Bitcoin’s value has risen by 3 per cent over the last 24 hours, taking the cryptocurrency above $12,000 for the first time in over a year.

The latest gains mean the price of bitcoin has nearly trebled since March, despite a global economic slowdown caused by the coronavirus pandemic.Other cryptocurrencies have mirrored bitcoin’s fortunes, with ether (ethereum) rising from just above $100 in March to today’s price of $430.

Bitcoin remains a long way off its record high of $20,000, which it reached in late 2017, but the recovery is a sign that cryptocurrency is increasingly being viewed as a safe haven asset.

During times of economic uncertainty, investors tend to turn to assets with a fixed supply, such as gold, as they are not subject to inflationary measures like quantitative easing.The finite supply of bitcoin – there will only ever be 21 million bitcoins in circulation – means it shares similar properties and is sometimes referred to as “digital gold”.

Earlier this month, business analytics firm MicroStrategy announced that it had become the first Nasdaq-listed company to adopt bitcoin as a primary treasury reserve asset - using as much as $250 million of its cash pile to invest in bitcoin.

"This investment reflects our belief that bitcoin, as the world's most widely adopted cryptocurrency, is a dependable store of value and an attractive investment asset with more long-term appreciation potential than holding cash," MicroStrategy CEO Michael Saylor said in a statement.

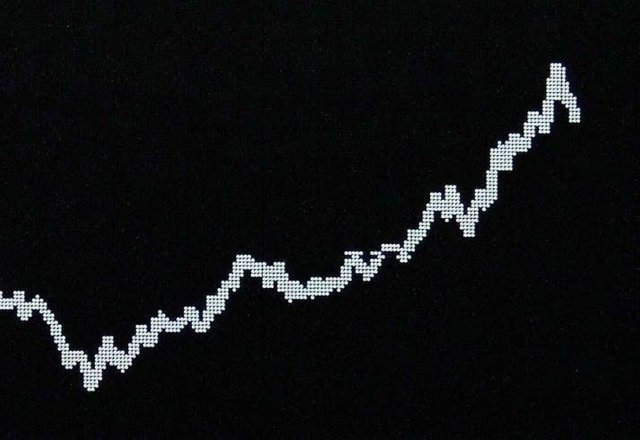

Bitcoin rose above $12,000 in August, having traded below $5,000 as recently as March

Bitcoin rose above $12,000 in August, having traded below $5,000 as recently as March ( AFP via Getty Images )

BITCOIN PRICE HITS 2020 RECORD AS INVESTORS TURN TO CRYPTOCURRENCY DURING PANDEMIC

Value triples since March towards prices not seen since 2017

Anthony Cuthbertson

5 hours ago

Bitcoin’s value has risen by 3 per cent over the last 24 hours, taking the cryptocurrency above $12,000 for the first time in over a year.

The latest gains mean the price of bitcoin has nearly trebled since March, despite a global economic slowdown caused by the coronavirus pandemic.

Other cryptocurrencies have mirrored bitcoin’s fortunes, with ether (ethereum) rising from just above $100 in March to today’s price of $430.Sharing the full story, not just the headlines.Bitcoin remains a long way off its record high of $20,000, which it reached in late 2017, but the recovery is a sign that cryptocurrency is increasingly being viewed as a safe haven asset.

During times of economic uncertainty, investors tend to turn to assets with a fixed supply, such as gold, as they are not subject to inflationary measures like quantitative easing.

Bitcoin trading in South America sky rockets as Covid-19 cases surge

The finite supply of bitcoin – there will only ever be 21 million bitcoins in circulation – means it shares similar properties and is sometimes referred to as “digital gold”.

Such investment may have contributed to the recent gains but could ultimately cause the price to stall, market analysts have warned.

Earlier this month, business analytics firm MicroStrategy announced that it had become the first Nasdaq-listed company to adopt bitcoin as a primary treasury reserve asset - using as much as $250 million of its cash pile to invest in bitcoin. MicroStrategy's stock has since surged over 20 per cent following the announcement.

“As bitcoin’s steady push higher continues, it is worth bearing in mind that a high bitcoin price can sometimes create a psychological barrier for the retail investor,” Simon Peters, from the online investment platform eToro, told The Independent.

“Just like investors can get fractional shares, cryptocurrency investors can hold fractions of bitcoins. Yet the fact remains that many retail investors will want whole bitcoins and the price of attaining them is moving further out of reach.”