Hello Guys! Here's my homework post. I hope you enjoy it.

WHY STABILITY IS IMPORTANT IN DIGITAL CURRENCIES

Stability in digital currencies is very important, this is because the main reason for stability, is the volatility of digital currencies, and this is one of the very few expensive disadvantages of digital currencies.

Cryptocurrencies are quite known for their unstable nature. Because Cryptocurrencies are decentralized, the prices and values are determined by the action of the market. Basic Economics helps us to know that, when the supply of a product doesn't meet its demand, there is a change in value. That is to say, if the supply of an asset outweighs its demand, the value and price would drop, and vice versa.

When Trading with crypto assets, one thing every trader doesn't want to experience is a negative slippage on an asset during a trade, and this is caused as a result of the instability and volatile nature of the assets. No trader wants a situation where there is a need to enter quick positions and while placing the trade, the value of the digital currency slips far below the expected price.

Another thing is, the unstable nature of these digital currencies makes it difficult to use them as a store of value. Because we cannot best tell what trend a digital currency is going to follow; be it an uptrend or a downtrend. Since digital currencies are not stable, it would be illogical to use them as a store of value, be because they are so volatile that, one minute they are stable and the next, their value could be as high as the sky or their value could just drop farther than the freezing point of nitrogen.

WOULD CBDCs BE GOOD IN THE FUTURE?

Central Bank Digital Currencies(CBDCs) can be referred to as a Crypto Asset representation of a Countries Currency. CBDCs could either be good or bad in the future, depending on the perspective it's been viewed. The idea of CBDCs is to create an atmosphere of security in the Crypto World. But in essence, the Crypto World is known very well for the level of anonymity it gives its users. Let's check out some of the Pros and Cons of CBDCs.

PRO's

Sense Of Security

CBDCs would seek to create an aura of security free and void of fraud, that would damp down all the issues of fraud and untraceable transactions.Ease of Transactions

Since CBDCs would be verified and recommended by the Central Banks, they would be trusted throughout the country and with time, it will become an established financial means of transactions; more like a legal tender and this would make it easy to send and receive the assets.Reliable Store of Value

CBDCs would be required to hold and maintain the prices of their respective Fiat Currency, and means they will be far more stable than the regular Crypto Assets. As a result, they can be used as a form or way to store value.Further Implementation of Cashless Societies

As the world is evolving technologically, every government is seeking to kill or reduce the use of physical currency in the system. With the implementation of CBDCs, it would with time, cause many countries to go cashless.

CON's

Centralization

One of the major setbacks CBDCs are going to cause is the centralization of the market. Crypto Assets are quite known for their decentralized nature because it is not controlled or governed by a central body. That means CBDCs would be prone to direct and purposeful influence, mostly by the government. Indirectly CBDCs are just an implementation of Fiat Currencies but just in the crypto form, this would give almost every true trader an 'ick', since it takes away what we know Crypto Assets to be.Absence of Privacy

With CBDCs, the government would keep a record of its user and monitor them for any cases of fraudulence or even money laundering. This gives them enough reason to invade the users' privacy, check their assets of individuals and eventually, how they acquired them.

From the points made, it can be seen that the good or bad of CBDCs can only be determined by your point of view.

HOW REBASE TOKENS WORK

Rebase Tokens or Elastic Supply Tokens are a type of token that uses the Rebase Mechanism to keep the value of the coin at a stable price. The Rebase Mechanism is a smart mechanism that controls the value of the token by alternating or adjusting the Supply of the token on the market. The Rebase Mechanism has a protocol that occurs routinely and it makes a lot of sense because it applies the basic laws of economics. Some examples of Rebase Tokens include;

- Olympus (OHM)

- Wonderland (TIME)

- Ampleforth (AMPL)

- Yam Finance (YAM)

The Rebase Mechanism has two actions, namely;

The Positive Rebase

For a situation where the token is rising farther than expected, the mechanism increases the supply strategically, and when the supply outweighs the demand, the token becomes cheap, causing the price to drop. But here's where the beauty of the mechanism is when the price is dropping it won't just fall, but it would drop to the expected price range. This is because of the strategically calculated increase in supply.The Negative Rebase

On the other, in a situation where the price of the token is dropping below the expected range, the mechanism strategically decreases the supply causing the demand to outweigh the supply, this causes a calculated rise in the value of the token.

