Hello everyone how are you all doing? I hope fine. I warmly welcome you to the first week of the 5th season. This is my first Intermediate course of this season.

Thank you, professor @image, for this insightful explanation of Exchange coins. My homework is listed below.

In this lecture by Professor @image, we learned the basics of exchange, its types, CEX and DEX, and also exchange currencies

So, as stated, in this question, I will do a thorough examination of two exchange tokens-

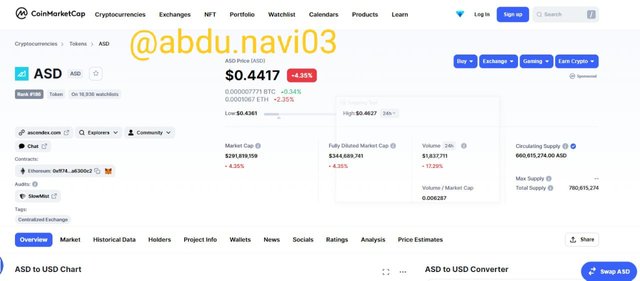

ASD (AscendEX)

GT (Gate.io Exchange)

- AscendEX

AscendEx is a cryptocurrency digital exchange platform which was founded by SAM BANKMAN-FRIED

AscendEX (previously BitMax) is a global operator of a cutting-edge digital asset trading platform that offers a wide range of assets and the services to corporate and business clients throughout the world (including big institutions or whales, professional traders, and also the private investors).

Its goals include providing a safe environment for traders and participating in charitable donations in order to ensure a brighter future. It does, however, have its own token, the AscendEX token (ASD)

Nonetheless, as shown in the screenshot above, it has not performed well in the last 24h and when considering its use case, it has the potential to do well, since it now ranks #246 on CoinMarketCap. The currency token may also be accessible on KuCoin, FTX, and Gate.io, among other exchanges, in addition to AscendEX.

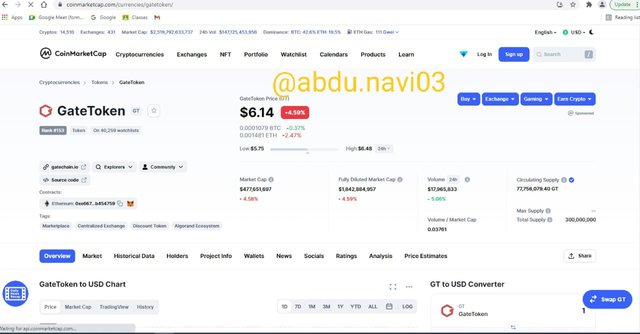

- GT (Gate.io Exchange)

Gate io has its own token, Gate Token, which is one of the world's leading cryptocurrencies and one of the top 10 cryptocurrency exchanges (GT). Gate io is a platform that hosts over 1000 coins and has been in operation for over 8 years, with high security depending on centralised and decentralised approaches. The GateChain ecosystem includes Gate io. GT is the platform's native token, and it helps organise trading fees on the GateChain system, as stated in class; similarly, it acts as a "native asset" whose purpose is to collect earnings or fees from activities carried out on the platform, as explained in class.

Gate.io, being one of the first cryptocurrency exchanges, has worked hard to give the best possible service to its consumers. Since 2013, Gate.io has been in operation. Gate.io is also one of the world's safest and secured cryptocurrency exchanges.

The GT is now valued $6.14 at the time of writing. It has a Market Capital of $476,094,824 and a total supply of 300 million GT with a circulation supply of 77,756,079.40 GT.

As it can be seen from graph that GT token is slightly bearish with respect to the previous 24h time. At the time of writing, it was ranked #153 on CoinMarketCap. Aside from Gate io, the currency token may also be found on Huobi Global, FTX, AscendEX(Bitmax), Bitfinex, and other exchanges.

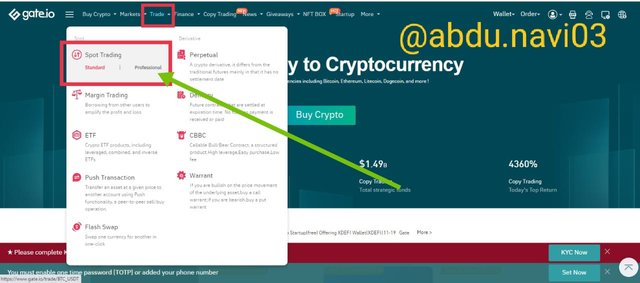

In this question, Im using Gate.io because it is comparitively easy to use than AscendEX

- TO use this, first visit their home page gate.io

- Simply click on trade, and go to Spot trading.

- You will be taken to the Spot trading page.

- Now search for GT token, So you will see there this coin. Now simply click on Buy Coin and place your order.

when we bought the GT token, its price was 6.39

After 24 hours, its price moved to 6.5 dollars which means it is in a bullish trend.

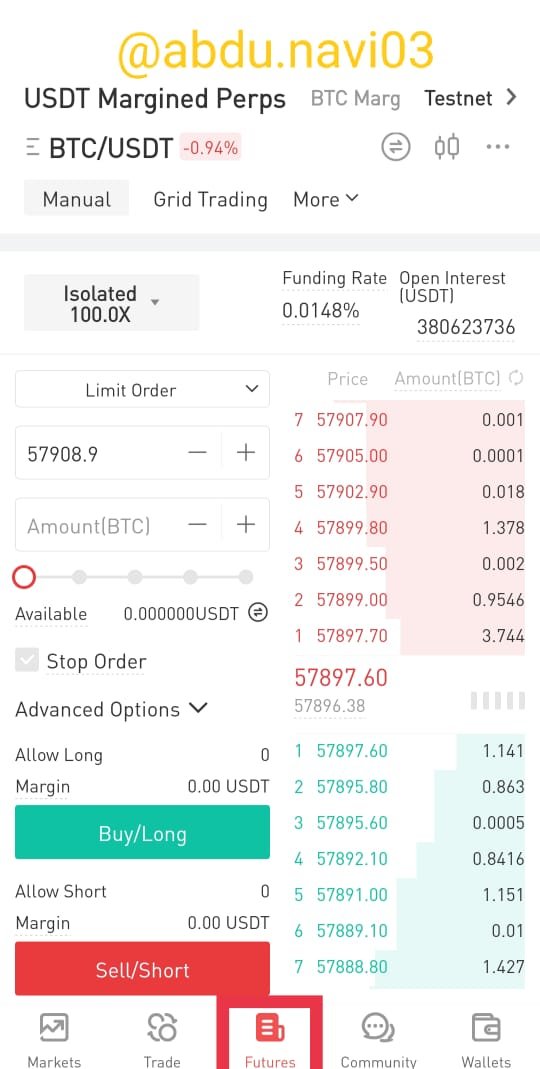

As the screenshot below indicates and what I think, the price of the GT token has not acted independently, the price pattern is somewhat similar to the price of the Bitcoin

- AT THE TIME OF PURCHASE

GT/USD Pair

source

BTC/USD Pair

source

- 24 HOURS AFTER PURCHASE

Even though after 24 hours, you can see from the screenshot provided below that the price of GT token is moving in the similar pattern as that of the BTC. So it means that the trends are somewhat very similar to eachother.

GT/USD

source

BTC/USD

source

On the futures market, you buy or sell contracts that indicate the value of a specific cryptocurrency. When you buy a futures contract, you do not own the actual coin. Instead, you have a contract in place that binds you to buy or sell a certain cryptocurrency or a asset at a future date. As a consequence, having a futures contract provides no financial benefits, such as giving votes or staking.

Crypto futures contracts offer protection against price volatility and price variations in the asset class. It also functions as a proxy for investors or dealers speculating on a cryptocurrency's future pricing.

source

By using futures contracts, you can take profit from price fluctuations, you may profit from market volatility. Futures contracts enable you to effortlessly engage in any asset or cryptocurrency price swings, irrespective of whether the price rises or falls. To put it another way, instead of buying the underlying commodity, you may wager on the future price of a cryptocurrency.

If you believe the value of an asset will grow, you will purchase a futures contract to go higher and long, and if you believe the value will decrease, you will sell to go short. Whether you earn a profit or a loss depends on the execution of your prediction you made before

I may also give you some extra information which i know myslef. The futures markets provide a plethora of liquidity, with trillions of dollars in monthly activity. Do you know that he monthly turnover of the Bitcoin futures market, is about $2 trillion, significantly surpassing the trading volumes of Bitcoin in spot exchanges. Its substantial liquidity facilitates price discovery and allows traders to transact in the market swiftly and effectively. A dynamic market is frequently linked with lesser risk, and investors or traders will encounter less washout, there will always be someone willing to take the opposing side of a given position.

Margin trading is used when investors or traders have very less or not much capital or primary money and wish to invest or do trading with much more than they have their capital so, it allows them to create a transaction using borrowed funds from the middleman. Traders can increase their earnings by taking such a big position that are substantially larger than their current holdings. However, it really should be remembered that there is a also danger of loss when the market moves in both directions.

The margin market is the act of executing out this stated margin procedure; it's essentially an account where a trader borrows or operates his money in order to get more assets and this is secured.

Margin trading may be employed in both the directions, and a the bids can be entered with both a bullish and a bearish assumption. This trade provides a large profit, but it also has a significant risk. If you make any mistake with your transactions, you might lose all of your money. This may completely demolish your wealth. So be careful not to do any foolish thing. As a result, newcomers should avoid doing margin buy and sell transactions unless they are well-versed in the subject.

People and different users use crypto exchanges to trade a variety of cryptocurrencies and trade their assets, and they put the majority of their daily assets in these exchanges. Keeping all this thing in mind the exchanges should know that they are responsible for the security of the funds held in these wallets by the users, attacks or robberies can still occur due to weaknesses discovered by hackers. Cyber assaults on cryptocurrency exchanges have risen dramatically in recent months. People have begun to doubt the crypto and different digital markets' safety as a result of this.

We all know that nothing in this world is completely safe and secure since hackers, or even someone with authority in the actual world, may take your stuff and rob you of your riches. But you're also aware that when you leave the house, you don't take all of your belongings with you. If you are robbed, it will not effect the rest of your life; this misfortune will only affect you. In the Cryptoworld, however, if an exchange is stolen or hacked by hackers, it is not just one or two individuals who lose their money; it is the money of all users linked to that exchange, as well as the reputation of that exchange. This will have an impact on the global economy as well as the public's faith in these digital trades.

To demonstrate this, I'll present two examples

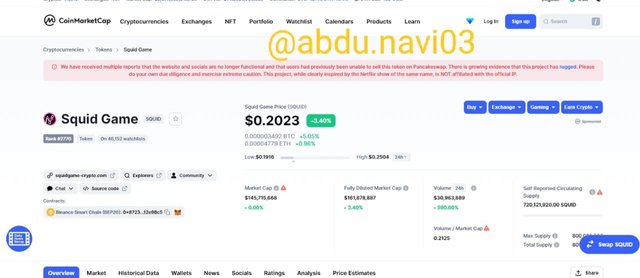

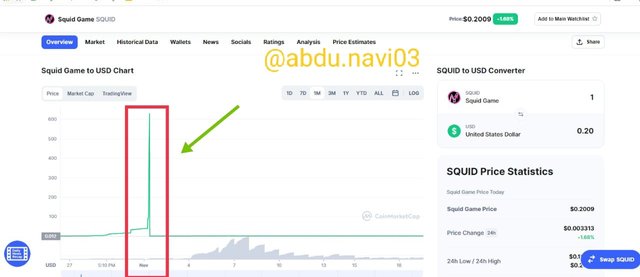

- Squid game coin scam

The first and most well-known example of a fraudulent cryptocurrency is the squid coin, which was recently launched after a popular show squad game. What happened with this coin is that it first sold out and many users bought it, and it gained strength against the US dollar, and users were suddenly unable to sell it. This has happened to a few coins in the past, but they then began trading in the market, but in recent times, the good game has simply vanished, and no one can buy or sell at its total

As squid game was launched on the very popular exchange, Binance. This is one of the reason, hacking that Binance exchange in banned In UK

- Robinhood Hacked

Robin Hood exchange the exchange hacked and around 7 million users affected by their accounts go zero.

Last week, hackers gained access to certain personal information of around 7 million Robinhood users and demanded a ransom payment, according to the popular trading app. The attacker stole the email addresses of around 5 million Robinhood members, as well as the complete identities of another 2 million, and demanded a blackmail payment. Even more personal information was exposed for certain consumers, including the names, birth dates, and ZIP codes of roughly 310 people, as well as more thorough data belonging to a group of about 10 people.

"Financial services organisations are enormous targets since new consumers come in all the time: a renewal of identification, a refresh of credentials," said Bob Rudis, chief data analyst at cybersecurity firm Rapid7 Inc. "Everybody there speaks about extortion, however on the dark web and criminal forums, passwords and identities are still on sale." It's really helpful information."

The theft, according to Robinhood, did not reveal any Social Security, bank account, or debit-card details, nor did it result in any financial losses for clients. It claimed to have controlled the intrusion, alerted law authorities, and requested the help of security firm Method consisted Inc. to look into it.

Robinhood's stock dropped 3%.

So simply, I would say that exchanges conduct transactions by producing their own tokens or coins, both to benefit their users and to benefit themselves because by this, it will make the coin or token popular and ultimately their exchange.

This lecture was essentially a comprehensive introduction to trading on a basic level using spot, margin, and futures, but it did so while also cautioning the investor (in this case, me) against crypto-fraudsters. As it clearly mentioned the risks and dangers on centralized exchanges

In addition, we discussed two recent frauds or hacking attempts. I used two examples: the Squid game coin fraud and the Robinhood exchange hack. So, whether you invest your money or trade, you must be aware of the situations and risks involved.

In the end, I would like to thank, professor @imagen . I hope I was able to meet all the objectives of this task as I put in all my efforts. So this is the end of my assignment. I hope you were able to grasp the basics of my lecture.

THANK YOU.

ps: all the pictures have been sourced accordingly. The grammar was checked from grammarly.com while the markdowns have been done according to the Markdown Styling Guide.

Cc;

professor @imagen

regards,

@abdu.navi03

.jpg)

Gracias por participar en la Quinta Temporada de la Steemit Crypto Academy.

Continua esforzandote, espero seguir corrigiendo tus asignaciones.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit