Hellow everyone, greetings to you all and welcome to my second homework task provided by @stream4u. Thanks to @steemitblog for this awesome initiative.

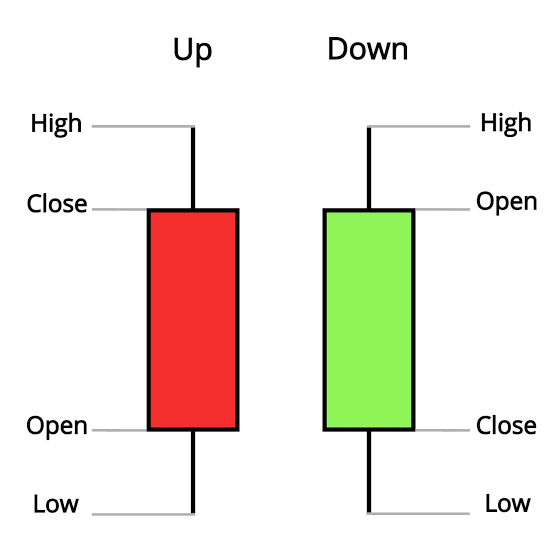

A candlestick is a way of exhibiting records about a belongings (assets) price movement. The movement ought to be high or low

The candlestick on green explains that the closing price for the day is higher than opening price for that particular day. Tht means that the price really moved up.

On the different hand, the red candle means that the closing rate is less than the opening rate for that particular day. That means the price really moved down.

QUESTION 2

Last one week chart for Bitcoin

source1 day ago chart

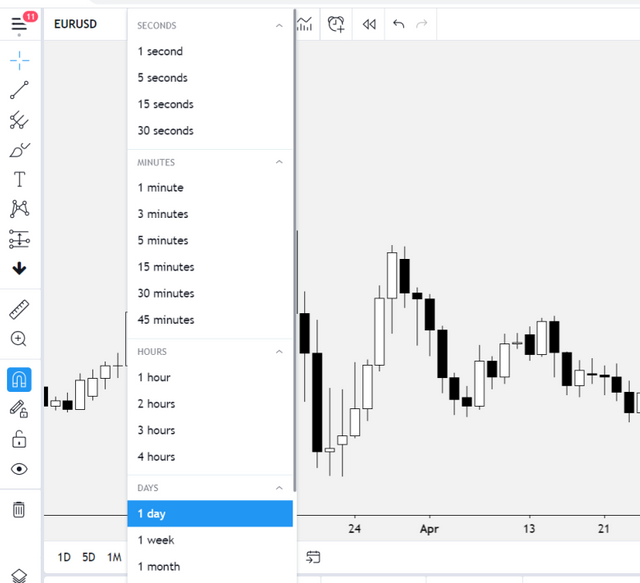

The chart above shows that candles can be set at different time frame viz:

1. Seconds

2. Minutes

3. Hours

4. Days

5. Weeks etc

So one set to

1sec, 10secs, 1min, 2mins, 10mins, 1hr, 2hrs, 1day etc

It is necessary to alternate the candle time frame due to the fact it helps traders to extend the odds.

QUESTION 3

Below is a chart candle in exclusive instances for ETH/BTC pair for LUNO exchange. It suggests absolutely the upward shove of upward push or fall of ETH with appreciate to BTC

In the 5th, 15th, 30th minute and ultimate 1hour the fall of ETH to BTC is apparent which is indeed a downtrend/sell indication.

5 minutes time frame

.jpeg)

15 minutes time frame

30 minutes time frame

.jpeg)

1hour time frame

However searching at the final 12hours and closing 1day, the downtrend/sell for the long term traders searching at the closing 12hours and the final day.

So a lengthy time period traders want to be patient and calm in order to take the proper decision or to make sound decisions as I opened in query 2 remaining paragraph.

12hours time frame

.jpeg)

1day time frame

QUESTION 4

There are three basic types of traders in the market according to professor @stream4u namely:

1. Short term traders: they are the day traders, this kind of trader purchase and sell on the identical day barring conserving function overnight. They preserve position for minutes to hours. It permits the 5minutes, 15minutes, and 30-40minutes as a result to locate their buy/sell positions.

Long term traders: I refer to them as the holding traders. The kind of merchants maintain position for days searching to achieve from the upward jab in cost After some time.

Majority of the long-term trades contain shopping for at a factor when charge of the coin had long past so so low and then wait to sell when the charge had gone significantly higher. They do not give up,No be counted the market circumstances.They wait patiently and promote when the rate is beneficial to them.

Scalping traders: This variety of retailers take small profits repeatedly.Their exchange closing from seconds to minutes and they make investments higher property inorder to make small and repeated profits.Most of them do now no longer comply with any time body of candle chart.

QUESTION 5

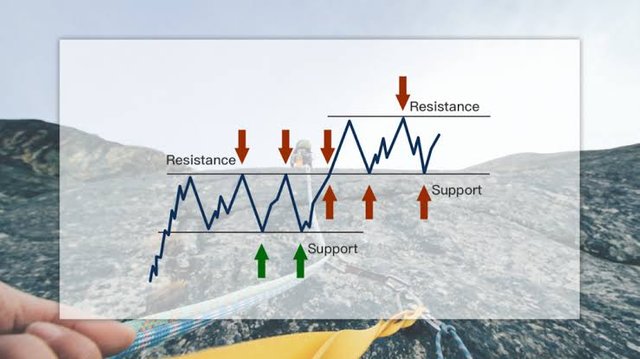

Support is in truth a BUY time.It is a charge diploma in the buying and selling chart previous which an asset will no longer fall.It is a length of BUYING spree.By default,support section is a pint when the fee is in such a way that customers are ever organized to BUY, and outlets are ever reluctant to sell.Hence, pushing demand greater and the asset cost alongside with it.

Other the exceptional aspect of the divide is Resistance.Resistance is truely a SELLtime.It is a rate element that restricts any in addition upward moves in the price of an asset.It is a duration of SELLINGspree.Resistance degrees oftentimes have get entry to to grant and decrease demand, which in the end pushes the charge down.

From the definition of the two terms above,it is easier to say that the significance of Support and Resistance in trading is that permits merchants to guide themselves in the market.It permits merchants to predict to a higher diploma the course of the prices.

QUESTION 6

From the chart above.Notice that at the starting of the year,there exist SUPPORT at 58(blue arrow) which was as soon as accompanied by a Resistance at 75.Take a appear at the chart for the 2nd time for readability purposes.

In the early section of MARCH,the stock fell as soon as greater to SUPPORT once again(58)(blue arrow).You can see the crimson circle.

This SUPPORT pushed shoppers to BUY.However the agents would be reluctant to sell leading to a decrease in advertising pressure.

In April,SUPPORT was further tested as the charge was once once as soon as greater at 58( the blue arrow is a pointer to that).

Therefore from the chart,it is much less tricky to thing that SUPPORT took location in the starting up of the year(58),Again in March and additionally in April.

QUESTION 7

After finding SUPPORT.It is important for us to recognize when to region a purchase order.

STEPS

Take notice of the role of inventory earlier than it commenced rising..ark it with a pointer.Then watch patiently as it spikes.Watcj when it will come down to that preliminary degree earlier than the spike.Thats the exceptional time to buy.

From the chart above.It is perfect to purchase in between the 8th and 15th of MAY.

Thanks for reading through

Special Regards to @steemcurator01 @steemcurator02 and @stream4u

Written by @aaron1990

Hi @aaron1990,

Please add #technicalcryptosr in the first 2 tags.

Thank You For Showing Your Intrest in Steemit Crypto Academy

You have completed the homework task and made a good post, explained very nicely about How To Read Candlestick Charts In Different Time Frame & Information about Buy-Sell(Support &

Resistance).

Remark: Homework Task Completed.

Thank You.

@stream4u

Crypto Professors : Steemit Crypto Academy

#india #affable

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for the correction sir, God bless you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is such an elaborate task you have written. It reveals your wealth of knowledge in crytocurrency. I now understand to some extent how to read candlestick charts. I hope to understand better.

Thanks for sharing @aaron1990

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for your comment ma. Am glad you like it

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I like the simplicity of your explanations.

The way you arranged it makes it so self clear. I gained more in reading your piece

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you sir.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit