Bitcoin has been surging in the recent past and it currently trades near $13,000.

I am bullish on the cryptocurrency and I believe that Bitcoin can test $20,000 in 2021.

The Institute of International Finance reported in July 2020 that the global-debt-to-GDP has touched a new record high of 331%.

Just for the United States, the all sector debt hit $80.8 trillion as of September 2020.

Why talking about global debt is relevant?

Because in the modern financial system, debt is money. As global debt swells, its an indication of huge money printing by central banks across the world.

The result is that all fiat currencies will depreciate against hard assets. Further, investors will seek diversification across asset classes and that’s the reason for renewed surge in Bitcoin.

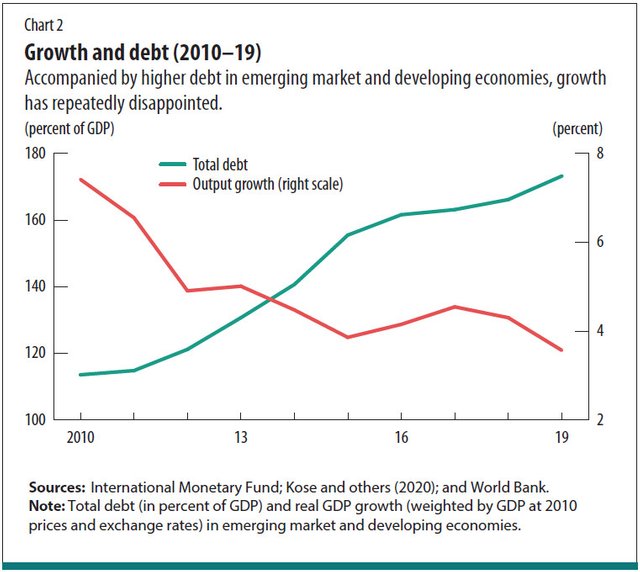

I also want to present another interesting chart from the IMF that underscores my view that all asset classes will continue to trend higher.

As the chart above shows, the global output has not responded in-sync with growth in debt. While this data is through 2019, the same is true for the current year.

High debt is not translating into higher GDP growth. Instead, the money is being re-routed to speculation across asset classes.

Its wrong to assume that expanding money supply is the solution to all problems. The only thing expanding money supply has done is to support various asset classes globally.

Therefore, don’t be surprised if Bitcoin surged past $20,000 in the coming year. Also, don’t se surprised if gold goes ballistic.