What happens from the user's end of the view is that the number of the user's tokens would increase if the value of the Rebase Token drops or it'll decrease if the price of the token rises. For instance, If a user has 1 AMPL (which is worth approximately $1) and the price rises to $2, the supply inflates during the rebase period. This means that the user's 1 AMPL becomes 0.5 AMPL but the value remains at $1.

In the same way, if a user has 1 AMPL and the price drops to $0.5, the supply deflates or decreases during the rebase period and the user's 1 AMPL becomes 2 AMPL, to keep the value the user had before.

AMPLEFORTH

Ampleforth is one of the first coins to work with an elastic supply or a rebase mechanism its value pegged to that of the US Dollar. It implies that 1 AMPL is equivalent to $1. It's rebases occurs routinely, every 24 hours.

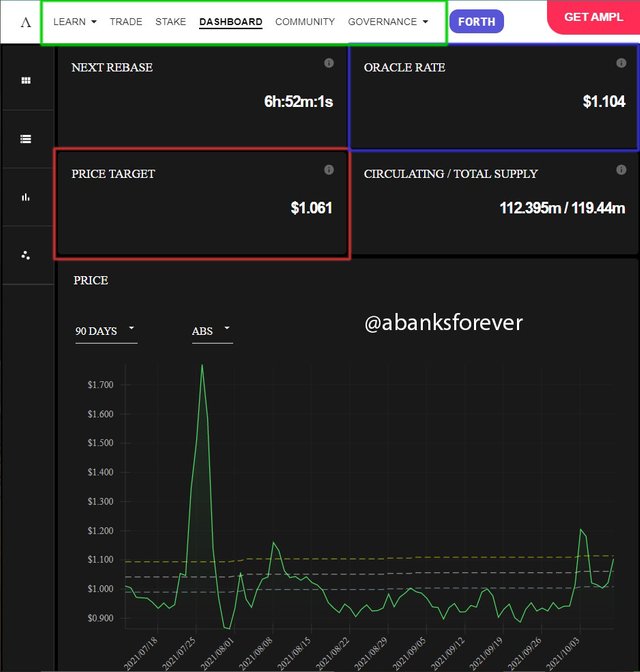

From the screenshot above, The Ampleforth Dashboard is the default section that is displayed when the website is opened. From there, the Oracle Rate, Price Target, Circulating/Total Supply and Next Rebaseof the Ampleforth token can be seen.

Oracle Rate = $1.104

Price Target = $1.061

Next Rebase = 6h:52m:1s

Circulating/ Total Supply = 112.395m/119.44m

Calculating the Rebase Percentage,

Rebase Percentage = ([(Oracle Rate - Price Target) / Price Target] x 100) / 10

Rebase Percentage = (($1.104-$1.061)/$1.061] x 100) / 10

Rebase Percentage = (($0.043/$1.061)x100/10

Rebase Percentage = 0.4053%

There's a lot on the Ampleforth Website. If you take a look at the screenshot above, the part highlighted in green, you can see some menu options available. The Learn, Trade, Stake,Community, Governance and finally the Dashboard which is open.

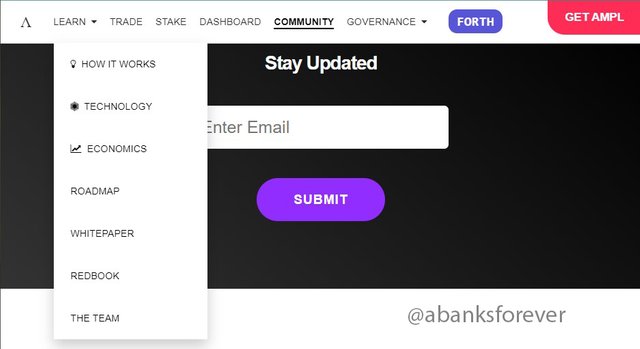

On clicking on the Learn Menu, It gives you options that help you to learn more about the Ampleforth token. The screenshot below shows what is displayed when you click on the LEARN section.

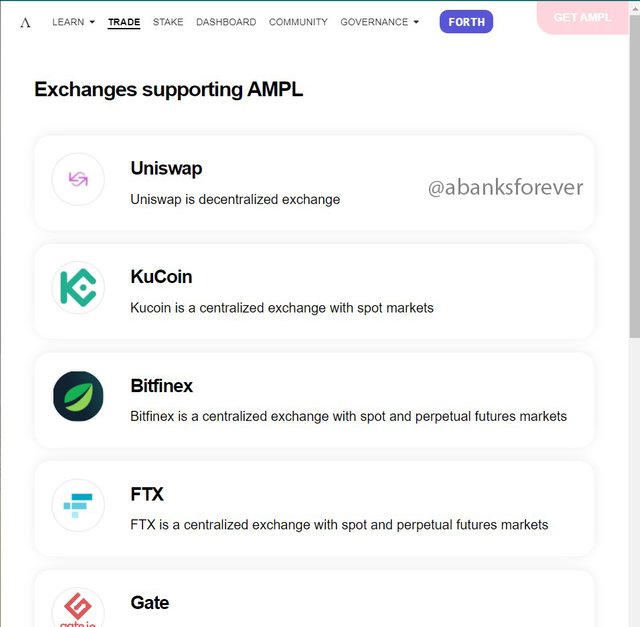

On click on the Trade, it shows you a list of trading platforms that support Ampleforth. The screenshot below shows a few of the trading platforms.

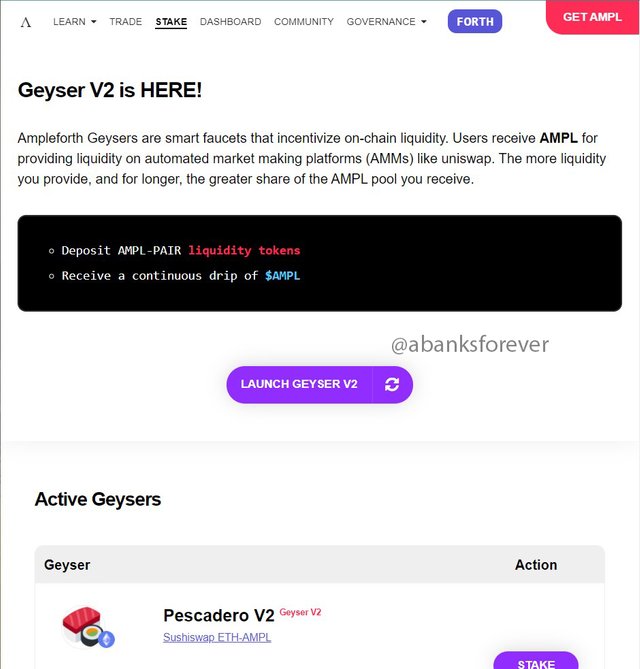

On clicking Stake, it shows a list of Ampleforth Geysers, they are like faucets that give their users incentives for providing liquidity on the market. The screenshot below shows the Stake section.

On clicking on Community, it is the section where users can get linked with the Ampleforth community. The Screenshot below shows what exactly it is about.

Clicking Governance shows a drop-down menu that gives you options to see how the token works, an option that redirects you to the Forth Token and the resources of the Ampleforth Token. The Screenshot below shows it.

TRADE SOME TOKENS FOR AT LEAST $15 WORTH OF USDT ON BINANCE AND EXPLAIN YOUR STEPS.

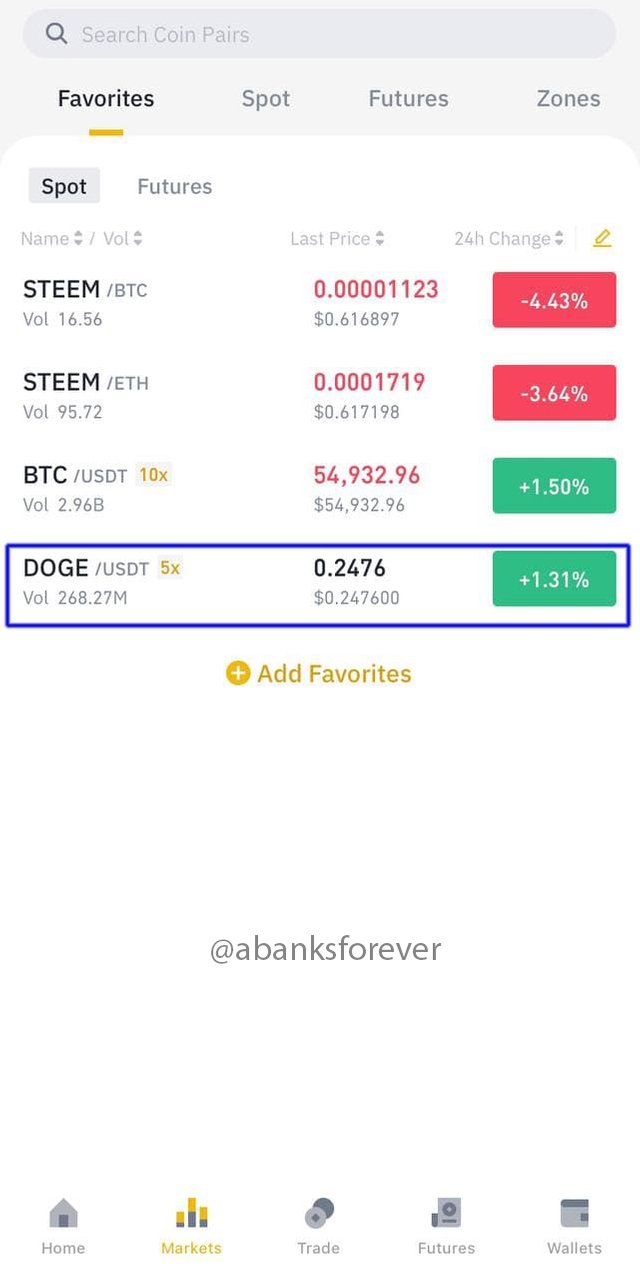

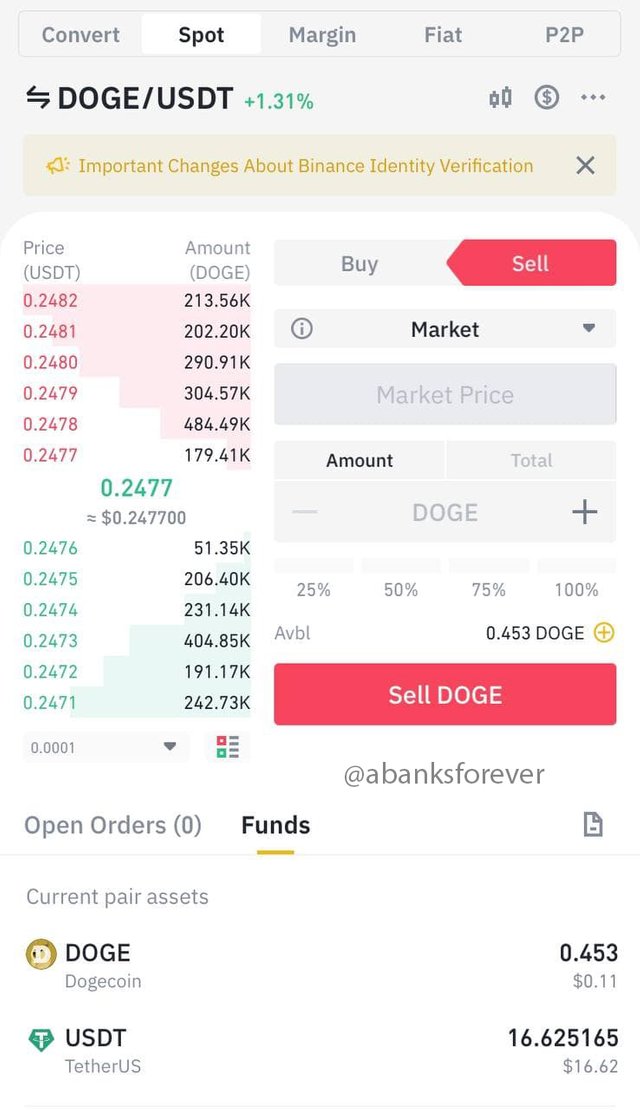

- To be able to trade on Binance, you'll have to log into your account. After logging in, I went to Markets and chose DOGE/USDT as shown below. I chose DOGE because I had my assets in Doge.

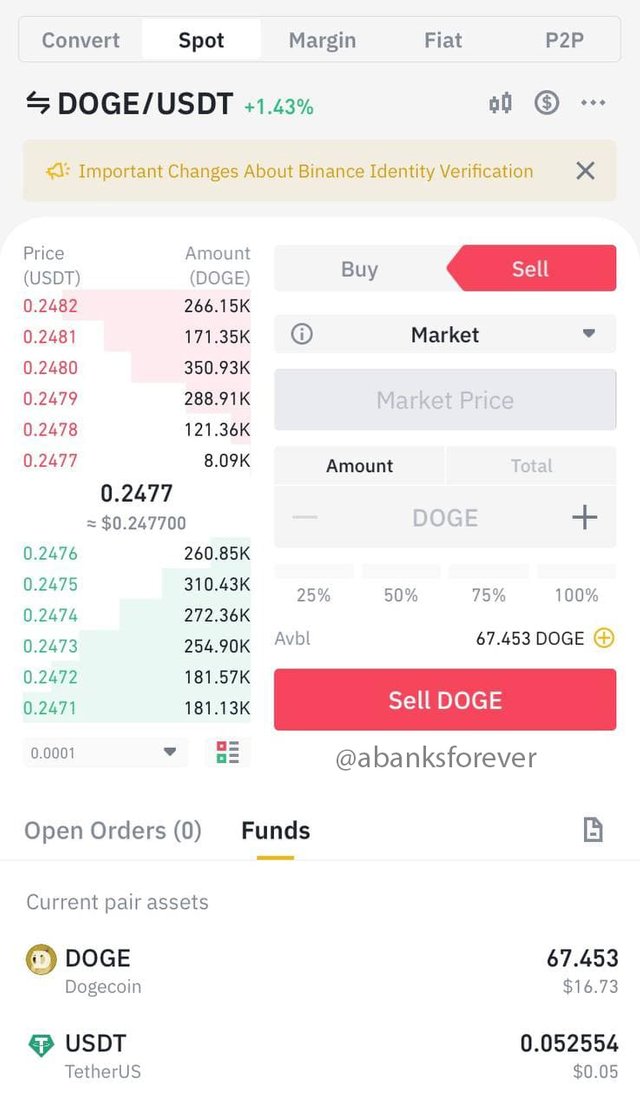

- Then I chose "SELL", so I could sell my DOGE in exchange for USDT. As seen below.

- Then I maxed out the sell amount and sold my DOGE. It can be seen from the "Funds" section below that I had 67.453 DOGE.

- Then I received 16.6251 USDT from the sale of my DOGE. This can be seen in the "Funds" Section below

TRANSFER THE USDT TO ANOTHER WALLET WITH THE TRON NETWORK. FROM THE TRANSACTION, WHAT ARE THE PROS OF THE STABLECOIN OVER FIAT MONEY TRANSACTIONS?

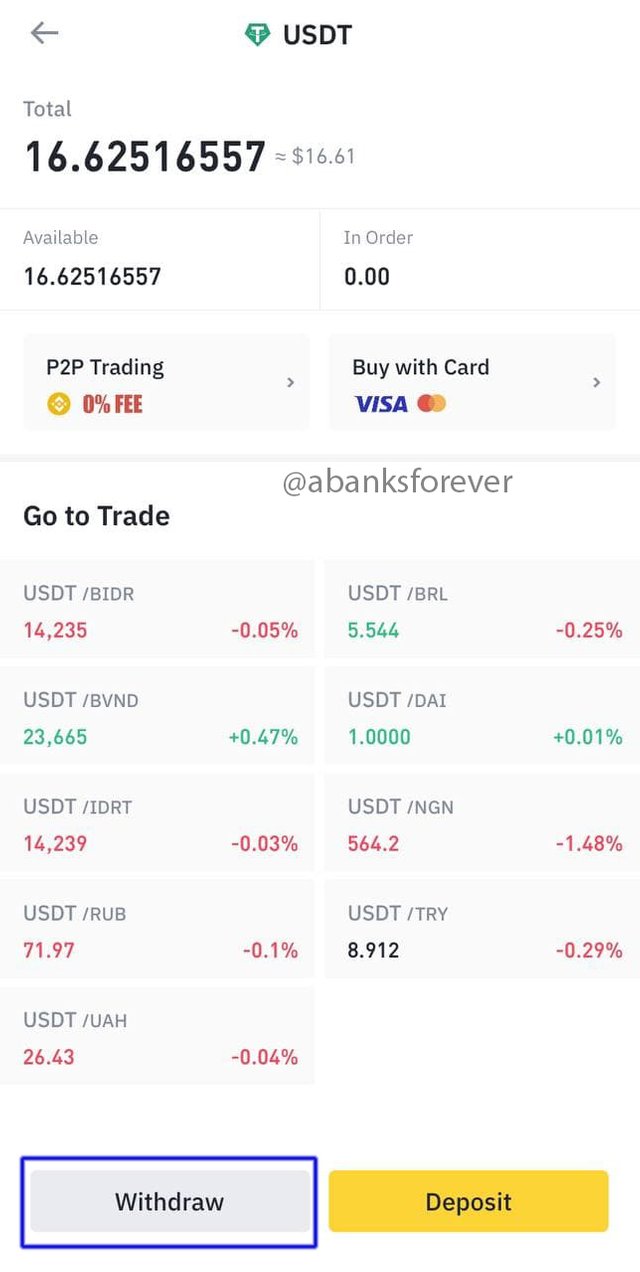

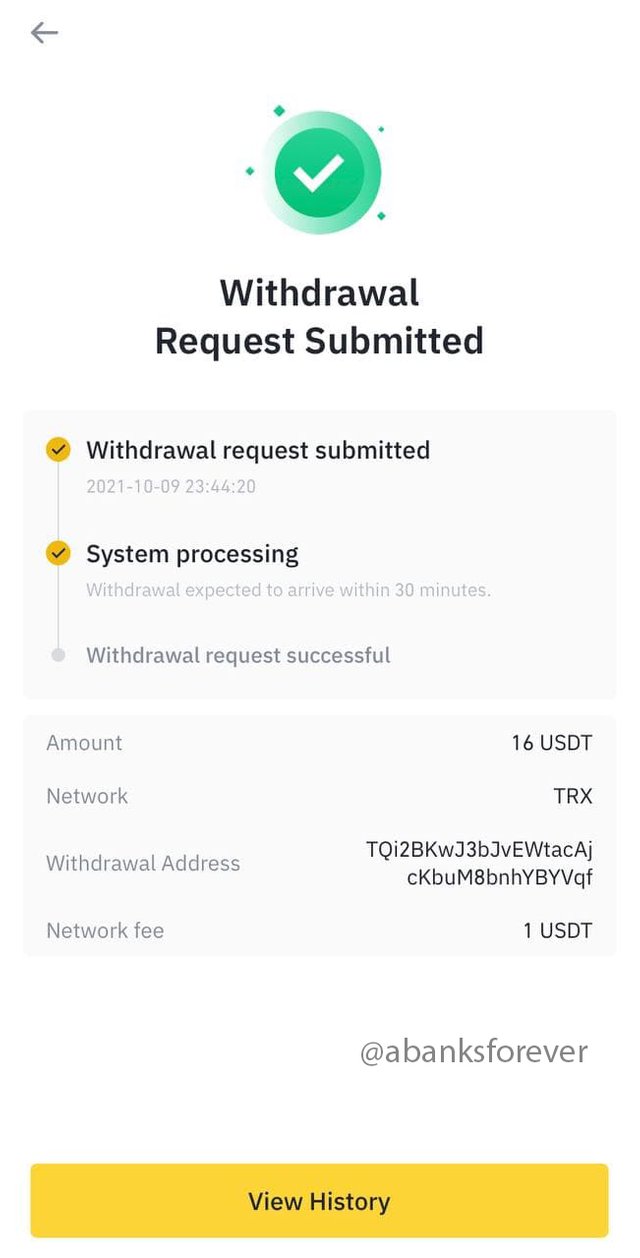

- To transfer the USDT to another Tron Network, you have to go to your "Wallets" and click on the USDT. After clicking on USDT, you'll see your available balance and other USDT pairs, and Deposit and Withdraw. Since we are transferring to another Network, we click on "Withdraw". As shown in the screenshot below.

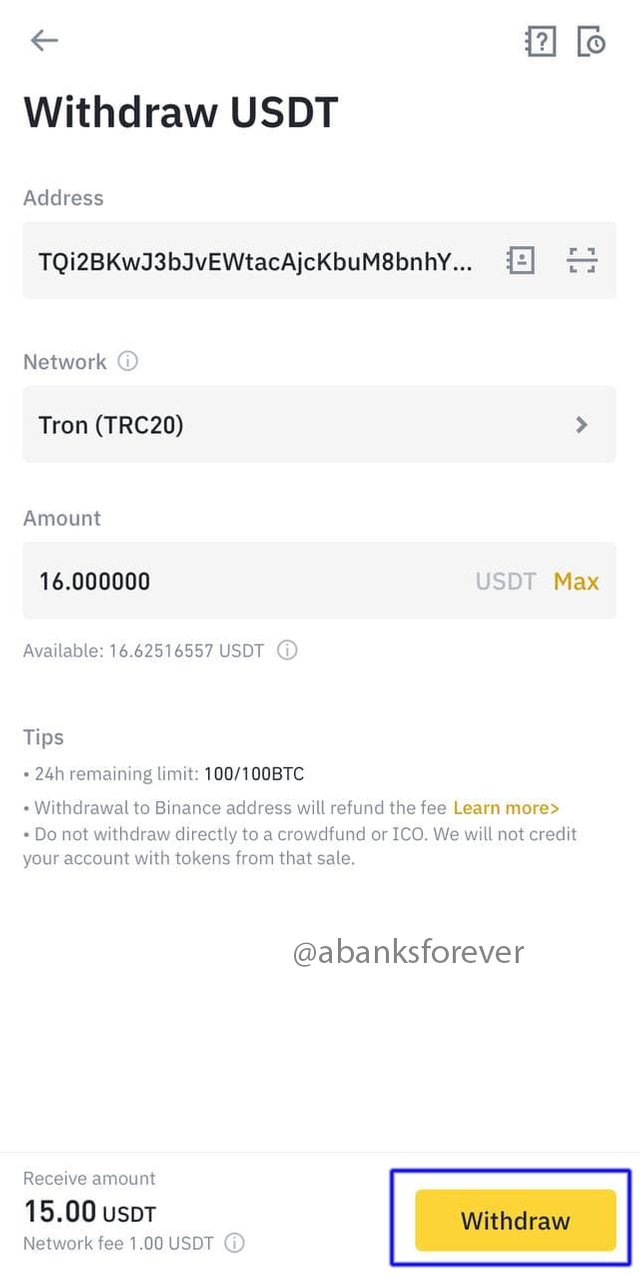

- After clicking "Withdraw", fill out the page with the address to the other network, and Select Tron as the network(Since we are sending to Tron) and then the amount you want to withdraw as seen in the screenshot below. After this click the "Withdraw" button again.

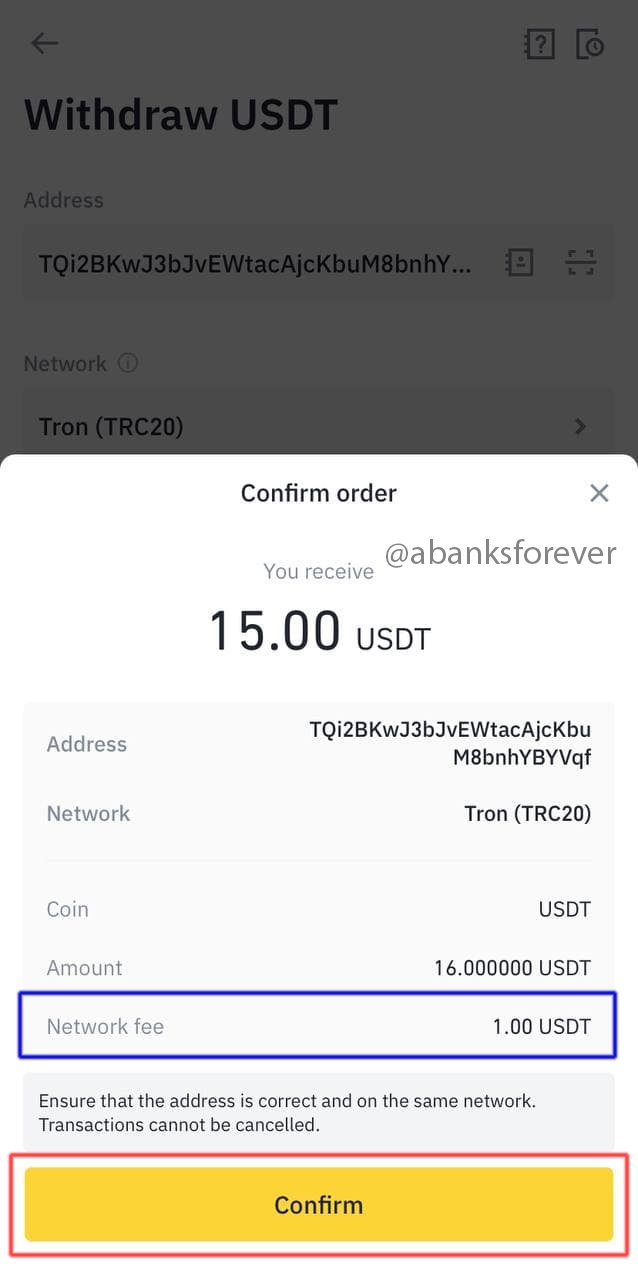

- After clicking the "Withdraw", a pop-up would fly out asking you to confirm Your Order. Click on "Confirm" as shown in the screenshot below. It can be seen that the "Network Fee" for sending USDT across the two platforms is 1 USDT.

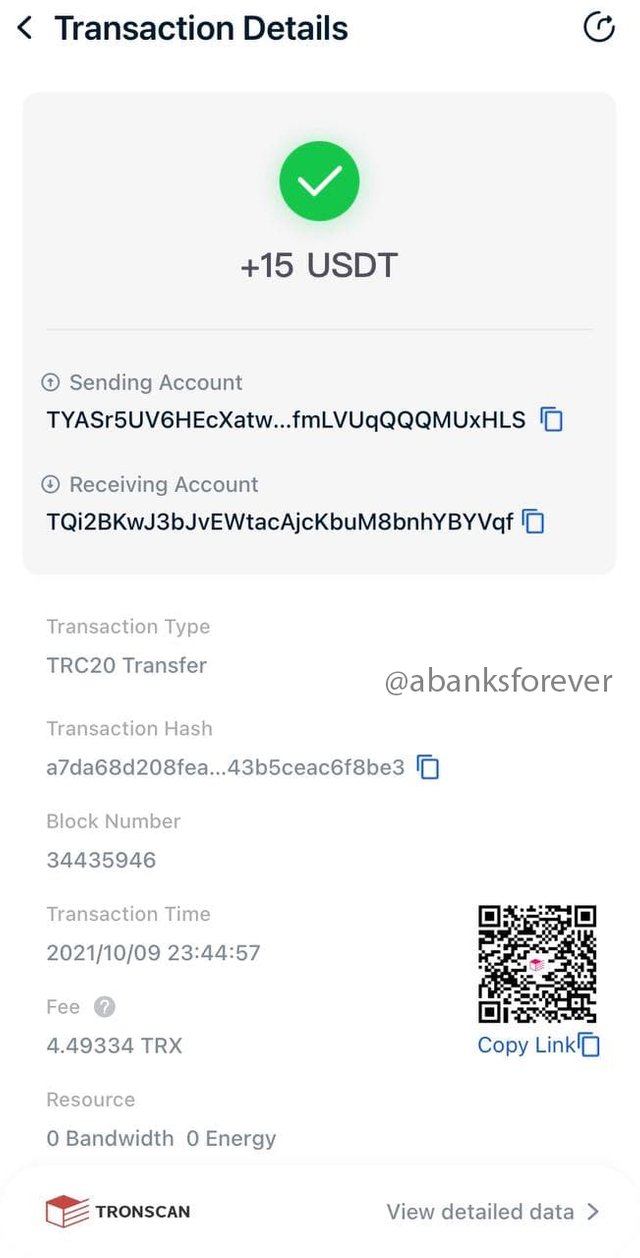

- After confirming the order, Binance submits your withdrawal and a few minutes later receive the USDT on your TRON network, as seen in the screenshots below.

PROs OF STABLECOINS OVER FIAT MONEY TRANSACTIONS

Fast and Easy

It is quite easy and fast to perform transactions with Stablecoins. All you need is to just copy the address of the recipient and then you are good to go.Transparency

Because of the decentralized nature of Stablecoins, the government has no control over it and every detail of the transaction is made available on the blockchain.Less Costly

From the transaction above, it can be seen that the Fee was just 1 USDT and this is because it was across two networks. Unlike the Fiat Money Transaction, where it is costly to transfer money through banks because the rates vary from bank to bank.

CONCLUSION

Thank You @awesononso for such an informative lecture.