Hi Crypto lovers!

Hope you all had an awesome time with season 3 and now the most awaited season 4 has come. I joined to crypto Academy amidst of season 3 and gained much knowledge regarding the universe of crypto coz of this alluring community. I would like to offer my sincere gratitude to the professors who gave lectures in season 3 and hope to start my voyage of crypto with season 4.

Also, I take this as an opportunity to thank professor @awesononso for delivering such an interesting and very clear lecture to us.

Suppose that, I’m a merchant and at the village fair to sell eggplants that are grown at my home garden. I’m planning a price to sell them, 2 Steem for 500g.

Meanwhile, I got to know that, I’m the only merchant selling eggplants and so lots of customers are getting attracted to my store to buy them. Hence, demand for purchasing eggplants rise up and by considering the situation, I decide to sell 500g of eggplants for 4 Steem.

So, the Bid price is the maximum price that buyer pays for a certain thing to buy.

Amidst this, a huge rain started to fall off, and demand for every commodity decrease due to no customers buying them. Also, commodities were ruptured and spoiled due to the rainy climate, ergo decided to sell 500g of eggplants to 1 Steem.

Ask price is the lowest price a merchant had to sell for a certain commodity.

Bid-Ask spread or the spread is the difference between Ask price and Bid price.

Bid-Ask spread = Ask price – Bid price

Bid-Ask spread is a very important and informative element in crypto markets, coz it helps for the decision making of buying and selling.

In a nutshell, with the help of Bid-Ask spread, it is easy to deduce when the buying and selling of a certain commodity or a thing are readily available.

A correct balance between demand and supply leads to execute trades quickly and also it makes the market more liquid.

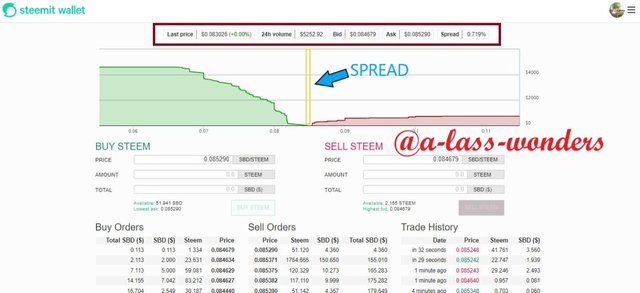

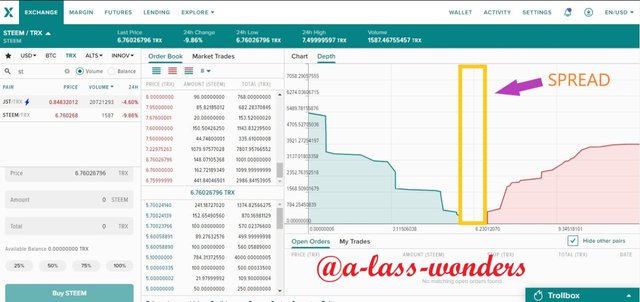

Here, I have taken screenshots from my Steemit wallet, and in it, you can see the spread for Steem/TRX and the spread for Steem/SBD. Here, my screenshots are taken when at zoom out, so the spread of them cannot be recognized easily. But if you take their percentage spread, obviously you can figure out Steem/TRX has a smaller gap between the Bid price and Ask price, but Steem/SBD has a higher gap compared to it. So, Steem/TRX combination gains more liquidity in the crypto market rather than Steem/SBD combination.

Therefore, if I were a buyer or a seller in the crypto market, I would definitely go for Steem/TRX combination coz of its smaller spread. Hence, the price gap between the Bid price and Ask price in Steem/TRX is lower, so gained more liquidity rather than Steem/SBD.

Bid price of crypto X = $ 5

Ask price of crypto X = $5.20

Bid-Ask spread = Ask price – Bid price

= $5.20-$ 5.0

= $0.20

Percentage spread =Spread/(Ask price)x100

= (0.20/5.20) x 100

= 0.03846 x 100

%spread = 3.846%

Bid price of crypto Y = $ 8.40

Ask price of crypto Y = $8.80

Bid-Ask spread = Ask price – Bid price

= $8.80 - $8.40

= $0.40

Percentage spread =Spread/(Ask price)x100

= $0.40/ $8.80) x 100

% Spread = 0.04545 x 100

% Spread = 4.545%

Crypto X has higher liquidity than Crypto Y, coz Crypto X owns a small spread compared to Crypto Y.

Usually, in crypto markets, cryptocurrencies are changing their values frequently. Amidst of this kind of situation, suppose that if you put a market order of $30 and the trader admits to carrying out that trade.

Normally, there is a small-time duration between initiation and execution of a certain market order. As cryptocurrencies are volatile, execution of a market order happens at $30.5, but with not the initiated price. This is called slippage.

Slippage = Execute price of a trade – expected price of a trade

This circumstance occurs when there is a wide Bid-Ask spread. Because when the Bid-Ask spread becomes broad, crypto markets are with less liquidity.

A) Positive Slippage

This can be interpreted as a favorable outcome of an amended price from its original bid.

As an example, I made a buy order worth $100 and when the trade was executed, it was valued at $98.

Positive slippage = $100 - $98

= $2

I made a sell order and intended to sell it at $50, but it was $53 when the trade was executed.

Positive slippage = $53 - $50

= $3

B) Negative Slippage

In here a loss is done for the executed orders. This is the opposite of positive slippage.

Suppose that, if I made a buy order worth $20 and if had to execute the trade at $22,

Negative slippage = $22 - $20

= $2

If I put a sell order worth $10 and had to execute it at $9,

Negative slippage = $10 - $9

= $1

Bid-Ask spread is a very informative parameter to make decisions on buying and selling in a crypto market.

When the difference between the Bid price and Ask price gets smaller, the spread will be smaller, hence the trading market is more liquid. Ergo, trading volume will be increased in the market.

Anyhow, you will find its own risky situation as slippage. So, you are exposed to encounter losses at your trading. But with a proper understanding of the spread, you can able to avoid some unwanted loss on your trades.

GOOD LUCK AND HAVE A NICE DAY!!

- My achievement 01 post: here.

- My achievement 02 post: here.

- My achievement 03 post: here.

- My achievement 04 post: here.

Hello @a-lass-wonders,

Thank you for taking interest in this class. Your grades are as follows:

Feedback and Suggestions

Your illustration of the bid price is incorrect.

Your arrangement can be improved upon. Question 2 was not properly arranged.

Some parts needed to be explained better for a better understanding.

Thanks again as we anticipate your participation in the next class.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you professor for evaluating my homework task.

Well noted my failures and hope to do my best with next task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit