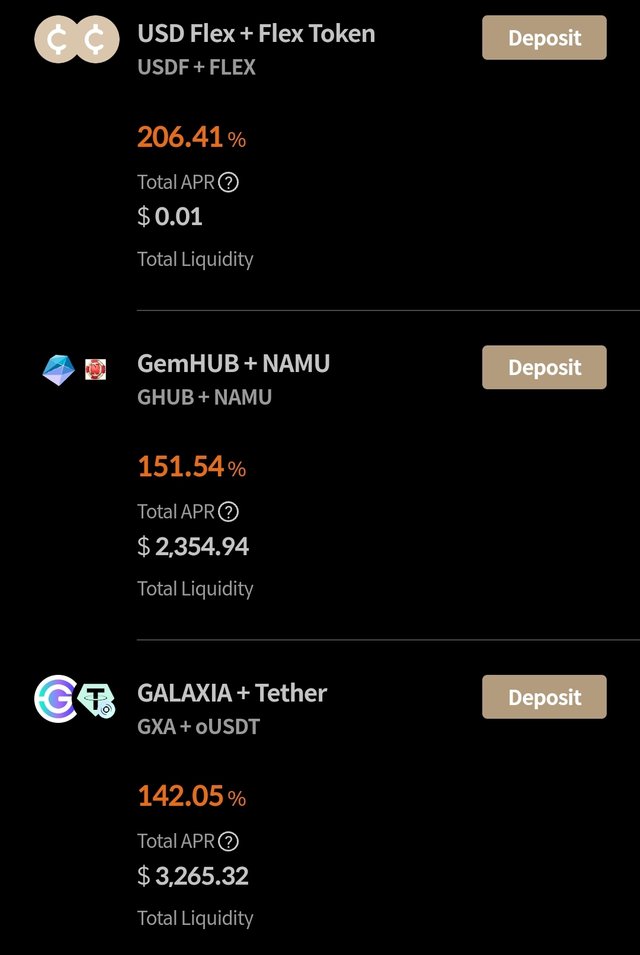

There are still many liquidity pools providing high APR(Annual Percentage Rate). However, I stopped providing my liquidity to these pools. Because, I noticed that it's risker than single deposit contracts. Today, I wanna share my experience from 2021.

As far as I remember, I bought 100k KLAY related to Kakao between 2020 and the beginning of 2021 at low prices, maybe 60 to 100 cents?

As I encounter the huge bullish market, the KLAY price skyrocketed. So, I wanted to create money flow such as dividends from KLAY. Finally, I found a De-Fi project based on the Klaytn blockchain. It was Klayswap. At that time, while there were many projects providing high APR, I was not interested in them, but something interesting was KLAY-KSP pool.

The pool is a liquidity pool. In a nut shell, individuals compose the pools by providing the liquidity pairs. For example, if there is KLAY-KSP pool. Individuals provide KLAY and KSP by proceeding the smart contracts. Individuals can claim the swap fee or governance token.

At that time, the KLAY-KSP pool provided about 35% APR. Overwhelmed by the tremendous cash flow, I felt powerful. But, I didn't know that there were many risky elements hidden in the liquidity provision pool.

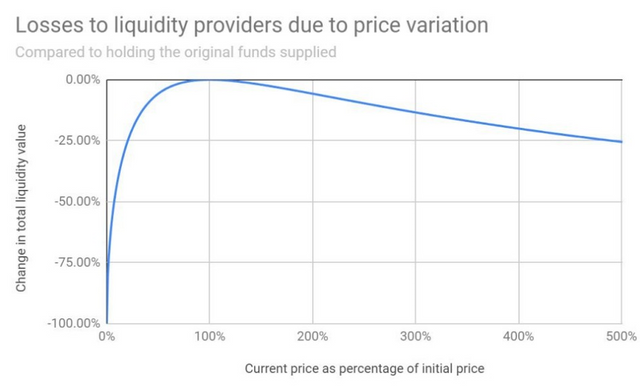

The first risk element is impermanent losses. If you provide KLAY-KSP liquidity, and those prices change, you will lose some of your total liquidity in USD value. I can't precisely calculate it. But, as far as I know, the reason is attributed to the arbitrage between the liquidity pool prices and exchange prices. It was really stressful during depositing the pair.

The 2nd is the price declines of the liquidity pairs. If those prices decline, it's meaningless of getting cash flow. Actually, I deposited around $350k KLAY-KSP 3 years ago, and over time the market suffered the bearish market. Nevertheless, I was captivated by the cash flow from KLAY-KSP pool, and I thought it would be fine. But, it wasn't. I lost around $250k value from that pool. Then, I realized my fault.

The last thing is small size liquidity pools. If you provide your liquidity to these pools, the exchange ratio of liquidity provison pairs will be extremely changed. So, you can immediately lose your assets in USD value.

For these reasons, I've not provided my liquidity in liquidity pools. Of course, some projects are prosperous, and got spotlighted. I acknowledged it. But, I don't wanna take risks a lot.

This comment is for rewarding my analysis activities. Upvoting will be proceeded by @h4lab

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

화이팅하세요 ~~

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Instresting post

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit