Hello everyone how are you all doing? I hope fine. I warmly welcome you to the 7th week of the 6th season. This is my first beginner's course of this season.

In this lecture by Professor @lenonmc21 , we learned the basics of Trading Strategy with Price Action and the Engulfing Candle Pattern

Cryptocurrencies are a vast technology and full of earning opportunities and ways. The. One which contains the most volume in earning is trading. Why is that? Because cryptocurrency's price is highly volatile, moreover it strictly follows the trend compared to other markets which don’t like stocks, forex, etc. However, to earn from them traders need some strategies and tools (indicators). One of the strategies is Price Action and Engulfing Candle Pattern strategy.

PRICE ACTION AND ENGULFING PATTERN

The strategy is in its name. It basically works according to price action. And for this strategy price should strictly follow the trends. That is why this strategy, when apply to crypto is more profitable than on stocks. For this strategy to work, the trend must not only be formed but must be in a harmonic fashion. After finding a trend that is harmonic and dominant. We must wait for it to stop or either reverse. Why? Because that will be our chance. During reversal we will find an engulfing candle, this candle will be our key. I know this strategy sounds complicated, but it is worth learning. It is long and time taking, requires traders' patience, but the profit is assured.

STEPS OF STRATEGY

STEP 1:- FINDING A HARMONIC AND DOMINANT TREND

The first step is to find a trend. But a proper trend with forming higher highs and lower highs if it is bullish and forming lower highs and lower lows if it is bearish

This kind of trend is known as the harmonic and perfect trend. It means that the prices are going in a direction in a steady manner and people are thinking like they should think for this strategy to work.

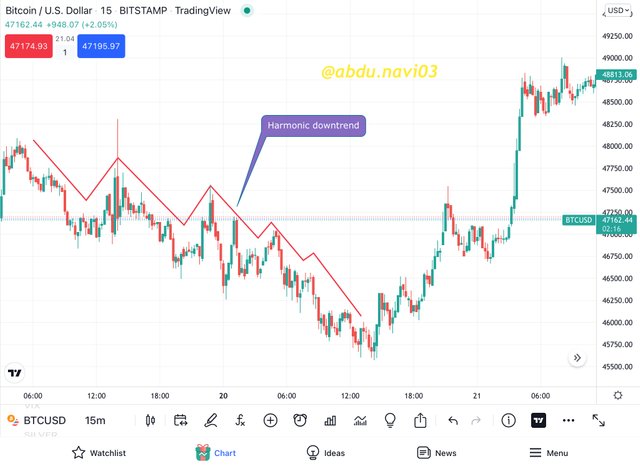

In this screenshot of BTC/USDT from BitStamp, having a timeframe of 15m we can see that there’s a harmonic pattern formed by the price chart. This type of pattern or trend is could be perfect for our price action and engulfing candle strategy.

STEP 2:- WAIT FOR TREND REVERSAL

Now we have to wait to find a trend reversal, in this case, the trend is downward so we have to wait for an upward trend.

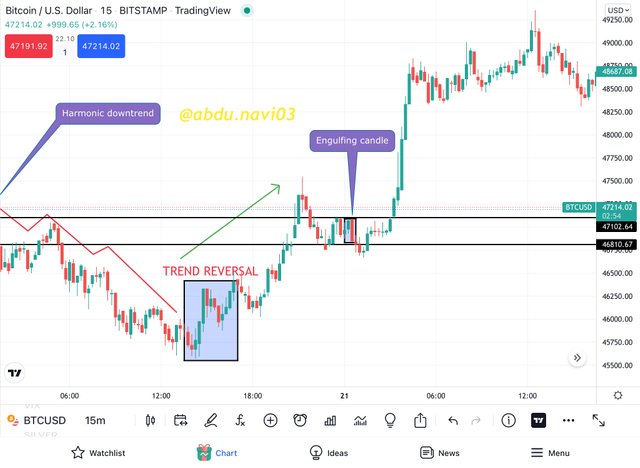

In this screenshot of BTC/USDT from BitStamp, we can see that the downward pattern had a trend reversal. This is just according to our price action and engulfing candle pattern strategy.

