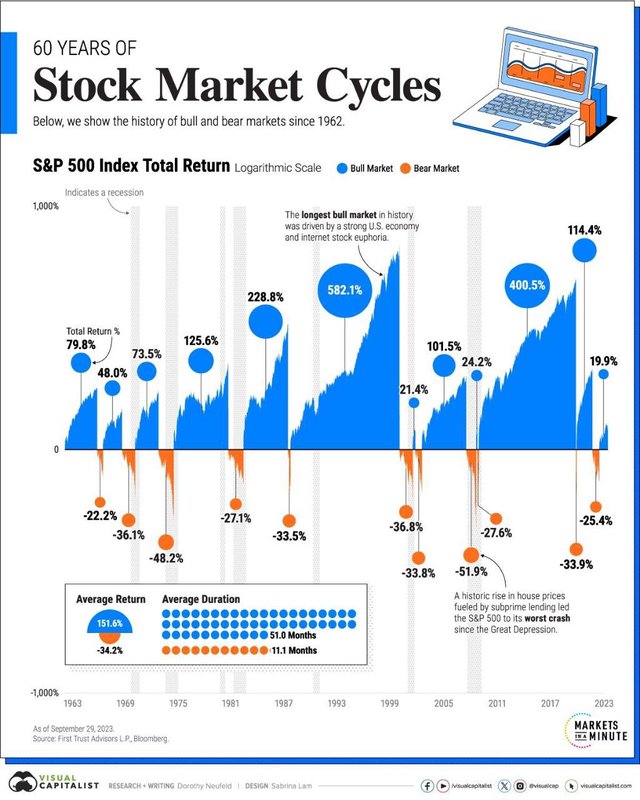

The crypto market has been 3 huge bullish and bearish markets during the last 13 years. The average period of crypto bullish market is around 3 years, including recovery and accumulation market conditions, and the average period of crypto bearish market is around 1 year.

However, the U.S stock bullish market has lasted for 51 months in average, and the U.S. stock bearish market period is less than 1 year. So, when the crypto market is bullish again, it would be better to increase your U.S. stocks ratio from your crypto portfolio with respect to hedging a next crypto bearish market.

This comment is for rewarding my analysis activities. Upvoting will be proceeded by @h4lab

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

让我们一起见证2024的蓬勃发展,相信即得到,加油!!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

2024年是个好的一年

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yeah, could see that but I still am confident that crypto bullish market is almost upon us & would love to make some $$ during it. Have invested in some potential gems like ORDI, SOL, & AVAX at Bitget platform.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hmm! Would love to diversify my assets by participating in stocks while HODLing some potential cryptos like ORDI on the largest copy trading platform.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The analysis provided offers a thoughtful perspective on the historical trends in both the crypto and U.S. stock markets. The comparison of average durations for bullish and bearish markets in each domain provides valuable insights for investors looking to optimize their portfolios.

The suggestion to increase the U.S. stocks ratio within a crypto portfolio as a hedge against potential crypto bearish markets demonstrates a strategic approach to risk management. Diversifying across different asset classes, especially when considering the longer average duration of U.S. stock bullish markets, can contribute to portfolio resilience and stability.

This proactive strategy aligns with the principle of spreading risk and capitalizing on the varying market dynamics between cryptocurrencies and traditional U.S. stocks. As the crypto market has exhibited cyclicality with distinct bullish and bearish phases, adapting the portfolio composition based on historical patterns in both markets could enhance overall investment performance.

Overall, the article provides a constructive perspective on potential portfolio adjustments, taking into account the historical behavior of both crypto and U.S. stock markets. This forward-looking approach can be valuable for investors seeking a balanced and well-considered investment strategy.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit