| 1922 | bullish |

| 1929 | bearish |

| 1930 | bearish |

| 1932 | bullish |

| 1937 | bearish |

| 1938 | bullish |

| 1949 | bullish |

| 1953 | bullish |

| 1957 | bearish |

| 1966 | bearish |

| 1973 | bearish |

| 1975 | bullish |

| 1979 | bearish |

| 1981 | bearish |

| 1982 | bullish |

| 1986 | bullish |

| 1990 | bearish |

| 1991 | bullish |

| 1995 | bullish |

| 2000 | bullish |

| 2008 | bearish |

| 2020 | bullish |

There were many cases of bullish markets after the federal funds rate cut. Therefore, the federal funds rate cut doesn't mean only a bearish market in the early. Furthermore, the federal funds rate cut has not necessarily lead recessions. It's just lagging behaviors of the Fed.

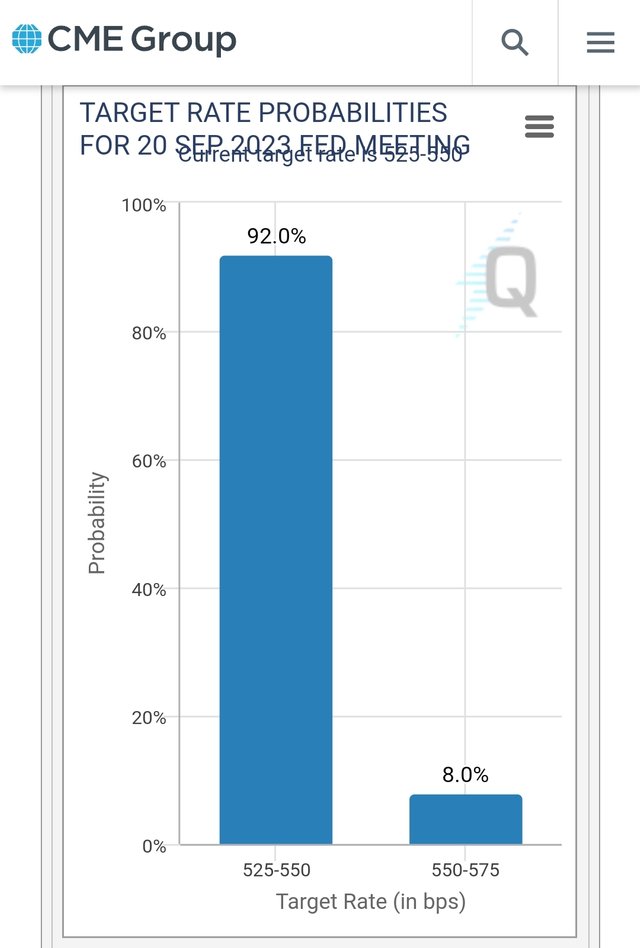

The CME FedWatchTool show the data that is 92% possible for the federal funds rate pause this month. The average period of the pauses is around 5 months. If we are lucky in the future, we might not have a next recession, and the Fed will start the federal funds rate cut.

The stock and crypto market are chaos. It would be better to prepare what's gonna be happened.

Upvoted! Thank you for supporting witness @jswit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your post has been rewarded by the Seven Team.

Support partner witnesses

We are the hope!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi there. Thank you for sharing. Its interesting for me!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit