While the United States gets ready for the consequences of the 2020 Presidential Election, various information focuses and dealers expect some critical digital currency value vacillations this week. Insights from skew.com show bitcoin's 30-day inferred instability has expanded to 59% while 3-multi month details hopped over 62%.

The computerized cash economy is drifting at around $388 billion, which is a goliath bounce from where it was during the last U.S. political decision in 2016. For example, during the 2016 official race, the cost of bitcoin (BTC) was around $709. From that point forward the crypto-resource BTC has seen a 1,802% quantifiable profit (ROI). Another model is ethereum (ETH), which was exchanging for $10.83 per unit in 2016, presently trades for $382 in 2020.

For this political decision, various dealers and a couple of purposes of inferred unpredictability estimations recommend that crypto market members anticipate a purge this week.

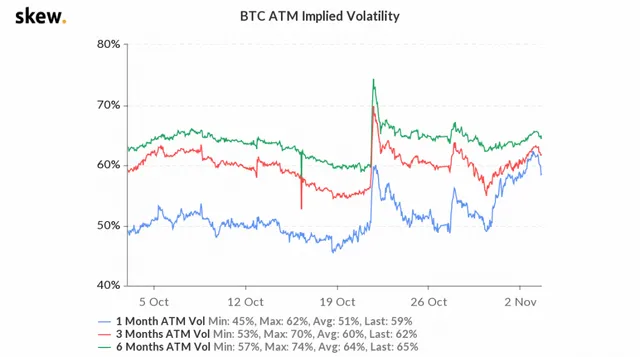

Information from skew.com's "Bitcoin ATM Implied Volatility" graph demonstrates that the crypto resource's alternatives market anticipates large value vacillations. Market players exchanging conventional account resources imagine a comparable market purge following the U.S. political race. At press time skew.com's graph shows one month suggested unpredictability has spiked and is presently drifting around 59% today. Three-month details have hopped to 62% and 65% for BTC's suggested unpredictability for the half year time frame.

On Twitter, the skew.com account tweeted about the suggested instability and stated:

It's political decision day. Choices dealers are estimating shortly of additional premium during the current week with a 3.5% bitcoin inferred move for the political decision. Week after week puts are most dynamic today.

Various other crypto intellectuals and computerized money economic analysts examined the post-political decision crypto market via web-based media channels and discussions. Subsequent to sharing its week 44th experiences report, Arcane Research tweeted out a graph that shows a diagram with bitcoin and the S&P 500 during the political race week. "Some fascinating developments from both bitcoin and S&P 500 during political decision day in 2016. What will happen this time?" Arcane tweeted on November 3.

"Inhale simple today realizing silver and gold will be just as sparkly and bitcoin as secure as could be expected, regardless of the result of this political race," the crypto defender 'Cryptoredacted' composed.

On political decision day, Messari.io's Ty Young likewise examined the financial implications of the U.S. political decision and bitcoin. "Most of surveys have Biden holding a 60% possibility of winning the official political decision and much higher potential for a blue wave move through the senate," Young composed on Tuesday. "Those results could mean bigger boost bundles, more QE, and more clear direction for financial specialists going into another organization."

Youthful proceeded:

One thing is plausible: unpredictability is coming. On the bullish side for Bitcoin, national banks will keep on flooding the world with cash and boost bundles, further making way for BTC. On the bearish side, a challenged political decision and a second influx of Covid-19 lockdowns could spell debacle for business sectors, hauling down BTC with it.

Besides, the exploration and exchanging stage Luno's week after week market report examined the political race on Tuesday too.

"Political decision day was rough four years prior, and there is little motivation to accept that we will experience this political decision without huge developments," clarified Luno investigators. "Subsequent to shutting hours on political race day, the S&P 500 prospects dropped considerably prior to eradicating all misfortunes when Trump was reported as the victor. The market responded decidedly to the conservative champ and finished the week up 5%"

Numerous different bitcoiners accept that regardless of who wins the U.S. political decision, boost and money related defilement will proceed. Alex Mashinsky, CEO of Celsius Network accepts that as common distress and monetary vulnerability uplift, national banks will attempt to siphon liquidity into the wavering economy.

"The U.S. decisions are expanding the vulnerability and the need organizations must have more holds and greater liquidity," Mashinsky clarified. "The worldwide economy is experiencing a moderate movement downturn, as the interest for merchandise and enterprises is easing back down. Then, the national banks siphon liquidity to attempt to invert this pattern. The entirety of this isn't useful for GDP or for our work rates. Regardless of who wins—we will have a serious downturn in the following 2-3 years."

Do you anticipate that cryptographic forms of money should be unpredictable after the U.S. political race? Tell us in the remarks segment underneath.