Hello Guys! I'm very grateful to be a part of this lecture. Here's my homework post and I hope you guys enjoy it!

ORDER BOOK AND ITS COMPONENTS

Order Book

An Order refers to a statement that has been made to buy or sell an asset. This brings us to what an Order Book is; An Order Book is simply a digital record of only open orders for a particular crypto asset. It can be noticed that the Order Book refreshes occasionally, this is as a result of the Open Orders been completed or filled.

The Order book is not as simple as it looks, it has several benefits to the technical eye. Where, it can serve as a means to check and calculate the Spread of an asset by comparing the average Bid Price to the average Ask Price; and with this, the Liquidity of an asset can be determined, even though it is not a very reliable one. The Order book is again advantageous to the trader, in the sense that, it can help a trader determine the trend a crypto asset is following; be it bearish or bullish.

Another advantage of Order Books are, they can also be used to determine the Resistance and Support levels of a given asset. The Resistance of a crypto asset refers to the highest price level at which the price of a crypto asset cannot go beyond at a given time and the Support of a crypto asset is the lowest price level at which the crypto asset cannot drop lesser than at a given time. Though Assets break their Support and Resistance from time to time, it is very difficult to break them. That been said, for Bid Prices to all be in the same range or level, it would mean that that is the Support Level and for the Ask Prices to all be in the same range or level, it would also mean that that is the Resistance Level of the asset.

Every Crypto Asset has its order book. Order Books contain a record for both Buy Open Orders and Sell Open Orders. This explains why the order book has two(2) sides, that is, Bid Side and Ask Side

Bid Side

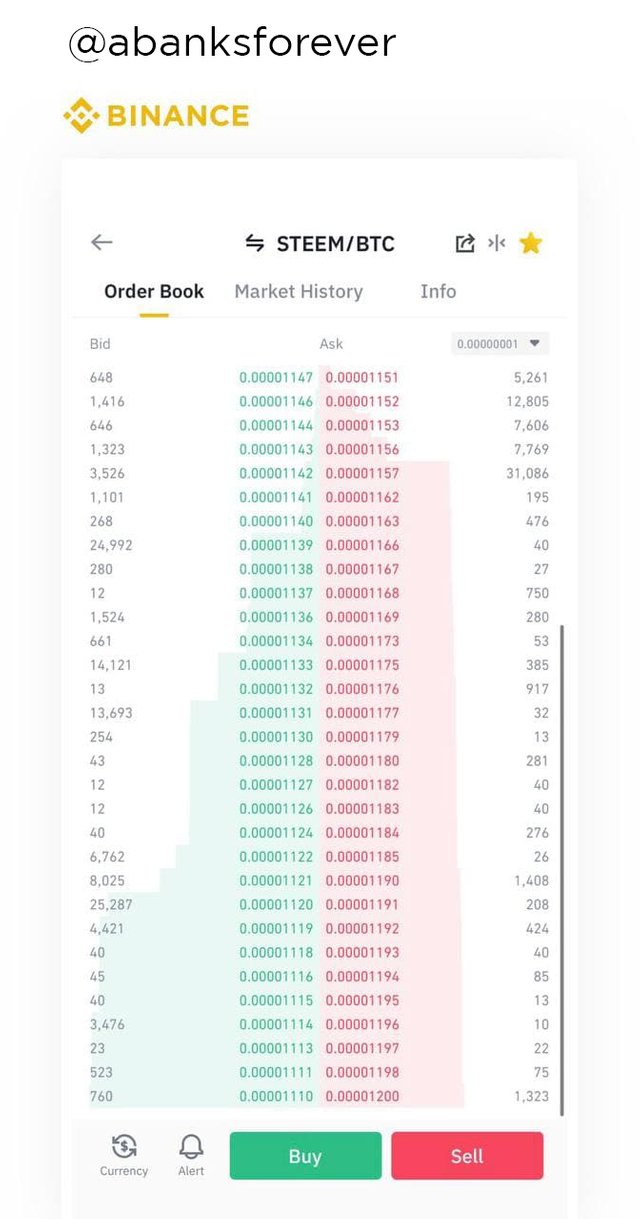

The Bid Side is usually the green part of the Order Book and it is the record for all the Open Buy Orders for the particular crypto asset. It is sorted in descending order according to the rates of purchase of the open orders. The screenshot below shows a screenshot of the STEEM/ETH pair Order Book and the features of the Bid Side can be seen in green.

Ask Side

The Ask side is often the red part of the order book and it is the list of all open Sell Orders of the crypto asset. Like the Bid Side, it is also sorted in descending order according to the rate of Sale. This is illustrated in the screenshot above.

MARKET MAKERS AND MARKET TAKERS

The concepts of Market Makers and Market Takers are drawn from the Limit and Market Orders features that are available to traders.

Market Makers

A Market Maker is a trader who buys/sells crypto assets with Limit Orders. They quote the prices at which they want to buy/sell their assets to the market; and wait till there's an order matching theirs before their order can be executed. As the name goes, they are the makers of the market. This simply means that they make the market by giving it liquidity; in the sense that, they offer other traders of the Crypto Asset different order price options to trade at, because of the prices they(Market Makers) want to buy or sell their assets at.

Market Takers

A Market Taker is a trader who buys/sells crypto assets with Market Orders. From the name, it simply means someone who takes the market as it is. This means that such traders buy or sell assets at the price the market has for them. With this, they take the liquidity of the market because once they place their orders, it is filled immediately due to the orders the Market Makers have made.

LIMIT ORDER AND MARKET ORDER

Limit Order

The Limit Order is a very beautiful feature of trading. This type of order allows traders to quote the price at which they want to buy/sell assets.

It is very useful especially when traders want to buy/sell an asset but the price of the asset is not favourable to them at that moment of the trade. The Limit Order allows them to set the price at which they want to buy/sell the asset, so that when the price of the asset matches with their order, the order will automatically be executed. One way or the other, the order book is made up of Limit Orders that are waiting to be filled.

Market Order

The Market Order is the easiest and fastest way to buy/sell a crypto asset. The Market Order executes all trades at the current price of the asset on the market. Traders use this type of order when they want to buy/sell assets immediately. Even though the Market Order is the fastest way to execute a trade, on some occasions, Market Orders may not execute as quickly as required as a result of price slippages. This is caused by how unstable the prices of Crypto assets are.

HOW MARKET MAKERS AND MARKET TAKERS RELATE WITH THE TWO ORDER TYPES AND LIQUIDITY IN A MARKET

Let's take the local marketplace where we all purchase our food items and other stuff. In our various local markets, different shops sell the same items, let's say tomatoes, at different prices. There would be a shop where you could get 10 tomatoes for $4, another place where you would get 12 tomatoes at the same price of $4 and even a third shop where you would get 8 tomatoes at $4. This availability makes the Tomato market very liquid.

The Market Makers(The Shops) place Limit Orders by setting the price at which they want to trade their tomatoes at and the Market Takers(The Customers) place Market Orders by coming to the market to purchase the tomatoes at the price the shops have set. For a situation where a customer doesn't find the available price suitable, he/she places a Limit Order by scanning through the market for a rate that would suit him/her; at this point, this customer ceases to be a Market Taker to become a Market Maker.

We can liken the Market Makers to the shops and the shops make the market and provide liquidity because they provide the food items at a variety of prices for Market Takers(the customers) to purchase.

PLACE AN ORDER OF AT LEAST 1 SBD FOR STEEM ON THE STEEMIT MARKET PLACE

a)

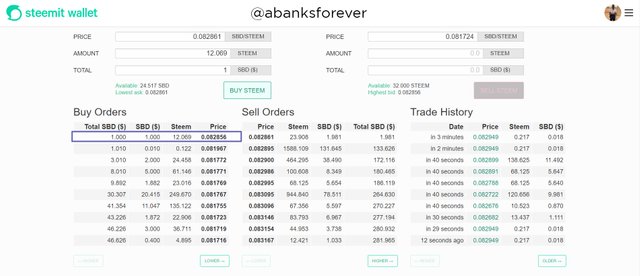

After placing the order for 12.069 STEEM at 1 SBD at the lowest ask, it took a little to 3 seconds to be filled. This is because the lowest ask is the least price STEEM can be bought at, making the Lowest Ask the Market Price. It means that placing an order at the Lowest Ask means you are placing a Market Order; Market Orders as we all know are executed very quickly because they are filled at the price the asset is valued at. My order can be seen in the STEEM Order Book in blue in the screenshot below.

b)

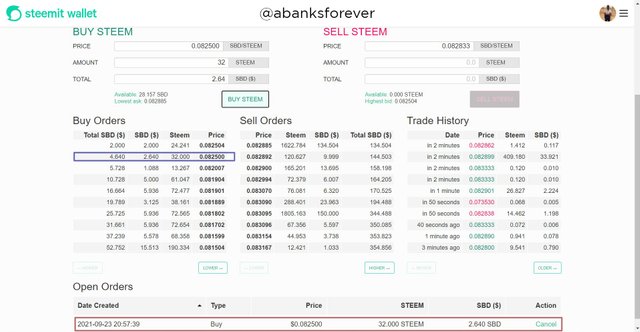

Upon reducing the Lowest Ask on the STEEM Market, it created a Limit Order for 32 STEEM at 2.64 SBD at a rate of 0.082500 as seen in the screenshot below. My Order can also be seen in blue in the STEEM Buy Order Book and at the bottom in red under My Open Orders.

PLACE A TRX/USDT BUY LIMIT ORDER ON THE BINANCE EXCHANGE FOR AT LEAST $15. EXPLAIN YOUR STEPS AND EXPLAIN THE IMPACT OF YOUR ORDER IN THE MARKET.

In placing a Buy Limit Order on Binance, I loaded my USDT wallet

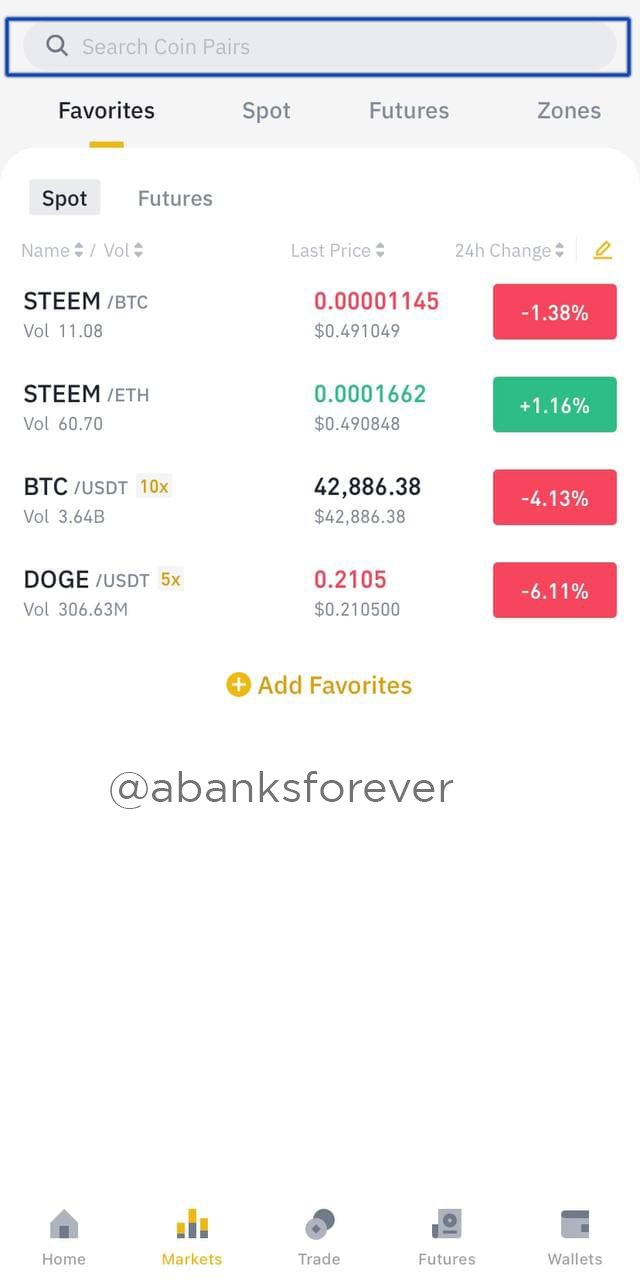

I then went to the Binance Market by tapping on the Market, as seen in the screenshot below.

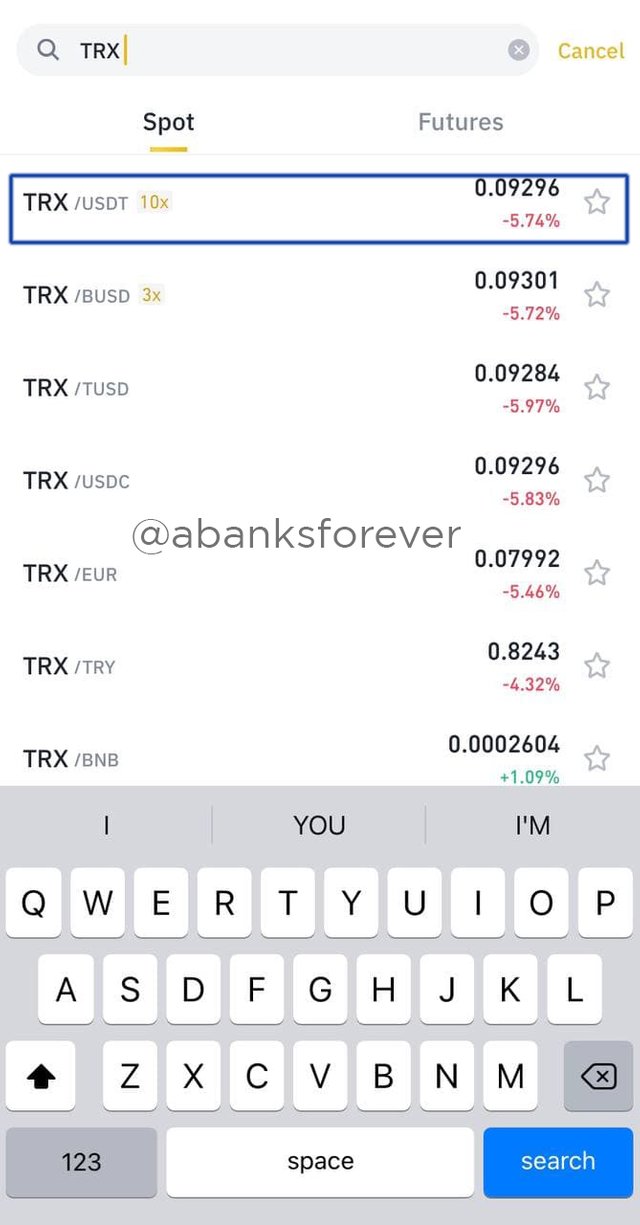

- I searched for the TRX/USDT pair in the search bar as seen in the screenshot below.

- I then selected the TRX/USDT pair.

