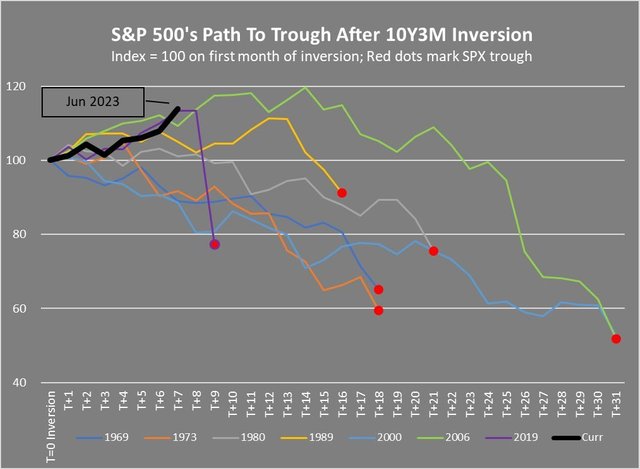

Since 1969, after 10y - 3m treasury yield spread inversion, the recessions necessarily followed. Oct 2022, the latest 10y -3m treasury yield spread inversion occured, and it's been lasting around 11 months.

Let's take a look at the above chart. Green and Orange line had bullish markets before recessions. It had lasted more than 1 year. Green line had even a 14 months bullish market.

It seems that the 10y - 3m treasury yield spread inversion is inevitable for recessions. So, if it follows the best scenario which is the Green line, it will be 3 months left until the next recession, which means the next recession could start Dec this year or Jan next year.

The latest official recession is COVID-19. The previous recession of the latest recession is the subprime mortgage crisis. Bitcoin was born after the subprime mortgage crisis. As you see the Mar 2020 market, all types of markets collapsed due to COVID-19. It's the 1st experience of recessions for crypto investors.

Therefore, if the next recession occur in the near future, BTC will also be hard to avoid the collapse. Of course, it's gonna be limited for the short-term.

Upvoted! Thank you for supporting witness @jswit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit