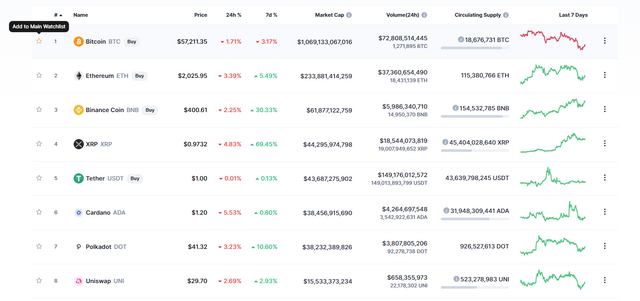

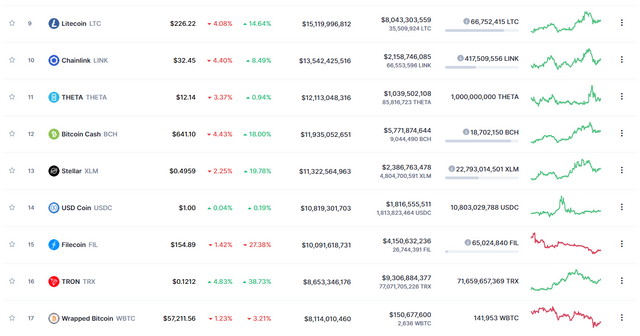

so as of lately in the cryptocurrency markets not only are we seeing mass adoption in major coins like ethereum and bitcoin. but we're also seeing crazy opportunity in all coins right now with projects that are sub 1 even sub 10 cents doing 10 to 100x gains in a very short period of time even vra and trx that we just called out in our cryptocurrency discord room have both basically already doubled within the last couple days.

we also went six for seven in our swing trades for the past couple of weeks so there's so much opportunity in the crypto market with these smaller altcoin projects and we're definitely taking full advantage of it and one question that we're constantly being asked in the cryptocurrency discord room is where we would recommend to invest a thousand dollars in an altcoin cryptocurrency portfolio.

i'll be using my four years experience as an equities day trader in my six years experience as a stock and crypto investor to explain to you which coins i would buy what percent allocation i would have in each to build a high potential but risk adverse altcoin portfolio with a thousand dollars. let's get into building this high potential altcoin portfolio with only a thousand dollars. so what we have to think about first is our overall goal with building a portfolio there's several questions that we have to ask ourselves but overall our goal is to increase reward but minimize risk by diversifying i always preach diversifying when you're trading you don't want to full send one investment. because if that goes bust you don't want to lose all of your money.

you want to sort of sprinkle them around and spread your money evenly around so that as long as one or two pay off and the rest could fail and you still won't lose your shirt so that's exactly the approach that we're going to be taking while we're building this portfolio so the first questions we want to ask ourselves when we're considering our investment strategy is how old we are how much risk we want to take on how much money we have to invest in what our investment goals are being how aggressively we want to invest what percent returns are we looking to get considering we're trying to build a high potential crypto portfolio we're shooting to maximize profits but also diversify so that if we are wrong about a lot of these altcoins which let's face it a lot of them are probably not going to work out long term the ones that do work out long term are going to carry the team while the other ones sort of fall by the wayside and could potentially go to zero or be nothing sandwiches and a lot of people probably don't want to hear that but the harsh reality is right now we're having a lot of speculation pump into these smaller projects that maybe don't have a hundred percent actual use cases and could end up being a nothing sandwich so we always have to go into it with that mindset not expecting that we're going to guaranteed make money or that it's guaranteed to work out that's

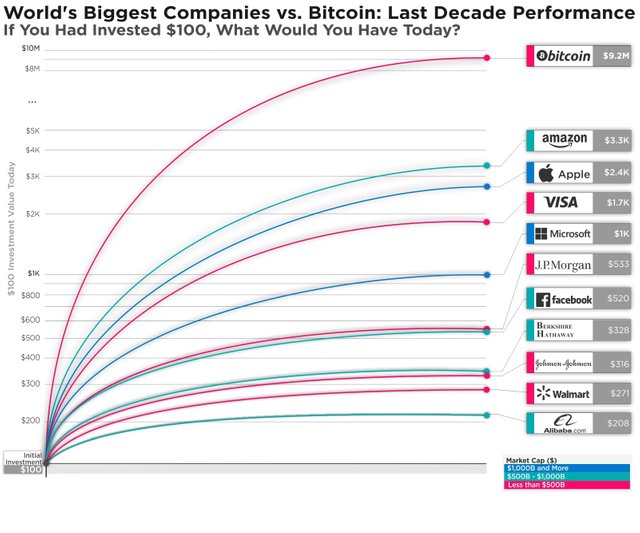

why we're going to be diversifying so i'm 22 years old but i'm assuming based on the demographics of my Blog you're anywhere from my age to about 30 so we're going to base it off of 25 and we're going to be going for the next 10 years to try to amass some capital so then we could redistribute it later on in the life cycle and go with something slightly less aggressive once we're dealing with slightly more capital because that's how you usually build portfolios when you're younger and you have more time to be able to bear volatility you want to go more aggressively so that you can have that growth because time is on your side as you age and your portfolio becomes larger we start distributing into more safe less volatile things so that we can preserve capital and so we're not having massive fluctuations on a large sum of capital.