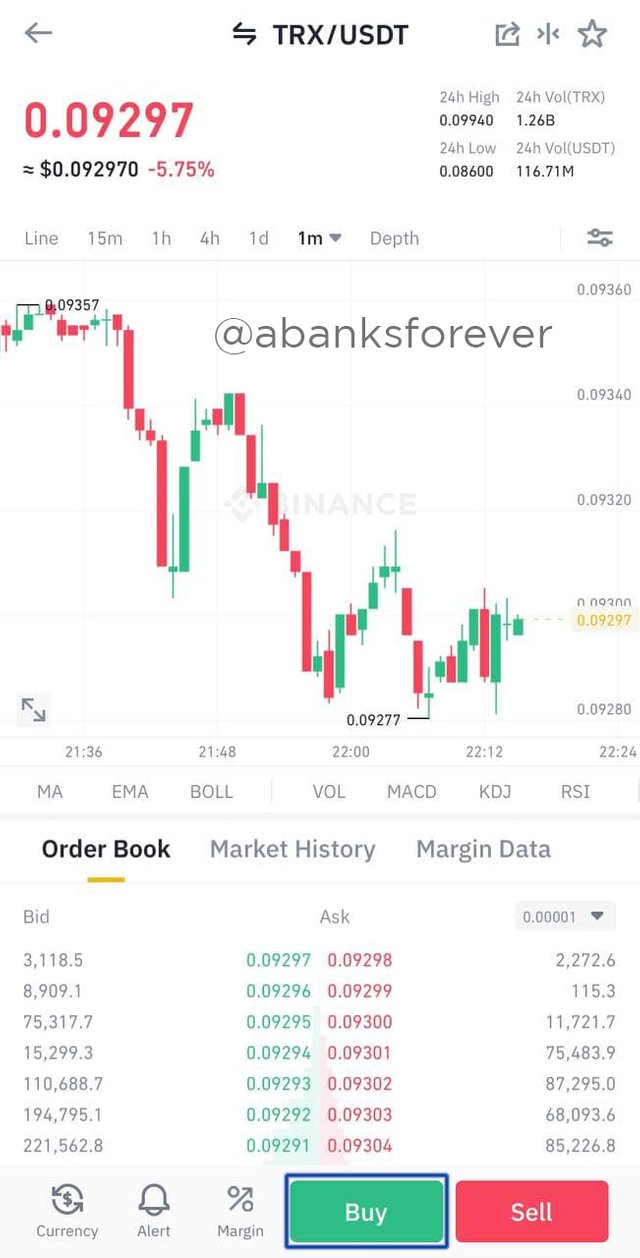

- After I clicked on the 'BUY' Button to begin the trade, as shown in the screenshot below

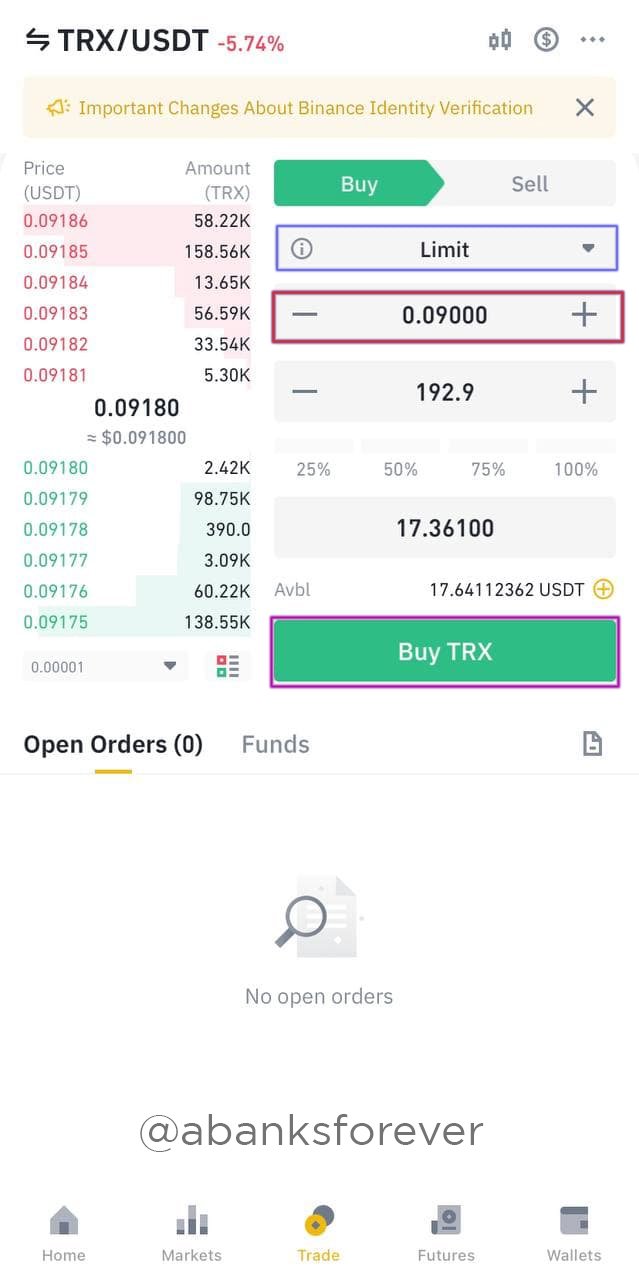

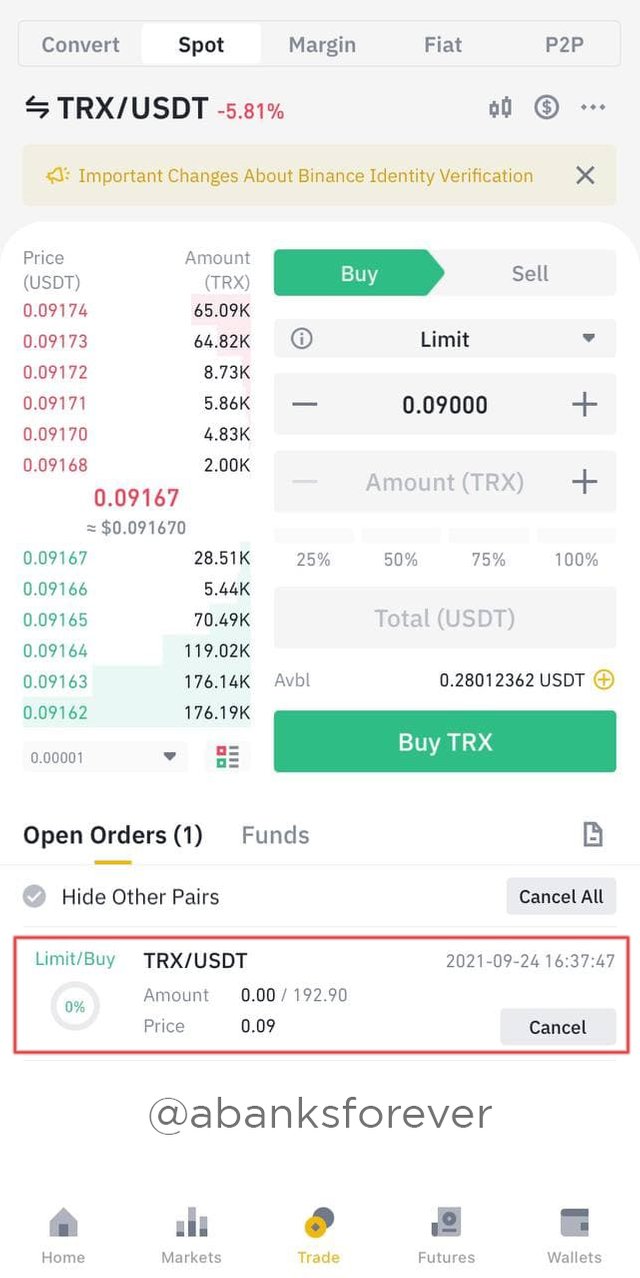

- I selected the type of order by selecting 'Limit' from the drop down menu shown in blue, quoted the price I wanted to buy the TRX at in shown in the Red and specified the Amount of TRX I wanted to buy; then clicked on 'BUY TRX'.

- After Clicking on the 'BUY' button, my limit order was added to the list of open orders as seen in Red in the screenshot below. It can also be noticed that my Available Balance reduced.

IMPACT

My Limit Order has impacted the market by giving it liquidity because placing this order makes me a market maker hence, I'm making the TRX/USDT market liquid by giving other traders who want to sell many price options to trade at.

PLACE A TRX/USDT BUY MARKET ORDER ON THE BINANCE EXCHANGE FOR AT LEAST $15. EXPLAIN YOUR STEPS AND THE IMPACT OF YOUR ORDER IN THE MARKET.

SUB-HEADING

In placing a Buy Limit Order on Binance, I loaded my USDT wallet.

I then went to the Binance Market and searched for the TRX/USDT pair; and selected it.

After I clicked on the 'BUY' Button.

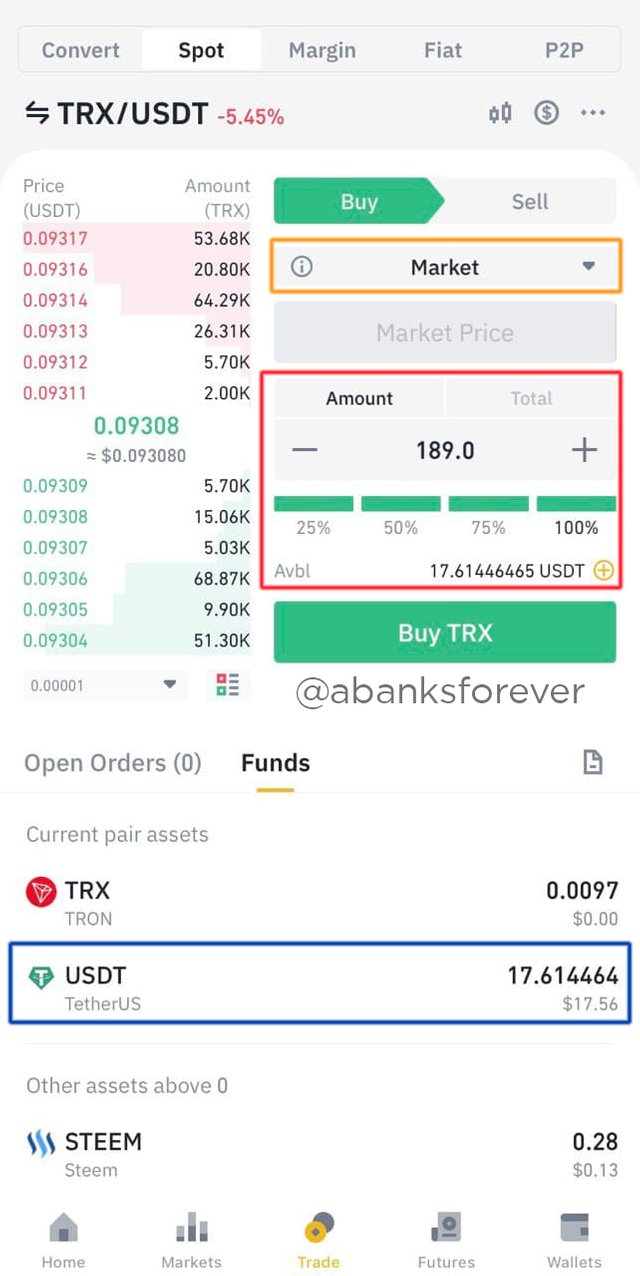

I selected the Market Order Option from the drop down menu seen in Orange and specified the amount I wanted to purchase from the Red Box and I tapped on the 'BUY TRX' button. It can also be seen in the Blue box under the 'FUNDS' column that at the time, I had a little over 17 USDT. All this can be seen in the screenshot below.

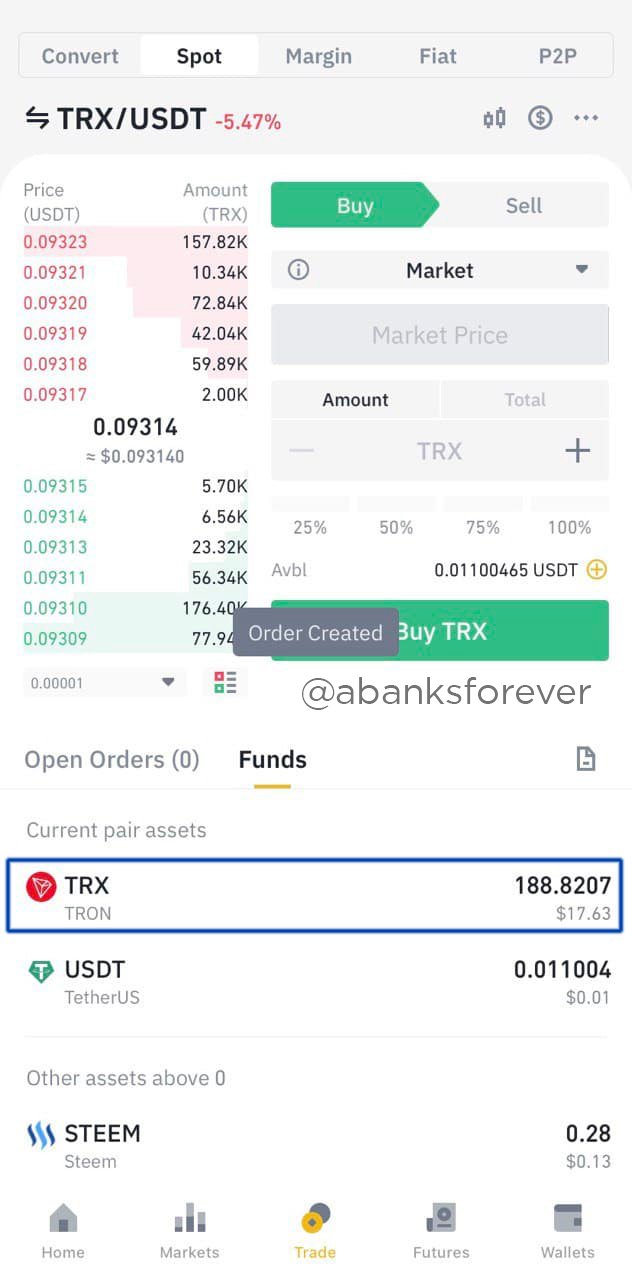

- After this it can be seen from the screenshot below that, I was able to purchase 188.8207 TRX worth roughly $17; at a rate of 0.09314.

IMPACT

By placing this order, makes me a Market Taker and by this I found to be taking the liquidity from the TRX/USDT market. This is because by purchasing at the Market Price I would be reducing the available market price option for the TRX/USDT market.

TAKE A SCREENSHOT OF THE ORDER BOOK OF ADA/USDT PAIR FROM BINANCE ON THE YOU ARE PERFORMING THIS TASK. TAKE NOTE OF THE HIGHEST BID AND LOWEST ASK PRICES

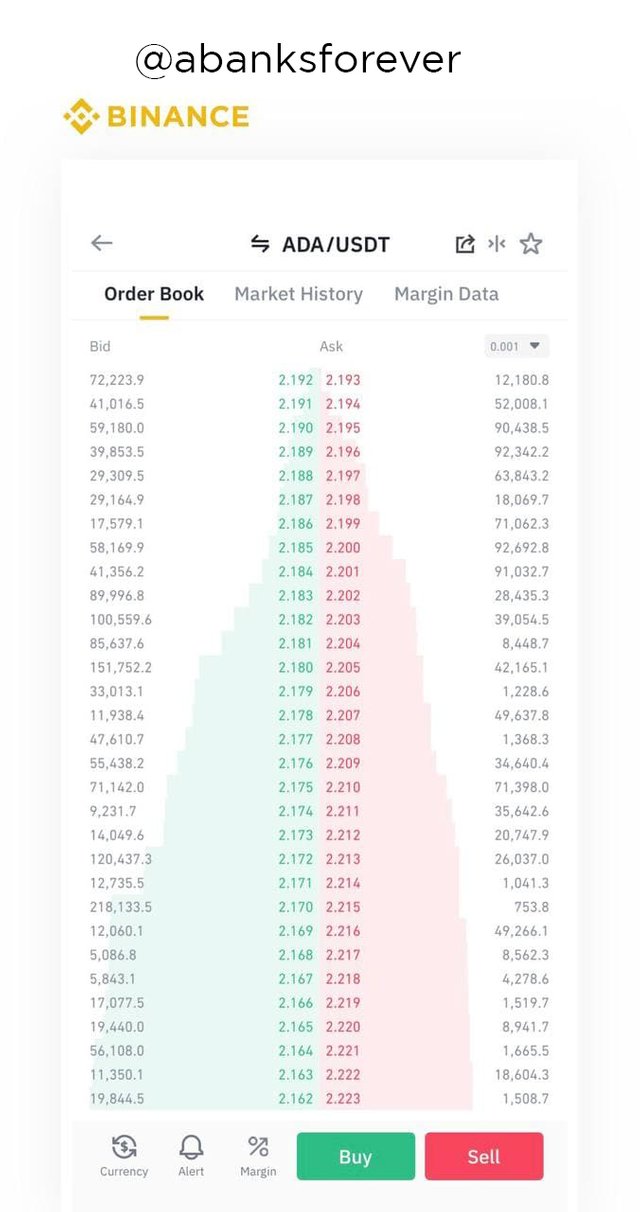

From the Screenshot above,

- Lowest Ask for the Crypto Asset = 2.192

- Highest Bid for the Crypto Asset = 2.193

a)

BID-ASK = ASK PRICE - BID PRICE

= 2.193 - 2.192

= 0.001

Hence the Bid-Ask of the ADA/USDT pair is 0.001

b)

MID-MARKET PRICE = (BID PRICE + ASK PRICE)/2

= (2.192 + 2.193)/2

= 2.1925

Hence the Mid-Market Price of the ADA/USDT pair is 2.1925

CONCLUSION

The types of Orders available to traders is a very useful and beautiful concept, and I am very glad to learn about it. This lecture revealed a mind boggling dimension I didn't notice, with how traders relate with the liquidity of the market through their individual orders.

@awesononso Thank you very much for this Lecture.

Hello @abanksforever,

Thank you for taking interest in this class. Your grades are as follows:

Feedback and Suggestions

You have done very well on this topic. Good job!

You should have explored the order book a little bit more.

You did not give a screenshot of the completed order for question 5a.

Thanks again as we anticipate your participation in the next class.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I thought the evidence for Q. 5 would be evident in my wallet history. Thank you very much and we’ll noted.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit