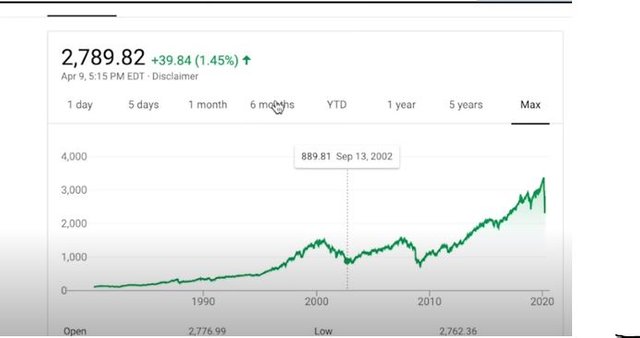

All right, I am very bullish on Bitcoin increasing in value and Bitcoin gaining adoption by people over time a lot of people say that what's happening right now in traditional markets a lot of people say that it's a lot like what happened in the financial crisis of 2008 a lot of people say that I don't think so right there are differences so banks today they're not as leveraged as they were in 2008 we don't have the same real estate fraud that we had in 2008 now some of the proposed solutions are the same as 2008 sure but other than that it is different I would say that the crisis today is a lot closer to 2002 this is the post 9/11 recession post 9/11. I want you to think about thinking back the markets were down everybody was afraid nobody wanted to travel Cruise Lines airlines hotels there was a lot of talk of those things going to zero because nobody was ever gonna travel again everybody was just gonna stay home stay hunkered down because going out in public means that terrorists might get you so people were fearful so what happened next the Patriot Act got passed we had some of our liberties taken away in the guise that you know this could only be temporary but we need to do this because we need to stay safe so what happened after that well the economy bounced back shortly after people eventually got over the fear but we never did get those liberties back huh here we are almost 20 years later still in the Middle East fighting those terrorists still getting molested at airports living under an ever-increasing surveillance state still losing our privacy more and more each year. and even though it was all proposed to us as something that needs to be temporary just until we beat those terrorists the American surveillance state and everything else I mentioned is now the new normal governments used the crisis to take more power why do I bring this up the reason I bring this up is that I believe that u.s. government combined with the Chinese government and probably more governments Russia Australia for sure they will use the fear and uncertainty that everybody is feeling right now to increase their censorship over us specifically by implementing a national digital currency one that can be tracked one that can be censored and eventually they will ban paper cash that is the control that they will seize in this national crisis.

Bitcoin is decentralized permissionless censorship-resistant on debatable money, okay so that's my thesis is that governments will use the pandemic to implement a tokenized dollar one that can be censored one that can be tracked and because of these people will opt in to store their wealth in Bitcoin let's unpack this so, first of all, we know as in we have plenty of evidence we know that both the US and China are in the early to mid-stages of creating their digital currency to replace the paper dollar start with China in China first of all everybody already pays for everything digitally in China they use a WeChat they use their cell phones it's commonplace to use your cell phone to pay for goods and services in China but beyond that and we know this because China has said this China is in the process of creating their own tokenized currency that they sell to us they sell this idea to the people in us by saying that China wants to stay tech innovators.

CNBC Anthony pomp Lian o explaining to the skeptical CNBC anchors this same thing like the video supports the channel you say it's a store of value I'm not gonna get into an argument with you over that I will say to you though we will reach a point where the US dollar will become digital mmm other global currencies will be digital how then could Bitcoin be a store value. if I'm the United States government sitting it from a rational seat I think that they should tokenize the dollar immediately right if you look at China there tokenizing their currency other countries will follow what's gonna happen is there's not going to be a competition between digital and non-digital currencies every currency will be digital what we're gonna have is a competition of monetary policy and if all of a sudden let's say China has a digital WAN and we don't have a digital currency it will be much more accessible for people to buy the Chinese one in other parts of the world than the US dollar and so you might see higher levels of adoption of the Chinese one than the US dollar so we can tokenize or digitize the dollar fast and drive that adoption globally.

We need to take precautions with it is serious I'm saying that people gladly and willingly give up their freedom is for safety in time of turmoil and governments gladly take it and they're not known to give up that power once they acquire it so I believe that people will opt into Bitcoin because of this not all at once and not with all the wealth at once but given time as trust and awareness for Bitcoin increases I think that people will gladly opt into it rather than be controlled and censored and more than that once people realize that Bitcoin can not be debased that's going to be a whole nother reason why people choose to opt-in. Because US dollars are getting to based more than ever and it's going to be easy to do that with with the tokenized dollar and more than that just thinking about Bitcoin in general as bitcoins price starts to go up against people will tell their friends about it and more people will put money into it and people already have money and it will put more money into it Bitcoin is this endless positive feedback loop plus if governments start implementing tokenized currencies or if Facebook's Libre launches that's going to make people very familiar with tokenized currencies think about it right now using Bitcoin and Bitcoin in general very foreign to people but if people have you know these wallets on their phone already where they're you know transacting Fed coin or Libre coin it's going to be a whole lot less foreign and I think it's just gonna be a no-brainer the censored currency.