so how much we're investing with today we're using a thousand dollars so we're going to be basing it off of a thousand dollars this portfolio is basically designed so that we can't lose money unless the entire cryptocurrency market collapses and based on my projections this portfolio could potentially outperform just buying bitcoin by 5x and like i said our goal is to maximize returns on this smaller portfolio. so then we can amass a larger size portfolio that then will redistribute into more secure holdings. so first i'm going to go over the holdings we're going to have and then i'm going to break down the percent allocation in our targets and then our total portfolio return so i'm not going to go into full depth about the fundamentals and why i like each project because every single altcoin that's on here.

since under 30 cents we're now sitting at a dollar 20 per coin and another thing i love about cardano is it was created by the co-founder of ethereum so we have a lot of good developers working on this project okay the next coin we're going to have in our portfolio is v-chain just partnered up with them but basically they're working to optimize consumer producer relationships. i can strongly see this over two dollars per coin within 2021 and you can mark my words on that we're sitting under 10 cents right now so this is a huge potential coin that i really really like and personally i have a pretty large allocation of my portfolio in v chain next holding we're going to talk about is hedera or hbar they have major integrations with google and are considered to be one of the more secure smaller d-app networks so i really like hedera especially at the price point we're sitting at 34 cents right now we had a pretty major push up and we sort of had to pull back down now. so i really like hbar moving on into the future next holding we're going to talk about is mana or decentraland they're tapping into sort of like a sims like environment where it's a vr environment they're moving into the nft space in the vr space as a cryptocurrency it's sort of like an open world concept where people can interact with one another i really like decentraland i think vr is definitely the future and i have an allocation in here as sort of an nft vr play definitely like decentraland moving on to the future as technology changes and moves sort of all into vr next coin.

i'm going to talk about is chain games this was actually launched on the swap launch pad recently gained about 2 500 this was trading way down low and now it actually went up all the way as high as a dollar we're sitting at right around 75 cents right now chain games is a project that works on esports betting sort of allows everybody to sort of place smaller bets on different games rather than having the big gamers make all the money and the smaller ones sort of left out this sort of solves that issue and allows people to bet on all sorts of esports entertainment. so i really like chain games huge growth potential very underrated unknown coin so i definitely like that as a high potential coin moving on into the future and then next of course we have a theorem and actually ethereum just broke over 2000 right now we were sort of looking for a pullback and i'll actually go over all the charts in a little bit but ethereum's now breaking out over all-time highs i like ethereum i actually allocated more of my portfolio into ethereum than bitcoin and a lot of people talk down on ethereum but personally i think ethereum is going to emerge as they improve on their gas fees and sort of as they optimize their network i think they're going to basically turn into the new internet and we're going to see mass adoption on ethereum, i really like ethereum moving into the future and then last but not least we have bitcoin for our holdings we want to have a little bit of bitcoin so that we're still diversifying into something that is extremely scarce because we have projections based on scarcity models of bitcoin hitting anywhere from 250 to 500 000 per coin within the next 10 years so bitcoin is a definitely a very safe bet but there's also other coins that we could see strongly outperforming bitcoin so we want to make sure that we have some allocation in other places in a small allocation especially with a thousand dollar portfolio in bitcoin just to sort of carry us.

worst case scenario we have our bitcoin holding so now we're going to take a look at our initial portfolio based on the asset use percent allocation 10-year projection based on the average growth we've seen it against bitcoin risk management expected percent return and then the actual dollar percent return on the side so we can sort of compare what we would get with this portfolio if our projections are right instead of just investing all of the money in something like bitcoin. so the first cryptocurrency that we have is mana and like we said before this is the vr nft play moving into the future we're going to be allocating 10 into this cryptocurrency okay our 10-year projection is right around 20 based on the average growth we've seen against bitcoin that's where i put my projection okay the risk on this is extreme just because it is a super small speculative play this could end up being a nothing sandwich and we would basically lose our entire investment so that's why we're only investing 10 into this but our expected percent return is sitting right around 2000 at twenty three hundred. so if we were to allocate ten percent of a thousand dollars into there and get that return we would be looking at twenty three hundred dollars off of basically a hundred dollar investment if we do see the adoption and growth that we are expecting in vr nfts and in mana itself.

all right, we're going to be looking at is chain this is the esports betting nft cryptocurrency we're allocating another 10 to that based on the growth we've seen right now against bitcoin i can see this going to 35 per coin within the next 10 years okay this is an extremely risky play once again jane's not even hosted on most exchanges it is a very speculative project but i do like it and i've liked it for a while and it's performed very well so we could see this doing 3 500 percent or 3 500 off of a 100 investment okay that's why we're swinging for the fences on these crypto currencies i understand that these projects could not develop and couldn't work out but this is assuming that we do see the adoption in the projects that i've picked are actually going to work out i'm just explaining to you the projects that i like and then i could see having actual use cases moving forward and that i've seen good adoption on and have good fundamentals.