STEP 3:- FINDING ENGULFING CANDLE

This is the most important step of this strategy. To find an engulfing candle we must know what is engulfing the candle. Engulfing candle is a candle which is a strong candle but opposite in current trend direction. In this case, the trend was first bearish, then a trend reversal occurred and the trend turn into bullish. Now any candle which will be bearish and have more strength or almost equal strength to its adjacent candle is known as engulfing candle. Let me give the example from the case which I’m presenting.

In this screenshot of BTC/USDT from BitStamp, having a time frame of 15m we can see that in the bullish trend reversal an engulfing pattern is formed. This engulfing candle is stronger than its adjacent candle. And this candle can be perfect for our strategy

STEP 4:- FORMING RESISTANCE AND SUPPORT

We now draw two horizontal lines, one is from above the engulfing candle and one is below the engulfing candle. In such a way that to the higher part of the candle be the resistance and the lower part be the support.

In this screenshot of BTC/USDT from BitStamp, having a timeframe of 15m, we can see that the engulfing candle has two horizontal lines drawn across it. One is above the candle and one is below the candle. These lines denote resistance and support. Resistance is the upper line while support is the lower line.

STEP 5:- CHANGING TIMEFRAME

We now change the timeframe and go to a lower time frame. Where this resistance and supports are applicable. As I’m using a 15m chart now therefore I’ll go to a 5m chart.

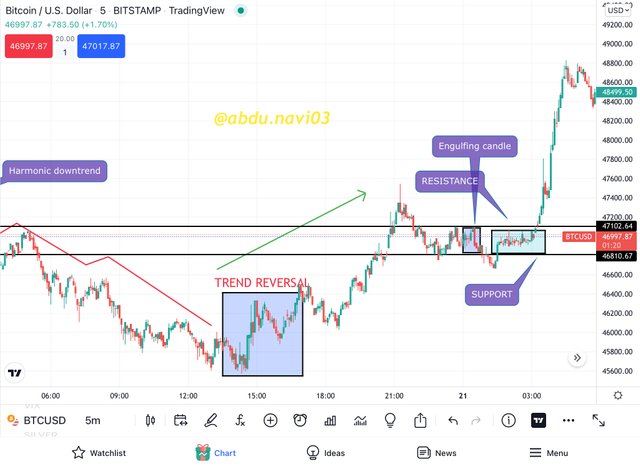

As you can see in this screenshot of BTC/USD from BitStamp, having a timeframe of 5m, as soon as we change the time frame we can see that the price is ranging into a particular phase, denoted by. Rectangle. Moreover, the support we formed through gets penetrated after we formed the resistance and support but it is not our time to take the entry in the market. The trader must wait for the price to be again in the ranging phase, i.e in between the resistance and support.

STEP 6:- FORMATION OF TREND AND ENTRY IN THE MARKET

When the price comes into a ranging area, the trader must wait for the price to break any one of these, resistance or support. If the resistance gets breaks, then the price will go up, and if the support gets breaks the price will go down. As soon as any of these gets penetrated, this is the time for a trader to invest its capital with stop loss and take profit marks

In this screenshot of BTC/USD from BitStamp, having a timeframe of 5m we can see that as soon as the resistance gets broken the chart turns into the bullish chart and almost every candle becomes a green candle for a considerable time. The breaking of resistance is the buying signal in this strategy and breaking of support is the selling signal in this strategy.

As the professor asked for two examples I will give you another example that will make it clear to you guys.

STEP 01

STEP 02

STEP 03

STEP 04

STEP 05

STEP 06

Big strong movements of the market always tell us that the whales are in charge. They travel the price in their wanted direction, by putting a lot of money to crush retail traders i.e traders with low capital. Therefore we as smart traders can benefit from it. Whenever a hormone pattern occurs and failed to continue itself, for example, fails to form a higher high in a bullish trend and fails to form a lower low in a bearish trend, the price changes direction. We can wait and let the whales change the direction by introducing an engulfing candle in the market. This engulfing pattern can be our key but even after that as a smart trader we must keep safe and wait for the price to break our formed range. Then we can put money.

The simple interpretation is, strong market movements control by the whales not by the retailers, so we just have to think with them.

Entry and Exit from the market are also very simple. In the above assignment question, I already explained the entry but here we will discuss it again. But for that, one must remember all the other steps which I earlier explained. That are, harmonic trend, trend reversal, engulfing candle, resistance, and support, shorten the time frame and breaking of support or resistance

ENTRY

For entry, we must make sure that the resistance and support are proper. As it is done, we now wait for the price to be in this range, if the price in the shorted chart has already broken the support or resistance then we must wait for the price to return to the zone again, if it doesn’t come back we have to find another chart. But let's say if it does come back we have to wait for the breaking of resistance or support. Now we can take our entry into the market.

In the above screenshot of ETH/USD Futures from Binance, having a time frame of 5m, we can see that as soon as the price breaks the resistance, the buying signal is generated and an uptrend is clearly visible.

EXIT

For exiting the market, there are several strategies but we must be acknowledged of the technical patterns formed by the price. Coming back to the first step, identifying a pattern, and waiting for it to fail. The failing is when, price fails to make the high, higher than the previous high or low, lower than the previous low. Similarly, our exit signal is when the price fails to form any of these. And we must bear other technical patterns in our minds such as double top or double low. Double top or double low is very common in the price charts like what I presented. Where, after picking up a signal there was no harmonic pattern.

In this screenshot of ETH/USDT Futures from Binance, we can see that the double top is formed after a bullish trend. A double top is a signal of ending a bullish trend, and either come into a ranging zone or trend reversal may occur. In either way, it is not profitable for traders so it is best for traders to exit from the market

So here’s, to sum up. Price action and engulfing candle strategy started with the harmonic trend formation and proper technical analysis, meanwhile, the ending of this strategy or exit of this strategy is also based upon harmonic price movement and technical pattern.

Anyhow every trader, according to its invested amount, sets some targeted goals to achieve profit. One can place these profits and be profitable. It is beneficial in a case where price failed to follow a harmonic motion.

FIRST TRADE

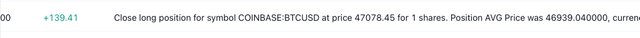

This is the first demo trade placed in the BTC/USD Chart from Coinbase with my demo trading account in tradingview application. Here first I used a 15m chart and then I found an engulfing candle, then changed the timeframe to 5 min. As soon as I saw that the price is getting breaking by the resistance, I put the demo trade.

SECOND TRADE

This is the second demo trade placed in the Funfair/USD Chart from Binance with my demo trading account in tradingview application. Here first I used a 15m chart and then I found an engulfing candle, then changed the timeframe to 5 min. As soon as I saw that the price is getting breaking the support, I put the demo trade. This trade is still going on

CONCLUSION

For being a better trader one should rely on more than one indicator or strategy. And for any trader no matter what its capital and in which timeframe it does trading, one thing is most important for him, and that is how he can always be in profit. Strategies like this strategy make sure that the trader always keeps its portfolio green while following a trend. This is the most important thing because usually, trends can help you in earning what indicators can’t. This strategy is based on the trend that reflects the market and its people thinking therefore its hardly can be wrong. Moreover, it has this many steps and complexities that it's not easy to find a perfect spot for this trading strategy, but this complexity is its beauty, this complexity and waiting in this strategy make sure that the trader can be in 100% profit. Of course, it can be wrong too but hardly. I’d say out of 10 times, 9 times this strategy will help you in earning money through cryptocurrency trading.

I hope I was able to meet all the objectives of this task as I put in all my efforts. So this is the end of my assignment. I hope you were able to grasp the basics of my lecture.

THANK YOU.

ps: All the pictures have been sourced accordingly. The grammar was checked from grammarly.com while the markdowns have been done according to the Markdown Styling Guide.

Cc;

professor @lenonmc21

regards,

@abdu.navi03