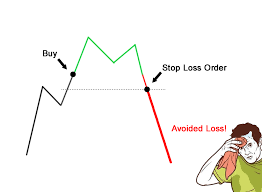

STOP LOSS

A stop loss is an extremely useful tool that enables sell orders to be placed and executed once a price reaches a certain level. This enables risk management through control over the maximum possible loss (excluding slippage). We will consider this situation: You’re placing a risky bet on a breakout over $40. If the price breaks out, the next series resistance level is at $46, representing a 15% gain. In this case, you may want to place a stop-loss order at $37. If the price ever reaches $37, your entire position will be immediately sold. Essentially, this means that the downside risk is limited to 7.5% while there’s a good chance of the upside being 15%. You can alter the stop loss to cap your potential risk at whatever you want, whether 5%, 15%, or 30%. To prevent false signals from triggering stop losses, make sure to account for volatility.

TRAILING STOP LOSS

Trailing stop losses are an advanced form of stop losses that move with the price. For example, given the example directly above, instead of placing a stop loss at $37, you could place a stop loss at $3 below the market price. This way, the order will still execute at $37, but if the price moves to $43, the order will then execute at $40. Hence, the risk is limited no matter the price. Trailing stop losses can be set as fixed-dollar amounts, or as percentages. You must also choose the degree to which the order will trail the price (meaning, should the stop loss execute if the price is $3 below the previous day’s close, the previous hour’s close, and so on.