Crypto’s future may be divided, not dead

Just when it seemed that cryptoland could not get any crazier — it has. Last week, Sam Bankman-Fried, the 30-year old wunderkind, oversaw an empire worth more than $32bn, composed of the FTX crypto brokerage and Alameda fund. He was a sports sponsor, philanthropist and backed by mainstream financiers such as BlackRock. Indeed, when I recently met “SBF” (as he is known) at a conference, he was thronged by Wall Street and Washington players.

No longer. This week SBF revealed that FTX has seen $6bn in customer withdrawals, and tried (and failed) to sell itself to his arch-rival Binance, the biggest crypto exchange. Unless he can plug a reported $8bn liquidity hole, bankruptcy looms.

This is the crypto version of the 2008 Lehman Brothers shock

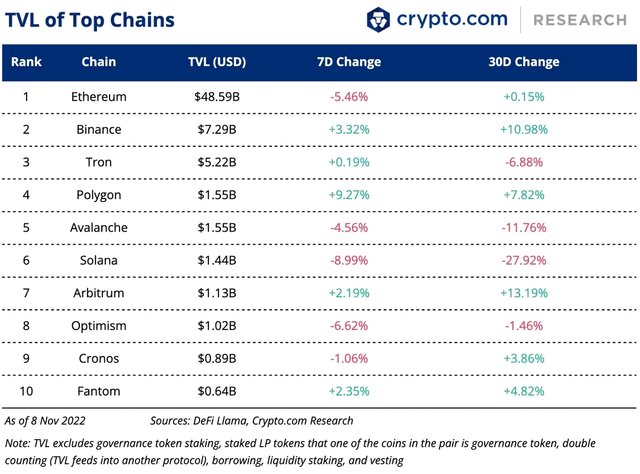

Not because it could cause the implosion of mainstream finance; the entire crypto universe is a mere $1tn in size today (a third of last year) and its tokens mostly operate like chips in a casino (ie they can only be used there). But what the FTX saga has done is unleash crypto contagion, further deflating a bubble previously pumped up by cheap fiat currency.