpetuity. There is a pay up date. And if you can’t pay, you go bankrupt and sell off your assets. The cocaine party stops being funny when millions of people get laid off because companies borrowed money for more Oscar nominations.

Here is the link to the original site I posted this article too.

Glad to see someone else also sharing the madness that is the corporate debt bubble, you should really use the @steemleo tag plenty of finance peeps following the tag would be keen on your content

I think that as long as loans can be rolled over with the promise of more growth the bubble can continue to inflate. How high can these FAANG stocks go? I mean boeing is already at 50x earnings? Its complete madness but clearly there is no cap on insanity

When this House of Cards, pun intended comes crashing down, people will have nowhere to hide. It's sad but we've allowed it to happen, one rule for those close to the capital allocations while those further away need to fight for theirs.

FYI i've nominated your post as my @pifc post of the week. You can find my nomination here. You can check out other nominations on the pifc account and even join us each week in finding new authors like yourself and sharing and promoting their content

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good article. I don't have a lot of interest in finance and business, but it's true that many of them have a get-rich mentality that's not going to do them well in the long run...

I found this post because @chekohler featured it in the Pay it Forward Curation contest. Keep up the great work!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wow, that debt is really piling up!!! What a madness.

Congratulations on being featured by @chekohler in an entry for the Pay It Forward Contest

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit